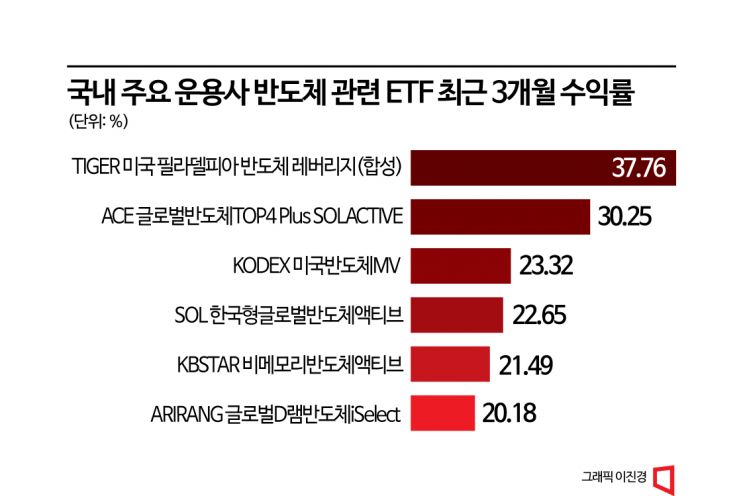

Domestic Major Asset Managers' ETFs Surpass 20% 3-Month Returns

AI Boom Drives Increased Demand for High-Value Memory Semiconductors like GPUs

The stock prices of major semiconductor companies have risen in anticipation of improved industry conditions, leading to a corresponding increase in the returns of semiconductor-related exchange-traded funds (ETFs). According to the financial investment industry, the three-month returns of representative semiconductor ETFs managed by major asset management firms have exceeded 20%.

Mirae Asset Global Investments' TIGER U.S. Philadelphia Semiconductor Leverage (Synthetic) ETF posted the highest three-month return among semiconductor-related ETFs at 37.76%. The Philadelphia Semiconductor Index tracks the stock prices of companies primarily involved in semiconductor design, supply, manufacturing, and sales. It is composed of the stock prices of 30 leading U.S. semiconductor companies such as Intel and Micron, and is considered a barometer of semiconductor stock trends. The Philadelphia Semiconductor Index surged from 2500.99 on January 3 to 3453.18 on May 31.

Korea Investment Trust Management's ACE Global Semiconductor TOP4 Plus SOLACTIVE ETF also rose 30.25% over the past three months. This semiconductor ETF was the first product launched after CEO Bae Jae-gyu took office and rebranded the company's ETF line as 'ACE.' It was listed in November last year. The ETF includes the top 10 global semiconductor companies by market capitalization listed in the U.S. and Korea, and follows a thematic strategy index that allocates 20% weight each to the top-ranked stocks in the key semiconductor sectors of memory, non-memory, foundry, and semiconductor equipment.

During the same period, Samsung Asset Management's KODEX U.S. Semiconductor MV (23.32%), Shinhan Asset Management's SOL Korea-style Global Semiconductor Active (22.65%), KB Asset Management's KBSTAR Non-Memory Semiconductor Active (21.49%), and Hanwha Asset Management's ARIRANG Global DRAM Semiconductor iSelect (20.18%) also showed high returns.

The sharp rise in semiconductor ETF returns is interpreted as reflecting expectations of an improvement in the semiconductor industry outlook. The market sentiment was changed by the AI boom triggered by the emergence of ChatGPT. Demand for graphics processing units (GPUs) needed for AI data centers has increased, significantly boosting demand for high-value-added memory semiconductors. Favorable changes in monetary policy and economic indicators, which had previously suppressed investor sentiment, are also positive factors for the market. There are even forecasts that the KOSPI could reach 3000 in the second half of the year.

Kim Jeong-hyun, head of the ETF business division at Shinhan Asset Management, said, "The stock price surge following Nvidia's earnings surprise has led to gains in major domestic semiconductor stocks such as Samsung Electronics and SK Hynix, improving investor sentiment across the semiconductor sector." He added, "As positive outlooks on the semiconductor industry spread, the stock price rebound of high-quality semiconductor materials, parts, and equipment companies may also become prominent."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)