Hankyung Research Institute Presents 'China's Political and Economic Risks and Implications for the Korean Economy'

China's Total Factor Productivity Growth Rate 1.8%p Lower than OECD

China's Self-Reliant Economic Strategy Negatively Impacts Total Factor Productivity

Due to China's structural risks of high debt burden and declining productivity, it has been argued that the long-term reduction of China's share in the Korean economy is inevitable.

The Korea Economic Research Institute (KERI) made this claim in a report titled "Political and Economic Risks of China and Implications for the Korean Economy" on the 16th.

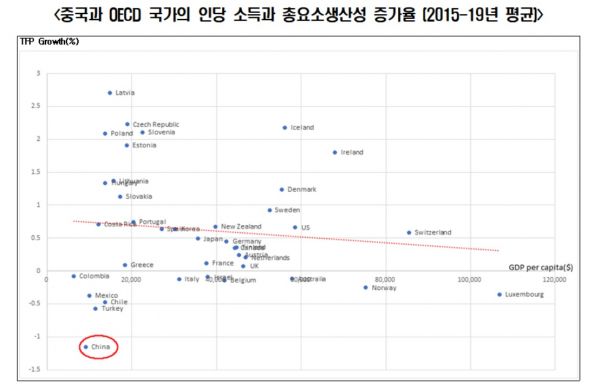

The report noted that while excessive debt burdens in both the private and public sectors are often cited as China's structural risks, the more fundamental risk is the decline in productivity. It further pointed out that the more fundamental risk in productivity for China is the decline in total factor productivity (TFP), and that this decline is very steep. In China's case, TFP accounts for a large portion of its economic growth. Although the growth rate of TFP tends to decrease as income levels rise, between 2015 and 2019, China's TFP growth rate was very low compared not only to countries with similar income levels but also to high-income OECD countries. Using the Penn World Table (PWT) database to compare the relationship between TFP growth rates and per capita income across various countries, China's average TFP growth rate from 2015 to 2019 was analyzed to be 1.8 percentage points lower than the OECD average during the same period.

Per capita income and total factor productivity growth rates of China and OECD countries. The red line represents the average total factor productivity growth rate by income level. [Data provided by Hankyung Research Institute]

Per capita income and total factor productivity growth rates of China and OECD countries. The red line represents the average total factor productivity growth rate by income level. [Data provided by Hankyung Research Institute]

The report forecasted that China's pursuit of a self-reliant economic strategy to overcome US-China conflicts will also negatively impact TFP. Senior Research Fellow Tae-gyu Lee pointed out, "Imports have a negative effect on the trade balance, but imported goods have a knowledge spillover effect on domestic industries, which increases total factor productivity." He added, "Based on statistics since 1980, it is estimated that in China's case, a 1 percentage point decrease in import share could reduce the TFP growth rate by about 0.3 percentage points on average."

Additionally, the report diagnosed that if China's dual circulation strategy's international circulation is conducted mainly with friendly countries, the effect on improving TFP may not be significant. Senior Research Fellow Lee argued, "Even excluding the coercive aspects caused by US-China conflicts, the long-term decline in growth rates due to China's productivity decline will inevitably lead to a reduction in China's share in the Korean economy."

The report pointed out that reducing China's share based on the fundamentals of the Chinese economy is a rational choice for companies, but forced reduction due to US-China conflicts causes considerable costs and inefficiencies for companies. Especially when supply chain adjustments are forced due to designation as strategic or economic security items, companies bear significant burdens, so appropriate institutional support is necessary. It emphasized the urgent need to pass the currently pending "Basic Act on Supply Chain Stabilization" (Basic Act on Support for Supply Chain Stabilization for Economic Security) in the National Assembly. Senior Research Fellow Lee criticized, "Our country, which is more dependent on China than Japan, has not responded quickly to establish a supply chain stabilization support system," and demanded the prompt review and passage of the bill in the National Assembly.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.