Major Listed Entertainment Companies, Stock Fluctuations Due to Core Artists' Activity Plans

Need to Strengthen Disclosure Standards Such as Contract Termination for Investor Protection Emerges

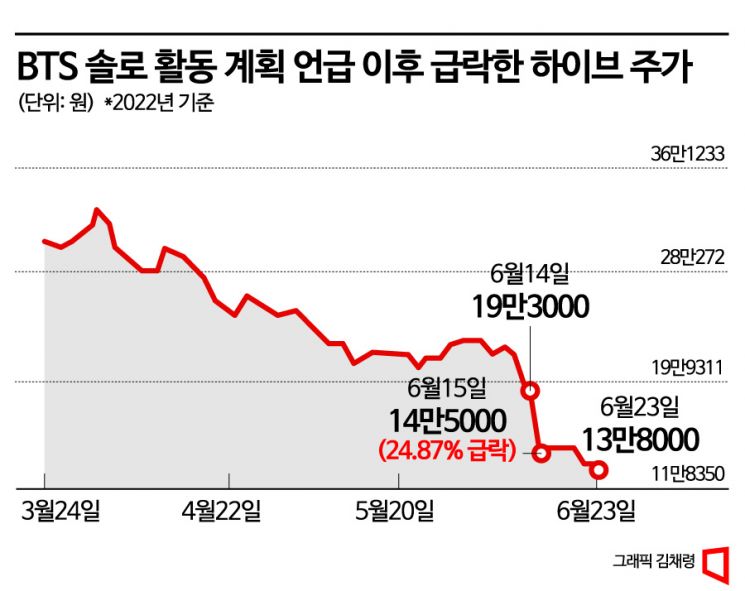

#1. On the night of June 14 last year, the aftermath of the video titled 'Jjin Bangtanhoesik' released on BTS's official YouTube channel was intense. The next day, the stock price of their agency HYBE plummeted by 24.87%, wiping out 2 trillion KRW in market capitalization. This was due to BTS members announcing their solo activity plans. The stock price fluctuated in response to the keyword of BTS suspending group activities.

#2. On October 17 last year, HYBE announced through a public disclosure that "Our artist BTS has begun specific preparations to fulfill their military service obligations," and "Member Jin (Kim Seokjin) will cancel his enlistment deferral at the end of October 2022 and follow the enlistment procedures of the Military Manpower Administration thereafter."

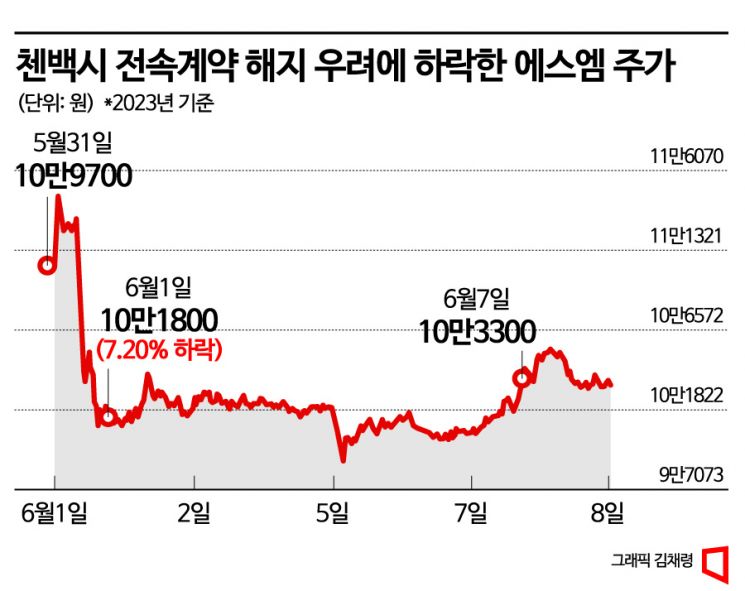

#3. On June 1, news broke that EXO members Baekhyun, Xiumin, and Chen (ChenBaekXi) had been notified of contract termination, causing SM Entertainment's stock price to plunge. The stock closed at 101,800 KRW, down 7.2% from the previous trading day. As of the previous day, SM's market capitalization was 2.6142 trillion KRW, but 190.6 billion KRW evaporated in just one day.

As the stock prices of listed entertainment companies fluctuate according to the activity plans of key artists, voices are growing for establishing a system that transparently discloses related information to investors in a timely and proper manner. One alternative is 'public disclosure.' Especially after the controversy over BTS suspending group activities last year caused HYBE's stock price to fluctuate daily, opinions have been continuously raised that the activity plans of key artists should become major management disclosure items for entertainment companies. Recently, the impact of artists on the stock prices of listed companies was proven when SM's stock price plunged following news that some EXO members had notified the agency of contract termination amid disputes.

HYBE Employee Sold Stocks Knowing BTS Group Activity Suspension in Advance

The issue of the need for proper response to artists' activity plans at listed entertainment companies was triggered by the video titled 'Jjin Bangtanhoesik' released on BTS's official YouTube channel. The day after BTS members announced their solo activity plans, HYBE's stock price fell as much as 27.9% intraday, nearing the lower limit. The decline continued afterward. HYBE's response was inadequate. If investors and the market had overinterpreted the situation, it should have been corrected immediately through public disclosures or press releases, but the official stance was delivered belatedly, causing controversy. The fact that the released video was a 'recorded video' was also revealed, amplifying the impact. Suspicions grew about why there was a time lag with 'pre-recording and post-broadcast.' Coincidentally, the day before the recorded video was released, HYBE's stock price suddenly dropped nearly 11% without reason, raising suspicions of information leakage. This led to an investigation by the Financial Supervisory Service's Capital Market Special Judicial Police (FSS Special Judicial Police). An FSS official stated, "At the end of last year, the FSS investigation department notified the Southern District Prosecutors' Office under the emergency measures of the Securities and Futures Commission (SFC) under the Financial Services Commission, and the Southern District Prosecutors' Office directed the FSS Special Judicial Police to conduct the investigation." Eventually, after a year, the suspicions were confirmed to be true.

The FSS Special Judicial Police uncovered that HYBE employees had prior knowledge of BTS's group activity suspension and sold their stocks using undisclosed information, and referred the case to the prosecution with charges of violating the Capital Markets Act. The FSS Special Judicial Police explained, "Three employees, including a team leader at HYBE, who were responsible for idol group-related work within HYBE's label, sold their stocks before the announcement after receiving the adverse information that BTS would temporarily suspend group activities, avoiding losses totaling 230 million KRW based on the closing price on June 15," adding, "This constitutes a violation of Article 174 of the Capital Markets Act for using undisclosed information."

HYBE's Inadequate Crisis Management

In fact, BTS did not mention suspending group activities in the video. The mention of members' solo activity plans was overinterpreted the next day as not only suspending group activities but even disbandment, causing HYBE's stock price to crash.

As a result, there were strong voices in the market to give HYBE a failing grade for internal crisis management. HYBE operates a risk management team directly under the Chief Communications Officer (CCO). A securities firm official said, "Since BTS accounts for 70% of HYBE's sales, the market perceives 'HYBE = BTS,'" adding, "Ultimately, the market reacted, but HYBE failed to predict the impact of the dining content, so internal crisis management did not function properly." He continued, "Now, a year later, three employees are accused of using undisclosed information, which is also a sign that crisis management did not work."

An official from the Korea Exchange's KOSPI Market Headquarters said, "No member mentioned suspending group activities in the video," but added, "HYBE's delayed response was regrettable, and it was unfortunate that they did not actively respond to investors through explanatory disclosures." A financial investment industry official commented, "Although the response was not smooth in various aspects as a listed company, the suspicions toward HYBE as a whole are excessive," and pointed out, "It is more appropriate to see it as the fault of individual employees."

Need for New Comprehensive Disclosure Guidelines

Following the BTS dining video incident, the activity plans of key artists are expected to become important major management matters for entertainment companies. HYBE, having been burned once, disclosed BTS member Jin's enlistment news through a public disclosure last October. A securities firm official said, "It is true that the response method of HYBE, the leading stock of listed entertainment companies, is influencing the entire industry," and explained, "Now, it will be a matter of consideration whether to disclose contract terminations or team disbandments of important artists through public disclosures."

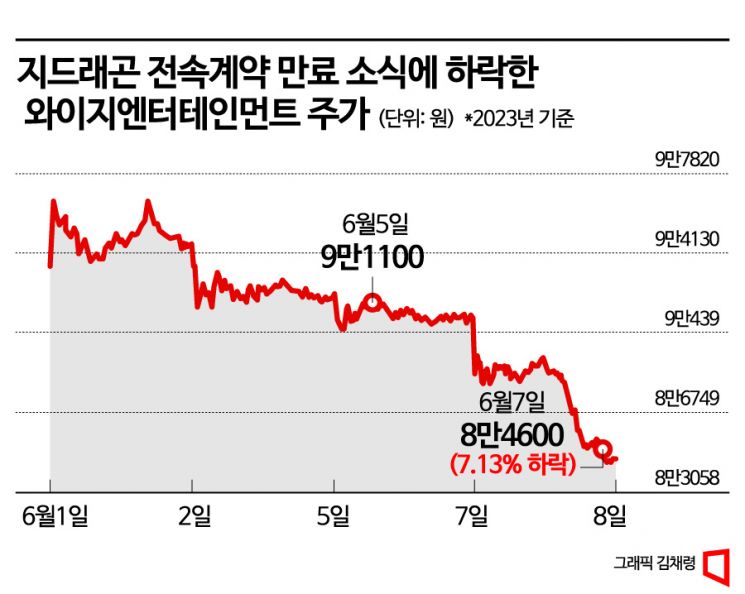

Moreover, recently, news that EXO's ChenBaekXi members notified SM of contract termination through the law firm Lin caused SM's stock price to plunge. YG Entertainment's stock price also showed weakness after news of Big Bang's G-Dragon's contract expiration surfaced. Last month, G-Dragon's name was missing from the list of affiliated singers in YG Entertainment's Q1 quarterly report filed on the Financial Supervisory Service's electronic disclosure system, leading to speculation that he had left YG.

An FSS official emphasized, "For listed entertainment agencies, the activity plans of key artists can significantly impact the company's stock price as major management matters, so companies must have systems to transparently disclose related information to general investors in a timely and proper manner." Senior Research Fellow Lee Hyo-seop of the Korea Capital Market Institute said, "Entertainment companies' dependence on key artists is increasing greatly, and whether contracts are terminated has a huge impact on stock prices," adding, "Just as disclosure standards for clinical trials have been strengthened for pharmaceutical and bio companies, disclosure standards related to key artist contract terminations need to be strengthened to protect investors."

There is an opinion that new comprehensive disclosure guidelines considering the characteristics of the industry itself are necessary. Comprehensive disclosure is a system where listed companies voluntarily disclose important information beyond mandatory disclosure items based on their judgment. For pharmaceutical and bio companies, when industry-specific important management matters such as clinical trials or product approvals occur, related information must be voluntarily disclosed. The disclosure standards have been strengthened by adding items such as ▲clinical trial completion ▲product approval ▲technology transfer and introduction.

However, related organizations believe that current standards are sufficient if disclosures are made properly. A Korea Exchange official said, "If the current regulations do not reflect disclosure items and system improvements are needed, then it should be done, but if artist disbandment, contract termination, or activity suspension is formalized and has a significant impact on the company, it can be disclosed through comprehensive disclosure."

In the market, there is also a strong voice that listed entertainment companies should voluntarily establish systems to disclose in a timely manner when they judge that information may affect the company's corporate value and stock price. A financial investment industry official said, "Concerns about contract termination or expiration of top artists caused the stock prices of SM and YG to fluctuate," and added, "Going forward, entertainment companies should make efforts to disclose such matters appropriately to investors through press releases or public disclosures." A Korea Exchange official explained, "Voluntary disclosures are made at the company's discretion unless mandatory, and explanatory disclosures fall within the scope of voluntary disclosures," adding, "When an incident like the BTS case causes waves to spread widely, smooth explanatory disclosures and responses by entertainment companies are essential."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)