Mongolian Beer Exports Reach $9.36 Million, Up 98% YoY

OB Beer Records Cass as No.1 Imported Beer Brand

Synergy from Beer Market Growth and Hallyu Expansion

Korean beer has nearly quintupled its export value to Mongolia over the past two years, challenging for the top spot in Mongolia's imported beer market. As the local beer market grows, especially among young consumers, and K-content gains popularity, demand for Korean products is higher than ever, suggesting that the export growth of K-beer is expected to continue for the time being.

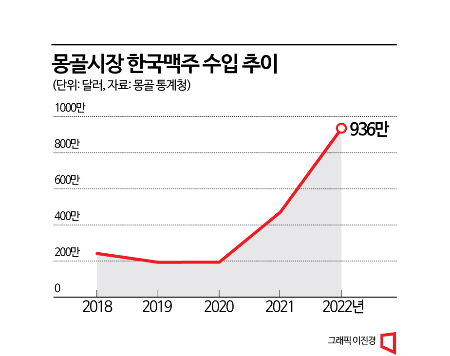

According to KOTRA on the 4th, last year’s export value of Korean beer to Mongolia was $9.355 million (approximately 12.4 billion KRW), marking a 98.3% increase compared to the previous year. Mongolia’s beer export value was $2.42 million in 2018 but decreased to $1.93 million in 2019 and remained flat at $1.94 million in 2020. Then, it rebounded by more than doubling to $4.72 million in 2021, and last year, the import volume increased by nearly 100% compared to the previous year.

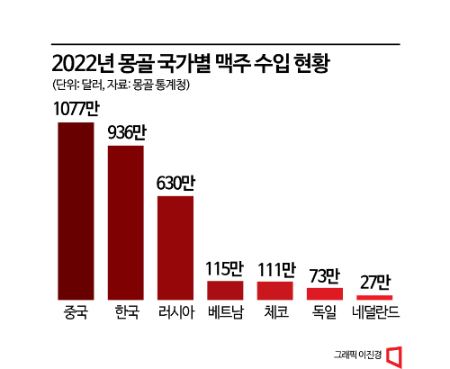

The leading position in Mongolia’s beer market is also within reach. The country that sold the most beer in the Mongolian market last year was China, exporting $10.77 million (approximately 14.2 billion KRW). Chinese beer’s export value was only $600,000 in 2018 but has rapidly increased its market share in Mongolia since 2020. Meanwhile, Russia, which had continuously held the top spot, peaked at $7.57 million in 2021 but dropped to $6.3 million last year, falling to third place.

By individual brand, OB Beer’s “Cass,” which entered the Mongolian market in 1999, ranks first not only among Korean beers but also among all imported beer brands. Cass accounted for 77% of Korean beer in Mongolia last year, showing an overwhelming market share. Particularly, in the Mongolian market where higher alcohol content is preferred, “Cass Red” is reported to be very popular among male consumers because it has a high alcohol content of 6.9% but a non-bitter taste.

Recently, domestic craft beer companies such as Kabrew and Jeju Beer have also been contributing to the growth of Korean beer. Kabrew, which started exporting to Mongolia in 2020, saw its export value increase by 282% in 2021 compared to the previous year and by 54% last year. This year, as of May, exports have grown by about 20% compared to the same period last year, continuing the growth trend. A Kabrew representative said, “Domestic craft beers including Kabrew are positioned as premium products locally and are receiving good responses,” adding, “After expanding the lineup to five types last year, including Gumiho IPA and Seoul Pale Ale, we plan to steadily expand our influence in the Mongolian market this year as well.”

The recent increase in Korean beer exports to Mongolia is attributed to the convergence of two factors: the growth of the Mongolian beer market and the spread of the Korean Wave (Hallyu). Last year, Mongolia’s beer consumption reached 156.08 million liters, up 26.8% from 123.07 million liters a year earlier and 52.5% from 103.5 million liters two years ago.

KOTRA analyzed, “Like Korea, the COVID-19 pandemic led to the spread of home drinking and solo drinking cultures,” adding, “Consumption of low-alcohol beers increased mainly among young women, and the trend among young people to seek various beers beyond local brands also had an impact.” Furthermore, the influence of various content such as K-pop and Korean dramas contributed to the rapid increase in demand for Korean beer as an extension of Korean cultural consumption, fueling the sharp growth.

With steadily increasing demand for Korean products and the rapid expansion of Korean-affiliated distribution networks, the offensive of Korean beer in the Mongolian market is expected to intensify. CU convenience stores operated by BGF Retail surpassed 300 stores locally in March, four and a half years after entering the market, and GS25 recently exceeded 150 stores.

KOTRA forecasted, “If Korean beer continues to release a variety of products that suit consumers’ tastes in the growing Mongolian imported beer market, it will be able to further increase its market share based on the popularity of the Korean Wave.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.