Financial Authorities to Announce Own-Share System Improvement Plan Within the Year

"Principle of Shareholder Equality" vs "Impossible to Defend Management Rights" Tension

The government is taking steps to improve related systems, including the mandatory cancellation of treasury shares, drawing increased market attention. The financial authorities plan to announce improvements to the treasury share system within the year. As part of this effort, the Financial Services Commission held a seminar on ‘Improving the Treasury Share System of Listed Companies’ on the 5th. Various opinions were expressed at the seminar, including mandatory cancellation of treasury shares, restrictions on treasury shareholding ratios, and strengthening procedures for disposing of treasury shares. The financial investment industry generally welcomed these measures as helpful in establishing a fair market order. In contrast, the business community is opposing them, arguing that key means of defending management rights could disappear.

Treasury Shares Exploited to Expand Major Shareholders’ Control... Calls Grow for Mandatory Cancellation

There is a reason why financial authorities are moving to improve the treasury share system. Although companies have been buying back treasury shares under the pretext of ‘enhancing shareholder value,’ in reality, treasury shares have been widely used to expand the control of major shareholders.

Originally, treasury share buybacks were not allowed in South Korea. However, with the revision of the Commercial Act in 2011, companies were permitted to acquire treasury shares if there were distributable profits and to freely dispose of acquired treasury shares. Contrary to the intent of this revision, cases of using treasury shares for specific shareholders such as major shareholders have increased, leading to a growing consensus on the need for system improvement.

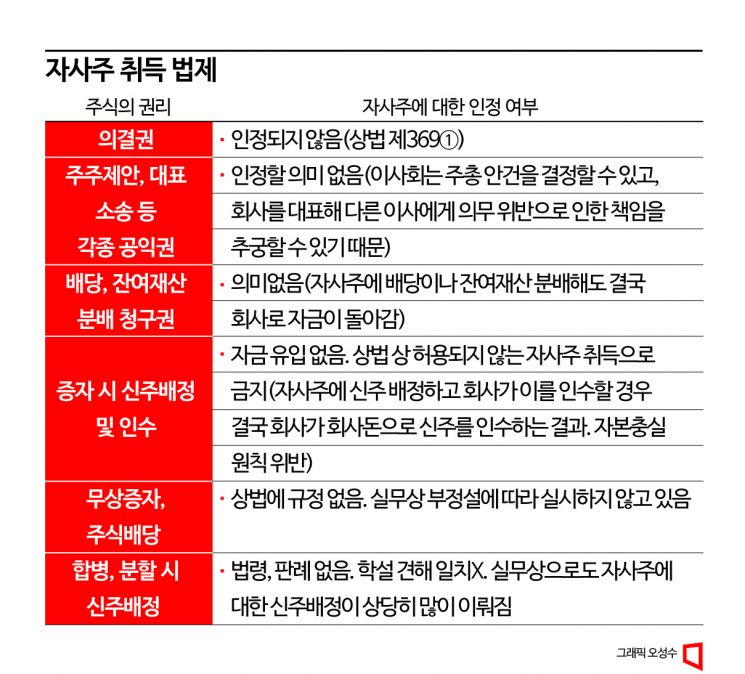

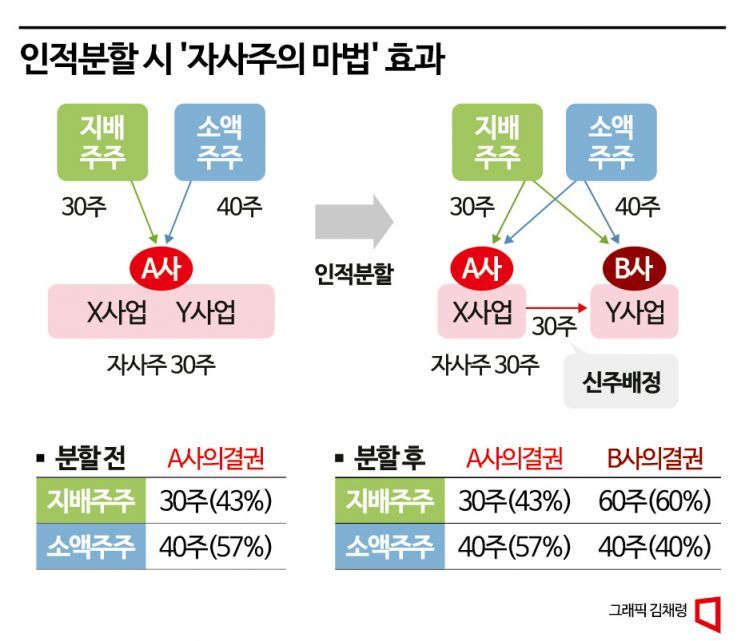

For example, OCI, Hanwha Solutions, and Dongkuk Steel used treasury shares to increase major shareholders’ stakes during their transition to holding companies through a spin-off. Unlike a physical spin-off, a spin-off by division creates new shares in the new company according to shareholding ratios. At this time, treasury shares, which do not have voting rights, are converted into shares with voting rights. This is called the ‘magic of treasury shares.’ From the major shareholder’s perspective, it is a useful means to restructure the governance system into a holding company structure and expand control over the new company. Instead of paying money to acquire shares, major shareholders strengthen control by using treasury shares, which are distributable profits.

One proposed measure to prevent such ‘tricks’ is the mandatory cancellation of treasury shares. Treasury shares belong to ‘all shareholders’ of the company. However, depending on how treasury shares are used, conflicts of interest arise among shareholders. Hwang Se-woon, Senior Fellow at the Korea Capital Market Institute, pointed out, “If shareholders share benefits or losses equally according to their shareholding ratios, there would be no problem, but the reality is different,” adding, “It is desirable to regulate to minimize conflicts of interest among shareholders when acquiring or disposing of treasury shares.”

The business community is opposing this. They argue there are significant legal and practical issues. A representative from the Federation of Korean Industries said, “Since the Commercial Act was revised in 2011, treasury shares can be freely used if there are distributable profits,” criticizing, “Changing this through an amendment to the Enforcement Decree of the Capital Market Act would be inconsistent with the current Commercial Act system.” He emphasized, “If mandatory cancellation of treasury shares is imposed, the only defense mechanism available to companies, such as share swaps, will disappear.”

Possible Restrictions on Treasury Shareholding Ratios and Strengthened Disposal Procedures

Due to strong opposition from the business community, opinions are leaning toward limiting treasury shareholdings to a certain threshold. Germany allows companies to hold treasury shares up to 10%, a system that has been in place since 1931. This choice was made considering creditor protection and capital soundness rather than just preventing board authority abuse. Setting limits on treasury shareholdings is also mentioned as a measure to prevent abuse of treasury shares.

As of the end of last year, 81.5% of all listed companies in South Korea held treasury shares between 0 and 5%. About 10.5% of listed companies held treasury shares between 5 and 10%. This means that 9 out of 10 companies listed on KOSPI and KOSDAQ hold treasury shares within 10%.

There is also discussion about strengthening procedures for disposing of treasury shares. It is argued that disposal procedures should be tightened. Currently, there are no special procedures or controls when disposing of treasury shares domestically. This has led to criticism that principles such as ‘shareholder equality’ are not applied.

In Delaware, USA, disposal of treasury shares is subject to strict regulatory oversight. In particular, disposing of treasury shares requires procedures similar to issuing new shares. A Korea Exchange official said, “In the US and Europe, acquiring treasury shares is considered internalizing equity capital, so they are regarded as unissued shares,” adding, “When disposing of treasury shares, companies must submit various documents and obtain approval as they do during an IPO.” Professor Jung Jun-hyuk of Seoul National University Law School stated, “Disposal of treasury shares has essentially the same effect as issuing new shares, so even if a defense mechanism for management rights is needed, it is appropriate to discuss it separately.”

In response, the business community criticizes that defense mechanisms for management rights would disappear. In South Korea, disposing of treasury shares is practically the only means of defending management rights. After acquiring treasury shares, companies swap them with friendly controlling shareholders to mutually strengthen control. However, share swaps are not favorable to minority shareholders because dividends are diluted. The dividends for existing shareholders decrease by the amount allocated to the swapped treasury shares.

The financial investment industry sees a high possibility of limiting treasury shareholding ratios. One of the financial authorities’ national agenda items this year is ‘investor protection,’ and considering next year’s general election, measures to improve individual shareholder rights are inevitable. Limiting treasury shareholding ratios faces less opposition from the business community than mandatory cancellation of treasury shares.

A Financial Services Commission official said, “The meeting held on the 5th was to hear industry opinions, and nothing has been decided yet,” adding, “We will review related matters and listen to industry opinions before deciding on the details.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)