May Seoul Apartment Transactions Reach 2,040

Rising Demand for Switching Fuels Uptrend in Gangnam and Mayongseong

But Reverse Jeonse Crisis and Economic Downturn Remain Variables

The volume of apartment sales transactions in Seoul has surpassed 2,000 units for four consecutive months. The real estate market, which suffered a transaction freeze in the second half of last year due to high interest rates, is showing signs of a turnaround. However, experts caution that it is too early to consider this a full-fledged upward trend due to uncertain economic conditions and increased risks of reverse jeonse.

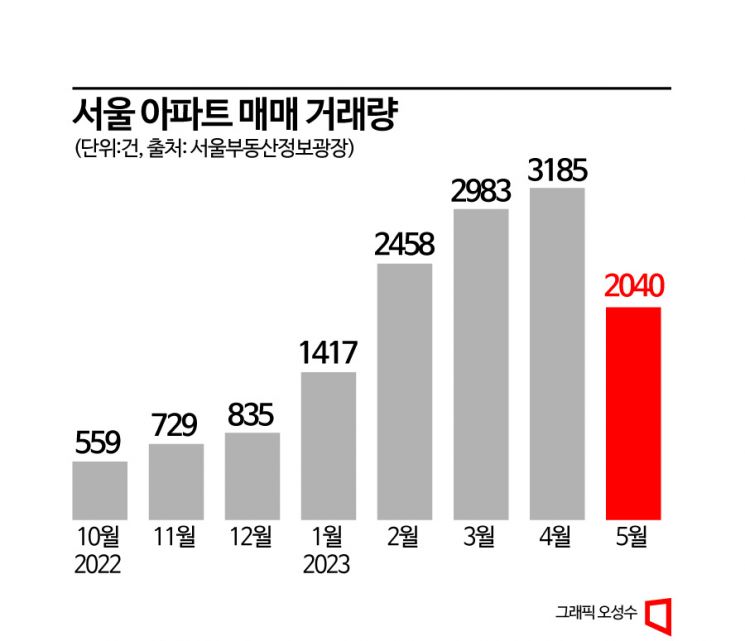

According to the Seoul Real Estate Information Plaza on the 6th, the volume of apartment sales transactions in Seoul for May was recorded at 2,040 units. Although this does not reach the 3,185 units recorded in April, there is room for an increase as the reporting deadline for actual transactions is about a month away.

The Seoul real estate market was cooled down to the point of a transaction freeze in the second half of last year due to the rapid interest rate hikes. From July to December last year, monthly transaction volumes did not even reach 1,000 units. In October, it dropped to as low as 559 units, effectively indicating a disappearance of transactions.

This atmosphere sharply reversed when the government announced a major relaxation of real estate regulations in early January. All areas except Gangnam, Seocho, Songpa, and Yongsan districts were removed from the regulated zones, and barriers related to loans and taxes were eliminated, reviving transactions centered on urgent sales. The volume rapidly increased to ▲1,417 units in January ▲2,458 units in February ▲2,983 units in March, and surpassed 3,000 units in April.

As buying demand revived, falling housing prices also turned upward. According to the Korea Real Estate Board, the Seoul apartment price index rose by 0.04% in the fifth week of May compared to the previous week, continuing the upward trend for two consecutive weeks following last week's 0.03% increase. The recovery centered on Gangnam, Seocho, and Songpa districts has now spread to other areas such as Mapo, Yongsan, and Seongdong. Except for nine districts?Jongno, Gwangjin, Jungnang, Gangbuk, Dobong, Yangcheon, Gangseo, Guro, and Gwanak?other areas have entered a phase of price increases or stabilization.

In particular, the launch of the Special Home Loan for houses priced under 900 million KRW has revived demand in mid- to low-priced areas. A representative from a real estate agency in Mapo explained, "As demand for houses under 900 million KRW emerges, there is a chain reaction of people selling these homes to move to higher-tier areas, which is sustaining the overall upward trend in Seoul."

However, some point out that it is premature to say that Seoul apartment prices have fully turned upward. There is a risk that the U.S. may raise interest rates further or that the domestic economy may deepen into a recession. Particularly, concerns remain that the spread of reverse jeonse difficulties could pull housing prices down again. In its recent June Financial and Economic Issue Analysis report, the Bank of Korea warned, "The proportion of households at risk of reverse jeonse has increased from 517,000 to 1,026,000 in one year and three months," adding, "The increase in 'empty jeonse' and reverse jeonse not only expands the risk of non-return of jeonse deposits but also raises downward pressure on the housing market."

Yeogyeonghee, Senior Researcher at Real Estate R114, also explained, "After the depletion of urgent sales, increased price burdens combined with the seasonal off-season have caused apartment purchase inquiries to slow down. While contracts for apartments priced under 900 million KRW, which qualify for the Special Home Loan, are occasionally being made in Seoul, the pace of transaction increases is slowing, especially in high-priced areas."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)