Sharp Rise in Card Payment Amounts... Card Companies' Earnings Stall

Declining Fees, Rising Funding and Bad Debt Costs Lead to Negative Margins

Photo by Getty Images Bank

Photo by Getty Images Bank

As demand for overseas travel recovers, card payment amounts in related industries are increasing, but card companies are facing a gloomy atmosphere. This is because funding costs remain unstable and there are concerns about negative margins due to still low merchant fees. On top of this, anxiety is spreading over Samsung Pay also imposing fees amid the 'pay war' triggered by Apple Pay.

Performance Stalls Despite Domestic and International Consumption Expansion

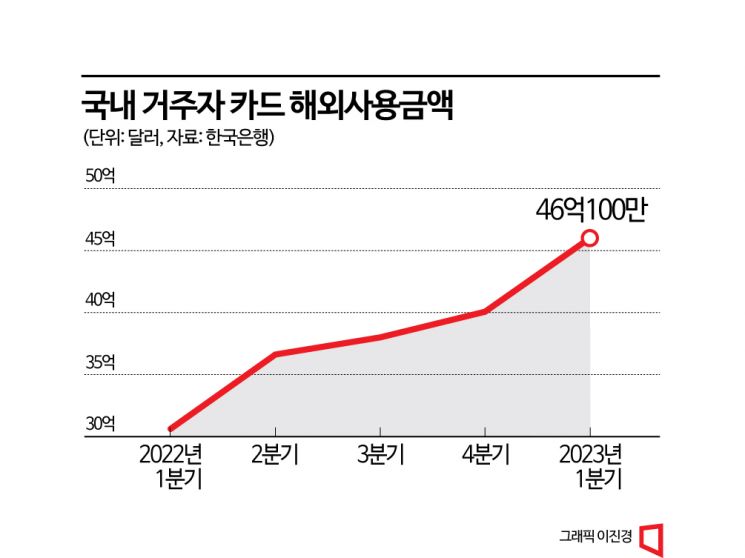

According to the Bank of Korea on the 2nd, the overseas card usage amount by domestic residents in the first quarter of this year was $4.601 billion (approximately KRW 6.08 trillion), a 14.8% increase from the previous quarter. Compared to the first quarter of last year, it increased by 50.3%. This is due to the easing of COVID-19 restrictions worldwide and increased demand for overseas travel. The downward stabilization of the won-dollar exchange rate also contributed to the increase by boosting direct overseas purchases.

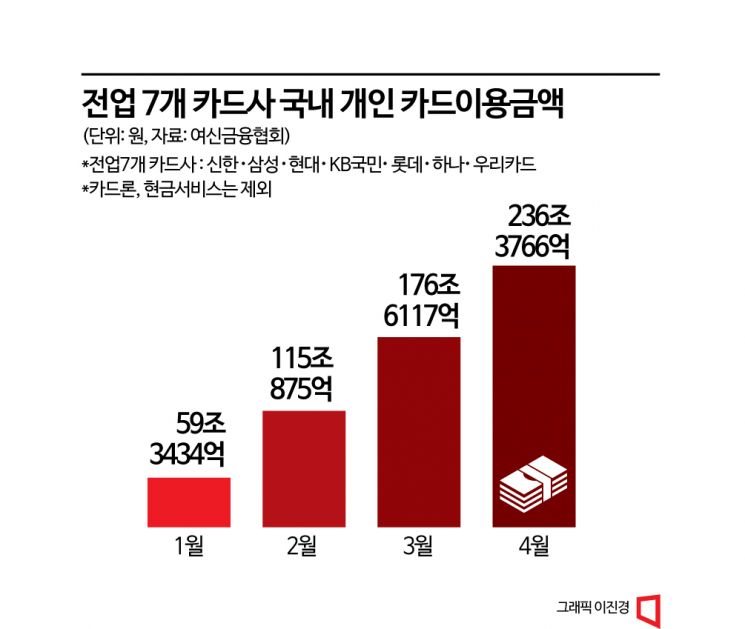

Domestic card usage is also rapidly increasing. According to the Credit Finance Association, the domestic personal card usage amount (excluding cash services and card loans) of seven major card companies?Shinhan, Samsung, Hyundai, KB Kookmin, Lotte, Hana, and Woori Cards?was KRW 236.3766 trillion in April. This is a 33.8% (approximately KRW 59.7649 trillion) increase from KRW 176.6117 trillion in the previous month. In particular, travel-related consumption is believed to have mainly increased. The industry views the sharp rise in payments in travel-related sectors as a significant factor. According to KB Kookmin Card’s analysis of its own consumption data, from the beginning of the year to the 15th of last month, sales in major overseas travel-related sectors such as travel agencies, airlines, and duty-free shops increased by 409%, 150%, and 88%, respectively, compared to the same period last year.

Nevertheless, card companies are not optimistic. Merchant fees continue to decline, and outgoing costs such as funding and bad debt expenses are not decreasing, making it difficult to resolve the negative margin situation. In fact, the domestic demand recovery in the first quarter of this year did not significantly help card companies’ performance. Rather, the net profit of the seven major card companies decreased compared to the same period last year. Shinhan Card, the industry leader, recorded KRW 166.7 billion, a 5.3% decrease from the previous year, which was the best performance among them. Large companies such as Samsung Card (-9.5%), Hyundai Card (-7.9%), KB Kookmin Card (-31%), as well as Hana Card (-63%), Lotte Card (-40.5%), and Woori Card (-46.3%) showed double-digit declines.

From Fees to Funding and Bad Debt Costs... A Mountain of Challenges

This is due to the sharp rise in funding costs caused by the surge in interest rates on credit specialized finance bonds, which are the funding source for card companies without deposit functions, at the end of last year. According to the Korea Financial Investment Association, the interest rate on credit specialized bonds (AA+, 3-year maturity) soared to the 6% range in November last year and then dropped to the 3% range in the first quarter of this year. However, it remains significantly higher than the 1% range at the beginning of last year. The increase in bad debt costs due to rising delinquency rates has also been a burden. In the first quarter of this year, among the seven major card companies, all except Hyundai Card (0.95%) saw delinquency rates rise to the 1% range.

They are exploring new revenue sources such as data business, credit evaluation (CB) business, and overseas expansion, but it is still early for these to become stable income sources. Shinhan Card, Samsung Card, and BC Card have been preliminarily designated as private data specialized institutions by the Financial Services Commission. Their strategy is to combine various data from financial and non-financial companies to develop products. Shinhan Card, KB Kookmin Card, and Hyundai Card have also entered the MyData (personal credit information management) business. BC Card has sought various new revenue streams such as digital payment support projects in Kyrgyzstan and art platforms.

Samsung Pay, which has been virtually free except for technology usage fees, is also expected to shift to charging fees per transaction like Apple Pay. Since its launch in 2015, the cumulative payment amount reached KRW 219 trillion as of February this year, so the industry expects an increase in annual fee burdens amounting to several hundred billion won. A card industry official said, "Everyone seems to be bracing for a cold winter this year," adding, "There is no clear way out, so the atmosphere is to tighten belts for now."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)