Stock Prices Recover Amid Interest Rate Downtrend

Domestic Real Estate Market Prices Also Show Stable Trends

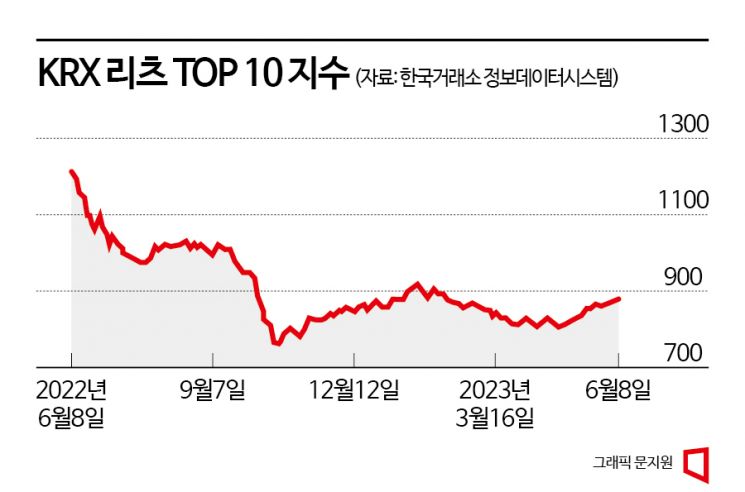

Domestic listed REITs, which have undergone a painful refinancing cycle during the interest rate hike period, are showing an upward trend in stock prices amid expectations that their financial cost burden will ease in the second half of this year.

According to the Korea Exchange, SK REITs, the largest domestic listed REIT by market capitalization, has recovered to the 5,100 won range and is now aiming to surpass 5,200 won. SK REITs, which fell below the 5,000 won mark in Q2 this year and dropped to a low of 4,900 won (closing price on April 5), has been gradually recovering since early May and has maintained above 5,100 won since May 11. It recorded 5,190 won as of the closing price on the 9th.

Lotte REITs, ranked second in market capitalization, touched a low of 3,550 won on April 27 this year and then showed a sharp upward trend. It recorded 4,000 won as of the closing price on the 9th, marking a 13% increase from this year's low.

Among domestic listed REITs, Shinhan Alpha REITs, which has the highest stock price per share, also traded at 6,260 won (as of the closing price on June 9), about 18% higher than its low of 5,290 won (April 17). Coramco Energy REITs, ranked second by stock price, closed at 5,560 won (as of the closing price on June 9), more than 13% higher than its low of 4,900 won (March 27).

The recovery of REIT stocks stems from the global pause in interest rate hikes and the relatively stable price maintenance of the domestic real estate market, unlike the U.S. commercial real estate market. Since last year, the rise in interest rates has increased financing costs, reducing REIT profitability and causing a sharp decline in stock prices. After the COVID-19 pandemic, the spread of remote work led to increased vacancy rates and decreased building values as office supply outpaced demand. Rent growth also slowed amid concerns about an economic downturn. However, with expectations of a halt in interest rate hikes this year, the domestic real estate market is gradually showing signs of recovery.

As global interest rates stabilize after a steep rise, the REIT market, which is a lagging market based on real estate interest rates, is also partially recovering its previous performance due to interest rate stabilization. In particular, hotel REITs and retail REITs, driven by rapidly increasing travel demand following the COVID-19 endemic (periodic spread of infectious diseases), are leading the recovery.

REIT stocks’ focus on asset sales and fundraising to maintain dividends in a high-interest-rate environment is also interpreted as having a positive impact on stock price increases. Shinhan Alpha REITs plans to sell Yongsan The Prime Tower. Industry insiders see a high possibility of special dividend payments through capital gains from building sales. ESR Kendall Square REITs is pursuing the sale of one logistics center that went public through an IPO. NH All One REITs has begun selecting a lead manager for the sale of the A-One Ingye Tower in Suwon. Aegis Value REITs and Coramco Energy REITs have also sold or are in the process of selling assets. A REIT industry official said, "The direction of interest rates is the most important factor in the REIT market," adding, "Unlike overseas, the domestic REIT lease market is still solid, so if the external variable of interest rates stabilizes, we expect it to improve again."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.