Since the Beginning of the Year, Chinese Funds Yield -6%, Ranking Lowest

Fund Inflows Are the Largest... Boost Expectations at Work

Although China’s lockdowns due to COVID-19 have been lifted, the country has yet to regain economic momentum, resulting in the lowest fund returns among major countries. The anticipated strong government stimulus measures have not materialized, and investors continue to wait for a 'big move' from the Chinese government while cautiously tapping into Chinese stock funds.

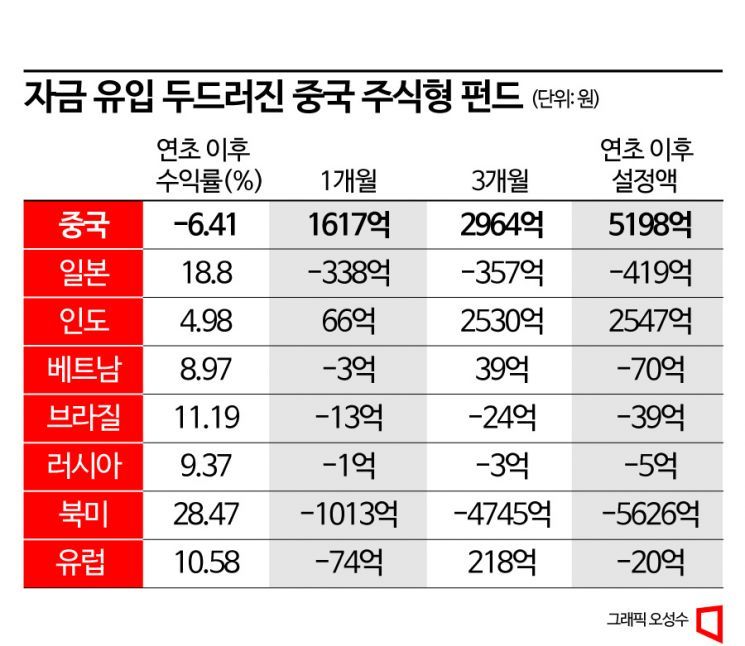

According to financial information provider FnGuide on the 9th, as of the 7th, among 196 overseas equity funds (excluding ETFs) investing in Chinese stocks, the year-to-date return was -6.41%, the lowest among country-specific equity funds. This figure is significantly below the average return of -2.84% for overseas equity funds. Most funds investing in other countries posted positive returns. Funds investing in the North American region gained 28%, followed by Japan (18.8%), Brazil (11.2%), Europe (10%), Russia (9.4%), Vietnam (9%), and India (5%).

While indices in countries like the U.S. have shown an upward trend this year, China alone has experienced a downward trajectory, leading to performance disparities. The U.S. S&P 500 index rose 12% year-to-date through the previous day, the Nasdaq Composite surged 27%, and Japan’s TOPIX index jumped 16%. In contrast, the Shanghai Composite Index increased by only 2.6% since the beginning of the year and dropped more than 6% in the past month. The sluggish recovery of the Chinese economy after reopening has led to growing investor fatigue and withdrawals. Additionally, delays in the announcement of government stimulus measures have prompted foreign investors to pull back.

Hong Rok-gi, a researcher at Kiwoom Securities, explained, “The early optimism about economic normalization since the second half of last year has backfired. Except for state-owned oil companies that strengthened cooperation with the Middle East to avoid U.S.-China conflicts, consumer goods and tech stocks have largely given back their gains due to slow consumption recovery and semiconductor tensions with the U.S.”

Nevertheless, investors’ money is flowing into China. Since the beginning of the year, China attracted the largest inflow among overseas equity funds, with 520 billion KRW invested. During the same period, the North American region saw a net outflow of 563 billion KRW, and the Japanese market experienced an outflow of 42 billion KRW. Over the past three months, China also received the highest inflow at 297 billion KRW. Inflows over the recent one month (161.7 billion KRW) and one week (30 billion KRW) were overwhelmingly larger compared to other countries. While investors in regions like North America, Japan, and Europe increased profit-taking amid rising indices, investors in China appeared to be buying stocks at lower prices amid the index decline.

By fund, since the start of the year, 15.3 billion KRW worth of the ‘Fidelity China Consumer Fund’ was purchased. This was followed by the ‘Fidelity China Fund’ (8.9 billion KRW), ‘Mirae Asset China H Leverage 2.0 Fund’ (3.7 billion KRW), ‘Mirae Asset China STAR Market Fund’ (2.8 billion KRW), and ‘Mirae Asset China H Index Fund’ (2.4 billion KRW). The Fidelity China Consumer Fund, which invests in consumer goods companies listed on the Chinese and Hong Kong stock exchanges, attracted money based on expectations that China’s economic stimulus would significantly boost consumption. However, with the consumer price index (CPI) recording negative growth in the first half and economic vitality sharply declining, the fund’s returns since the beginning of the year and over the past three months were -9.6% and -10.5%, respectively, underperforming the average return.

Experts foresee a not-so-bad outlook for the Chinese market in the second half of the year. The May manufacturing Purchasing Managers’ Index (PMI) released by China’s National Bureau of Statistics was 48.8 (contraction phase), marking a decline for three consecutive months, highlighting the need for government intervention. Park Su-hyun, a researcher at KB Securities, said, “The May PMI confirms that expectations for both domestic demand and export markets remain low, and the employment market is still sluggish. If this trend continues, the government will have no choice but to stimulate the domestic economy through monetary and real estate support policies.” There are also talks that local governments in China will announce measures to ease the housing market.

However, a short-term approach is risky. Even if the Chinese government moves to stimulate domestic demand, it is unlikely to translate immediately into returns. Moreover, if the stimulus measures are not as strong as expected, disappointment could deepen. Park said, “Even if stimulus measures are announced, it will take time for their effects to materialize, and a rebound in consumer spending based on employment market recovery is necessary to resolve the undervaluation of Chinese stocks.” Choi Seol-hwa, a researcher at Meritz Securities, explained, “From the Chinese government’s perspective, although the stimulus may seem weak compared to market expectations, the growth target of 5% set at the beginning of the year is being exceeded, so there may be no need to rush. Considering available funds, it will be difficult to introduce strong stimulus measures, including easing real estate regulations in first-tier cities.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)