As a result of Zigbang's re-investigation

Only 1 out of 4 households actually sold

37,000 households scheduled for sale in June

Last month, only 22% of the planned housing units were actually supplied. Although unsold units are gradually decreasing, construction companies are postponing their sales plans due to soaring raw material costs and a sluggish real estate market. Despite recent market changes such as consecutive interest rate freezes and a decrease in unsold units, it remains uncertain whether the postponed units will be sold this month.

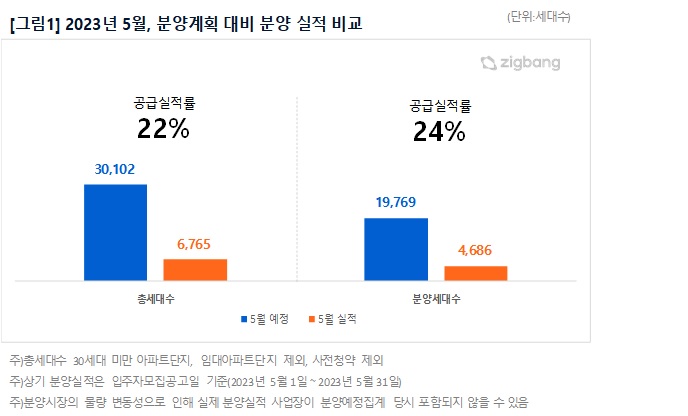

According to real estate big data company Zigbang on the 5th, the housing units scheduled for sale in May, surveyed at the end of April, included 32 complexes with a total of 30,102 households, of which 19,769 were general sales units. Upon re-investigation, only 16 complexes with a total of 6,765 households (a supply performance rate of 22%) were actually supplied. For general sales, 4,686 units were put up for sale, recording a 24% supply performance rate. This means that only one out of every four planned units was actually sold. This is interpreted as construction companies postponing their planned sales due to the continued slump in the sales market, with unsold units reaching 70,000.

In this atmosphere, a total of 37,733 households are scheduled for sale in June. According to Zigbang, the planned supply for June is 47 complexes with a total of 37,733 households. This is about 138% more than the same month last year (15,877 households).

By region, the metropolitan area is expected to supply 17,979 households. △Gyeonggi 9,139 households △Seoul 6,047 households △Incheon 2,793 households will be supplied. In the provinces, a total of 19,754 households will be supplied, with △Gyeongnam 3,504 households △Gangwon 3,105 households △Gwangju 2,771 households △Daejeon 1,974 households △Chungnam 1,847 households △Chungbuk 1,518 households △Jeonbuk 1,368 households △Busan 1,249 households △Jeju 1,005 households △Daegu 731 households △Ulsan 682 households in descending order of planned supply volume.

Whether June sales will proceed on schedule remains uncertain. Ham Young-jin, head of Zigbang Big Data Lab, said, "There are market changes such as interest rate freezes and a decrease in unsold units that could be factors for expecting a recovery in the sales market, but it is still uncertain whether the postponed units will actually be sold in June." He added, "Rather than a full market recovery, it seems that the easing of regulations such as the 1·3 real estate measures and the slightly improved housing purchase sentiment earlier this year have partially influenced the resolution of some unsold units."

Meanwhile, Zigbang pointed out urban supply complexes to watch in June, including 'Lotte Castle East Pole' in Jayang-dong, Gwangjin-gu, Seoul, and 'Sangdo Prugio Cla Venue' in Sangdo-dong, Dongjak-gu. In the metropolitan area, complexes preparing for sale this month include those in popular areas during past sales such as 'Gwangmyeong Central I-Park' in Gwangmyeong-dong, Gwangmyeong-si, Gyeonggi, and 'Seongnam Bokjong 2A-1' in Sinheung-dong, Sujeong-gu, Seongnam-si.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.