FedChamber Survey of 150 Companies in 12 Major Export Sectors

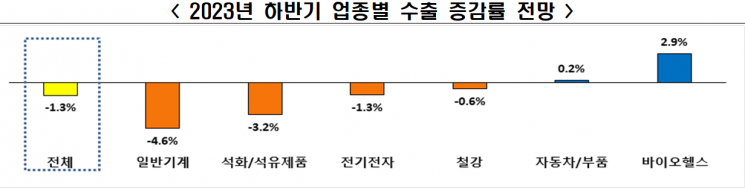

General Machinery -4.6%, Petrochemicals & Petroleum Products -3.2%

4 out of 10 Companies Say "Profitability Worsens"

It has been revealed that companies expect exports to decline in the second half of the year as well.

The Federation of Korean Industries (FKI) announced the results of the "Second Half Export Outlook Survey" on the 1st, targeting 150 companies in 12 major export industries such as semiconductors and automobiles among the top 1,000 companies by sales nationwide.

Among the 150 respondent companies, 70 (46.7%) anticipated a decrease in exports in the second half. The reasons cited included ▲economic downturns in major export destination countries (35.7%) ▲supply chain difficulties due to US-China hegemonic competition (21.4%) ▲decline in export unit prices due to falling raw material prices (18.6%), among others. The forecasted export growth rates by industry for the second half were general machinery (-4.6%), petrochemicals and petroleum products (-3.2%), electrical and electronics (-1.3%), steel (-0.6%), automobiles and auto parts (0.2%), and biohealth (2.9%).

Among the 150 companies, 59 (39.3%) expected export profitability (profit levels) to worsen in the second half. Only 23 companies (15.3%) anticipated improvement. Industries with a high outlook for deteriorating profitability included electrical and electronics (50%), general machinery (44.8%), petrochemicals and petroleum products (42.4%), and biohealth (42.3%). Factors contributing to worsening export profitability were ▲rising raw material prices such as crude oil and minerals (37.3%) ▲increased interest expenses due to interest rate hikes (22.0%) ▲rising public utility costs such as electricity, gas, and water (16.9%).

The exchange rate was expected to rise slightly. The Korean won is anticipated to be valued lower than the US dollar, which is expected to act as a positive factor for export companies. The average highest exchange rate forecast for the second half provided by companies was 1,355.9 won per US dollar. Recently, the rate has been hovering around 1,310 to 1,320 won. When asked whether export profitability would improve if the exchange rate surged to a peak, half (50%) of the respondent companies answered "it will improve," which was more than those who answered "no effect" (34%) or "it will worsen" (16%).

Companies responded that their strategies to cope with sluggish exports include ▲reducing factory operating costs and selling and administrative expenses (44.3%) ▲diversifying export markets (27.1%) ▲restructuring supply chains (15.7%). As necessary government support policies, they cited ▲tax support related to raw material supply (44%) ▲strengthening diplomatic efforts to resolve supply chain difficulties (23.3%) ▲support to prevent export logistics disruptions (12%).

Choo Kwang-ho, head of the Economic and Industrial Headquarters at FKI, stated, "The government needs to make every effort, such as increasing tax support related to raw material imports and strengthening diplomatic efforts to resolve supply chain difficulties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.