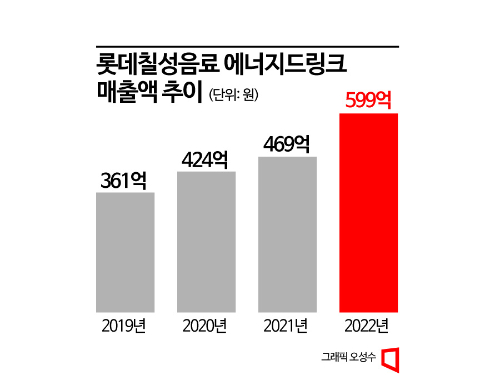

Lotte Chilsung, Last Year's Sales 59.9 Billion KRW... 28% Increase YoY

Monster Energy, 30% Average Annual Growth Over the Past 3 Years

Expansion of Consumption Purposes from Studying and Overtime to Exercise and Parties

Energy drinks, which were mainly consumed to stay awake during past exam periods or night shifts, are expanding their consumer base by responding sensitively to trends such as switching to low-calorie options.

According to the industry on the 15th, Lotte Chilsung Beverage's energy drink sales reached 59.9 billion KRW last year, a 28.3% increase compared to the previous year. Lotte Chilsung's energy drink sales, which were 36.1 billion KRW in 2019, have shown steady growth in recent years, with 42.4 billion KRW in 2020 and 46.7 billion KRW in 2021. This year, first-quarter sales increased by 38.5% compared to the same period last year, further expanding volume.

Monster Energy, an energy drink distributed by Coca-Cola Beverage, a subsidiary of LG Household & Health Care, has also maintained a continuous growth trend with an average annual sales growth rate of about 30% over the past three years. This year, sales are estimated to have increased by approximately 15% compared to last year as of the end of May.

The industry evaluates that the market growth is driven by an expanded purpose of consumption as negative perceptions of energy drinks and caffeine have improved compared to the past. An industry insider explained, "The consumer base drinking energy drinks to boost vitality in daily life has increased," adding, "While energy drinks were previously consumed to enhance concentration during studying or night shifts, recently, the consumer base drinking for purposes such as exercise, gaming, and parties to enjoy self-development or leisure has grown."

The active response with low-calorie products in line with the 'zero' calorie trend sweeping the beverage industry is also having an impact. As consumption by fitness enthusiasts sensitive to calories has increased, product responses that heighten sensitivity to calories are considered a necessity rather than a choice, according to industry voices. Monster Energy launched 'Ultra Sunrise' last month, reducing calories per can to about 10 kcal, and Daesang Wellife introduced 'Arpoten' the same month, emphasizing 0% fat and saturated fat for the first time. Lotte Chilsung, which launched Hot6 The King Zero in May last year, is also preparing to release a new peach-flavored product soon.

With consumers' demand for fatigue recovery and energy supplementation steadily increasing, and unlike other beverage categories, energy drink sales are not concentrated in summer, the energy drink market is expected to continue growing. However, the Ministry of Food and Drug Safety recommends not exceeding the recommended intake as excessive consumption of high-caffeine drinks containing more than 15 mg of caffeine per 100 ml can cause increased heart rate, palpitations, and elevated blood pressure. The maximum daily caffeine intake recommended by the Ministry is 400 mg for general adults and 150 mg for 60 kg adolescents, while the caffeine content in high-caffeine drinks available on the market is generally about 60 to 100 mg per can.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)