Sangui, Tax Innovation Forum

South Korea's corporate tax competitiveness ranks 34th out of 38 OECD countries. There are calls to reform corporate tax to secure corporate competitiveness and to establish tax policies for balanced regional development.

The Korea Chamber of Commerce and Industry held a Tax Innovation Forum on the 7th to discuss the need to simplify the tax system. This forum was organized to discuss improvement measures for tax laws that are complex or unreasonable compared to global standards in response to changes in demographic structure and economic environment.

The Korea Chamber of Commerce and Industry held a Tax Innovation Forum on the 7th at the Chamber of Commerce building to discuss the need for simplification of the tax system. Woo Tae-hee, Executive Vice President of the Korea Chamber of Commerce and Industry (fifth from the left), is taking a commemorative photo with the attendees.

The Korea Chamber of Commerce and Industry held a Tax Innovation Forum on the 7th at the Chamber of Commerce building to discuss the need for simplification of the tax system. Woo Tae-hee, Executive Vice President of the Korea Chamber of Commerce and Industry (fifth from the left), is taking a commemorative photo with the attendees.

Professor Oh Jun-seok of the Department of Business Administration at Sookmyung Women's University said at the forum, "According to the international tax competitiveness index published by the Tax Foundation in the United States for OECD member countries, South Korea's overall tax competitiveness ranking in 2022 was 25th, with consumption tax ranking 2nd, but corporate tax ranking very low at 34th. Compared to 2014, the United States rose 11 places, but South Korea fell 21 places."

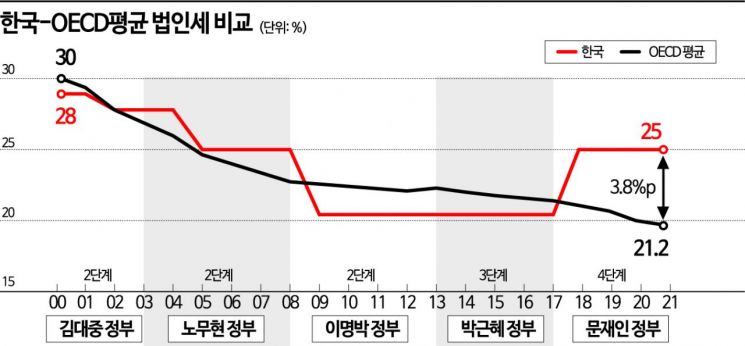

The reason for the reversal in corporate tax competitiveness between South Korea and the United States is attributed to the U.S. simplifying its progressive tax rate structure of 15-35% in 2018 to a flat 21% rate, whereas South Korea introduced a new highest tax bracket of 25% in 2017.

Professor Oh pointed out, "In the process of global supply chain restructuring, the tax environment as an infrastructure for attracting investment in advanced industries is more important than anything else. South Korea's nominal highest corporate tax rate is 24%, exceeding the OECD average highest rate of 21%, and while most OECD countries have only 1 to 2 tax brackets, South Korea has 4, making it complex. There is a strong need to lower corporate tax rates and simplify the progressive system into a flat tax system in line with international trends."

Han Won-gyo, a lawyer at the law firm Yulchon, argued, "Corporate income ultimately belongs to shareholders, and since shareholders have different income brackets, there is no need for progressive taxation at the corporate level." Hwang Seong-pil, a legislative researcher at the National Assembly, also mentioned, "Tax rate reductions need to be decided legislatively by comprehensively considering economic conditions, fiscal needs, and international trends."

In particular, Professor Oh suggested, "There is a need to prepare measures to utilize the corporate tax system to overcome the crisis of regional extinction," and proposed, "It is worth considering differentiating corporate local income tax by region under the Local Tax Act."

In the United States, in addition to the federal corporate tax (21%), corporate taxes are imposed at varying rates of 0-12% by state. In South Korea, 10% of the national corporate tax is uniformly imposed as corporate local income tax.

Professor Ha Jun-kyung of Hanyang University emphasized, "Differential tax rates by region are a good idea to discuss for balanced regional development," adding, "What is important is the practical effect, so not only tax incentives but also complementary aspects such as education and healthcare should be considered together."

Researcher Lim Dong-won of the Korea Economic Research Institute stated, "South Korea's tax system has many tax items, and the tax brackets and rates for each tax item are complex," and argued, "It is reasonable to integrate individual consumption tax, tobacco consumption tax, transportation, energy, and environmental taxes into a national consumption tax, and to abolish the individual consumption tax on automobiles, which is difficult to consider a luxury item among the individual consumption tax targets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)