Top 3 Kosdaq Net Buying Secondary Battery Stocks by Institutions Since May

Individuals Significantly Reduce Net Buying... L&F Shows Net Selling

In One Month, 9 Firms Upgrade Ecopro BM to 'Buy', 4 to 'Hold'

The trading dynamics of secondary battery stocks, which heated up the domestic stock market in the first quarter of this year, have completely reversed. As individual investors' sentiment cooled, institutional investors have started buying secondary battery stocks. In particular, the shift to net buying positions by institutional investors is notable amid ongoing debates about the overvaluation of secondary battery stocks. Individual investors appear to have taken profits as these stocks surged sharply since the beginning of the year.

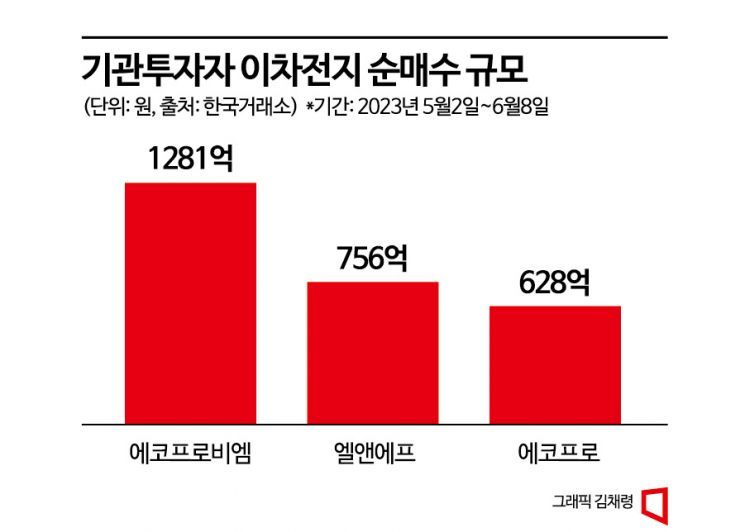

According to the Korea Exchange, from May 2 to June 8, the top three stocks most purchased by institutional investors in the KOSDAQ market were all secondary battery stocks. The stock most bought by institutional investors during this period was EcoPro BM, with purchases totaling 128.1 billion KRW. It was followed by L&F (75.6 billion KRW) and EcoPro (62.8 billion KRW).

This behavior by institutional investors has changed 180 degrees within a month, drawing attention. In April, the top three stocks that institutional investors net sold in the KOSDAQ market were all secondary battery stocks. The stock most heavily sold by institutional investors in April was L&F, with net sales amounting to 232.4 billion KRW. This was followed by EcoPro (-144.5 billion KRW) and EcoPro BM (-115 billion KRW).

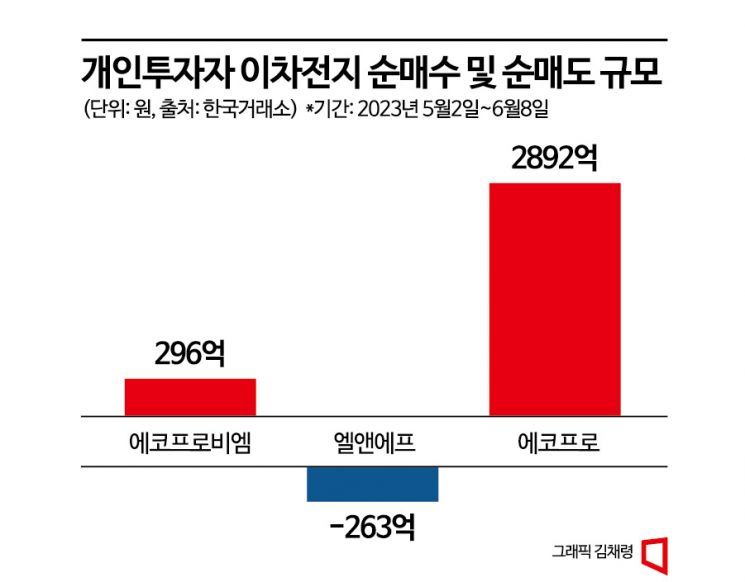

Individual investors have shown the opposite trend to institutional investors. The top three stocks net purchased by individual investors in the KOSDAQ market in April were EcoPro (629.9 billion KRW), L&F (375.6 billion KRW), and EcoPro BM (258.4 billion KRW).

However, from May onwards, individual investors appear to have withdrawn from secondary battery stocks. Since May 2 to June 8, individual investors net purchased only 29.6 billion KRW worth of EcoPro BM, which is just 11.45% of the net purchase volume in April (258.4 billion KRW). During this period, EcoPro (289.2 billion KRW) was purchased at less than half the volume of April. L&F was net sold by 26.3 billion KRW.

The stock prices of secondary battery stocks, which had been adjusted due to institutional buying pressure, are also fluctuating. EcoPro BM, which recorded an intraday high of 315,500 KRW on April 10, steadily declined to an intraday low of 212,500 KRW on May 15. As of the closing price on June 8, EcoPro BM rose about 25% from the May 15 low to 267,500 KRW. EcoPro also increased approximately 32% compared to the low of 499,000 KRW on May 15, with a closing price of 658,000 KRW on June 8. L&F rose 15% during the same period.

Opinions in the securities industry are divided. EcoPro BM, the largest KOSDAQ market capitalization stock and the most purchased secondary battery stock by institutions, had 15 securities firms publish stock reports in the past month. Among them, nine firms issued a 'Buy' rating, four gave a 'Hold,' and one suggested a 'Marketperform,' which effectively means 'Hold.' There was also a securities firm that issued a 'Sell' rating for the first time.

Researcher Han Byunghwa of Eugene Investment & Securities, who issued the sell rating, stated, “The current price of EcoPro BM already reflects expected growth through 2030, so we are downgrading our rating from 'Hold' to 'Sell.' The intensity of expansion competition among domestic, European, and Japanese companies is increasing, intensifying the overheating phase.”

On the other hand, some securities firms recommended buying based on stable earnings growth. Researcher Kim Cheoljung of Mirae Asset Securities said, “Earnings will steadily grow despite market concerns,” adding, “This is because the group can stably procure lithium hydroxide, a key raw material for secondary battery cathode materials, at stable prices within the group.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)