Vacancy Rates Fall and Rents Rise in Seoul's Major Office Districts

Overseas 'Distressed Funds' Targeting Devalued Buildings Left Empty-Handed

Slow Overall Recovery in Commercial Real Estate Due to Poor Conditions in Logistics and Data Centers

"These days, there are no office vacancies in Gwanghwamun."

Unlike the sharp downturn in the U.S. commercial real estate market, demand in the Korean office building market has hardly decreased. This year, the vacancy rates in major office districts in Seoul have fallen, and rents have risen, signaling a reversal in the office market sentiment. Financial companies and institutions that had put a complete stop to real estate investments are now turning their attention to office buildings in key districts, resulting in a concentration of investments.

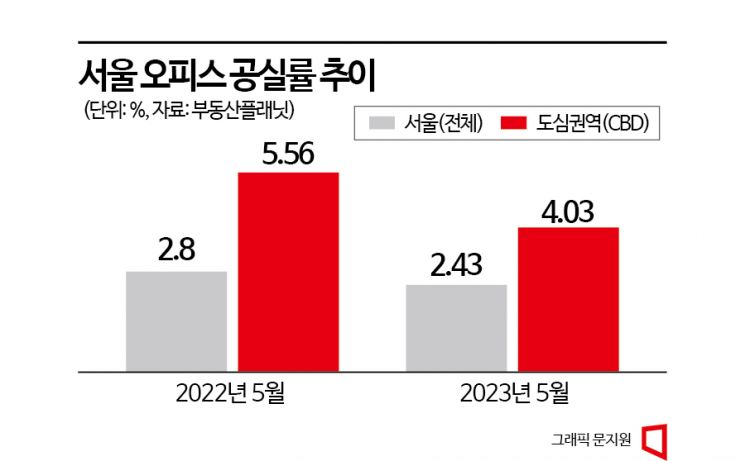

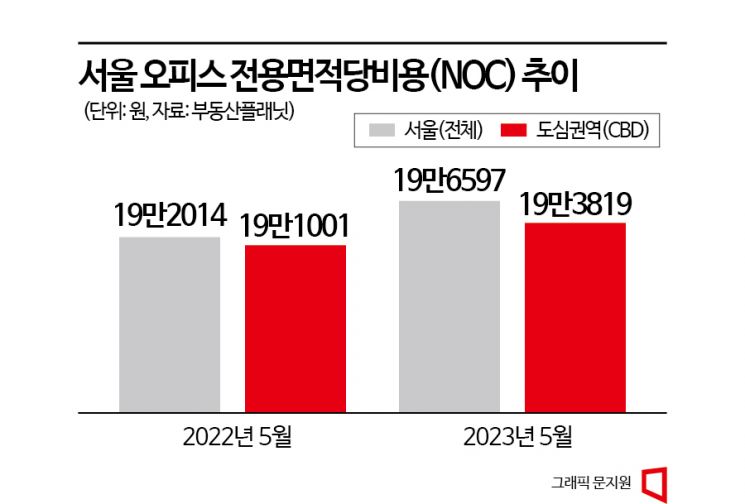

According to Real Estate Planet, a commercial real estate specialist company based on big data and artificial intelligence (AI), the office vacancy rate in Seoul (overall) was 2.43% in May, down 0.37 percentage points from 2.8% in May last year. Meanwhile, the net operating cost (NOC), which includes rent and maintenance fees per exclusive area, rose by 4,583 KRW (2.4%) to 196,597 KRW from 192,014 KRW a year earlier. The vacancy rate in the Central Business District (CBD) decreased by 1.53 percentage points from 5.56% a year ago to 4.03% last month. The NOC increased by 2,818 KRW (1.48%) from 191,001 KRW in May last year to 193,819 KRW this May. The CBD area covers the business districts around Jung-gu and Jongno-gu in Seoul, spanning from Jonggak Station to Gwanghwamun Station and Seoul Station. Representative buildings include Gwanghwamun Kyobo Building, Centropolis, D Tower Gwanghwamun, Center One, State Tower Namsan, Grand Central, Seoul Square, Grand Seoul, Pine Avenue, and Signature Tower.

Unlike the U.S., Korea has rapidly transitioned from remote work back to normal office work, which is believed to sustain office demand. Lee Hyung-gu, Head of Research & Consulting at Genstar Mate, explained, "Since COVID-19, office building demand and value have shown different patterns in the U.S. and Korea. While remote work is still ongoing in the U.S., in Korea, culturally, everyone is back to working in the office. Also, in the U.S., if office vacancy rates reach around 30%, prices immediately reflect this, causing market valuations to drop sharply below purchase prices. In contrast, in Korea, even if some vacancies occur, real estate values do not decline drastically and tend to remain stable."

In the U.S. and Europe, specialized distressed funds target buildings whose values have sharply declined to scoop them up. Overseas funds prepared for such situations have been gathering capital since last year to target the Korean market, but because building prices have not significantly dropped domestically, distressed funds have not been active.

Although investment sentiment has been gradually reviving around prime office buildings since early this year, most analysts agree that it is still too early to proceed with aggressive investments given that interest rate cuts have not yet fully materialized. Lee Hyung-gu noted, "Loan interest rates for prime office buildings have risen from a minimum of 2.4% to as high as 6.5% currently. A 3% increase in loan rates causes a 4.5% drop in yields, making it impossible for institutional investors to achieve their desired annual dividend yield of 6%." Kim Dong-jung, Head of the REIT Business Division at NH Nonghyup REIT Management, also said, "The decline in vacancy rates and rise in rents are clearly observed and undoubtedly expand investment demand, but since interest rate cuts are not yet certain, investor sentiment remains uncertain."

Institutions that had been diversifying investments into logistics centers, data centers, and other assets have narrowed their focus to office buildings supported by stable demand, but some analysts caution against prematurely assuming a market recovery. Kim Cheol-gyu, Head of REIT Business Division 1 at Koramco Asset Trust, said, "When considering real estate investments, we see investments concentrating on office buildings in Seoul’s three major districts with solid demand. However, logistics centers and other real estate sectors are still struggling, so it will take some time for overall commercial real estate investment sentiment to recover."

Meanwhile, as of the first quarter of this year, the total assets of indirect real estate investments in Korea were recorded at 90.5 trillion KRW. This has grown from 34.02 trillion KRW in 2017, 43.2 trillion KRW in 2018, 51.2 trillion KRW in 2019, 62 trillion KRW in 2020, 76 trillion KRW in 2021, and 87.4 trillion KRW in 2022.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)