Ripple Foundation launched 'Ripple CBDC Platform' last month

Also acquired stake in virtual asset exchange Bitstamp

SEC lawsuit on 'securities classification' expected in first half of the year

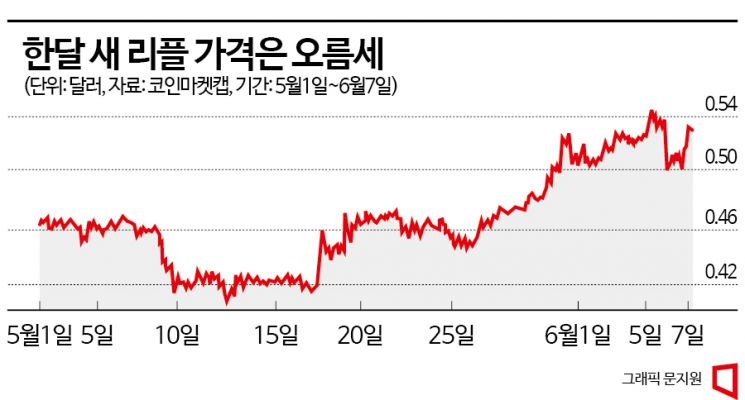

Thanks to various positive factors such as the acquisition of shares in virtual asset exchanges, the price of Ripple, a top market capitalization coin, is showing an upward trend. Ripple is the virtual asset with the second-largest holding ratio among domestic investors, following Bitcoin, the representative virtual asset. Despite adverse news from the U.S. Securities and Exchange Commission (SEC), the price has shown a recovery trend supported by several positive developments.

According to the global virtual asset market status relay site CoinMarketCap, as of 3:07 PM on the 7th, Ripple's price was recorded at $0.53 (approximately 691 KRW), up 4.70% compared to the previous day. Compared to $0.45 a month ago, Ripple's price rose by 15.09%. Furthermore, it surged 20.75% compared to last month's 12th, when it had dropped to $0.42.

Ripple is the coin used in the Ripple virtual asset payment system. Ripple is characterized by its specialization in remittances. It was created to provide transparent and traceable services to customers through partnerships with financial companies. Ripple is especially known as a coin that attracts significant interest from domestic investors. As of the end of last year, Bitcoin (3.99 trillion KRW) held the top market capitalization in the domestic virtual asset market. It was followed by Ripple (3.24 trillion KRW), Ethereum (2.41 trillion KRW), and Dogecoin (790 billion KRW). The market capitalization shares were 20.6% for Bitcoin, 16.7% for Ripple, 12.4% for Ethereum, and 4.1% for Dogecoin, respectively.

The recent upward trend in Ripple's price is due to several positive announcements. On the 22nd of last month, the Ripple Foundation announced the launch of the CBDC (Central Bank Digital Currency) issuance platform, 'Ripple CBDC Platform.' Central banks around the world are conducting research and development on CBDCs, and the Ripple Foundation plans to help central banks digitally transform at a high level and improve financial accessibility through this platform.

Additionally, the Ripple Foundation acquired shares in the virtual asset exchange Bitstamp. According to the Ripple Foundation, this move aims to enhance the status of Ripple coin and diversify its business. According to data from the virtual asset market status relay site CoinGecko, Bitstamp ranked 30th in trading volume among global centralized exchanges (CEX). The trading proportions were largest for Bitcoin, Ripple, and Ethereum, in that order.

The expectation that the lawsuit between the SEC and the Ripple Foundation will end soon is also a factor driving the price increase. The prevailing view is that the lawsuit will conclude in the first half of this year. In December 2020, the SEC filed a lawsuit alleging that the foundation violated securities laws. The key issue in the lawsuit is whether Ripple coin is a security. If Ripple, which argues that it is not a security, wins, it is expected that the U.S. Commodity Futures Trading Commission (CFTC) will handle most virtual assets, leading to relatively lighter regulations and positive effects on the coin market.

There is also an analysis that even if the SEC wins, it may not lead to the delisting of Ripple coin, which has had a positive impact. The Bithumb Economic Research Institute, affiliated with the domestic exchange Bithumb, predicted in its report titled 'What Will Happen to SEC vs. Virtual Asset Ripple Based on Past Cases?' that Ripple will continue to be traded in the market regardless of the lawsuit outcome.

The Bithumb Economic Research Institute explained, "Even if Ripple loses, there is a possibility that virtual asset Ripple will not be removed from the U.S. distribution market," adding, "The SEC did not request the court to delist Ripple at the time of filing the lawsuit." It further stated, "If the court orders delisting, many investors worldwide are expected to suffer losses, so the judiciary cannot disregard investor damage."

Moreover, the startup company Ripple Labs, which issues the virtual asset Ripple, attracted market attention by announcing plans to pursue an initial public offering (IPO). The Ripple Foundation intends to proceed with the IPO after the lawsuit with the SEC concludes.

Thanks to consecutive positive factors, Ripple's price has shown a recovery trend even after the SEC filed lawsuits against global exchanges Binance and Coinbase. The SEC sued Binance and its founder and CEO Changpeng Zhao for allegedly gaining unfair profits using customer assets. It also requested the court for an emergency order to freeze Binance's assets in the U.S. The SEC pointed out that Coinbase earned billions of dollars through virtual asset handling since at least 2019 but violated securities laws by evading disclosure obligations for investor protection. Following the news of the lawsuit against Binance on the 6th, Ripple's price dropped to $0.50 but rose back to $0.53 by the afternoon of the 7th, returning to its previous price.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)