Sharp rise then decline after Gangseongbu Fund's stake purchase announcement

Foreign ownership decreases amid ongoing conflicts... Operating profit also expected to decline

Despite the intervention of activist funds and a favorable trend in semiconductor stocks, DB HiTek's stock price remains stuck in a trading range. This is attributed to the ongoing management dispute causing foreign investors to withdraw, as well as a bleak outlook for this year's earnings.

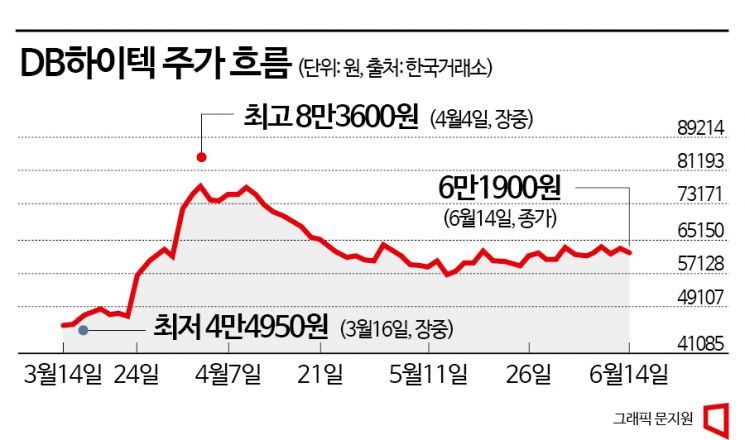

According to the Korea Exchange, on the 15th, DB HiTek's stock price closed at 64,200 KRW, up 3.72% from the previous trading day on the KOSPI market. However, this is about 25% lower compared to the intraday high of 83,600 KRW on April 4. Notably, DB HiTek's stock price has been confined within a range for about two months. This contrasts with semiconductor companies like Samsung Electronics and SK Hynix, which surged 10-20% and hit new highs following the surprise earnings announcement by U.S. semiconductor company Nvidia on the 17th of last month. Despite the semiconductor sector's positive momentum, DB HiTek remains sidelined.

Even with the involvement of the activist fund Korea Corporate Governance Improvement Fund (KCGI), the stock price remains stagnant. DB HiTek previously announced on March 31 that KCGI, known as the Kang Sung-bu Fund, acquired a 7.05% stake (3,128,300 shares) through the limited liability company Caropy Holdings. At one point, DB HiTek's stock price surged to a 52-week high but soon reversed into a downward trend.

Since April, KCGI has sent three shareholder consultation letters to DB HiTek but received no response. On June 1, KCGI publicly released a shareholder letter outlining governance modernization plans for DB HiTek and began active shareholder actions.

In the shareholder letter, KCGI questioned whether DB HiTek's controlling shareholders and management are committed to enhancing shareholder value, citing the causes of DB HiTek's undervaluation as ▲ pursuit of private interests by controlling shareholders ▲ opaque management and inadequate internal controls ▲ disregard for shareholder rights. KCGI demanded ▲ establishment of an independent board of directors ▲ strengthening internal controls to improve management transparency and efficiency ▲ share buybacks and cancellations to enhance shareholder value.

However, as KCGI has yet to achieve clear results and the management dispute continues, foreign investor withdrawal is accelerating. Since KCGI's stake acquisition announcement on March 31, foreign investors have net sold 234.4 billion KRW worth of DB HiTek shares through June 14. The foreign ownership ratio has also dropped from the mid-20% range to 18.75% over the past month.

The earnings outlook is also not promising. DB HiTek's first-quarter results showed sales of 298.2 billion KRW and operating profit of 83 billion KRW, down 24% and 45% year-on-year, respectively. The main cause is attributed to a decline in utilization rates due to weak semiconductor demand. The operating profit forecast for this year is also expected to decrease to 431.9 billion KRW compared to the previous year. Lee Seung-woo, a researcher at Eugene Investment & Securities, said, “DB HiTek has announced plans to enter the 12-inch foundry business, but it is expected to take at least three years. Given the considerable time required, this year's performance is expected to be weaker than last year's.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)