Reevaluated Value of Jeonjang Business Hits 52-Week High

VS Division Operating Profit Expected at 333.2 Billion KRW This Year... Sales Forecast to Surpass 10 Trillion KRW Next Year

As the value of the automotive components business is being reevaluated, LG Electronics' stock price hit a 52-week high. With the electric vehicle market expected to grow rapidly, especially in the United States, the value of LG Electronics' automotive components division is projected to reach 10 trillion won, double its current level.

According to the Korea Exchange on the 31st, LG Electronics' stock price closed at 124,900 won, up 10.83% in a single day. This is the highest closing price in about 13 months since April 21 last year (125,000 won). Foreign and institutional investors net bought 86.7 billion won and 43.4 billion won respectively on that day alone. Compared to the beginning of this year, LG Electronics' stock price has risen about 44.39%. During this period, foreign investors maintained a steady buying trend, accumulating a total of 607.6 billion won worth of shares (cumulative from January 2 to May 30).

A major factor behind the recent rise in LG Electronics' stock price is the joint venture with Canadian auto parts manufacturer Magna, called Magna Joint Venture (JV). Although this company's sales this year are estimated to be less than 2 trillion won, it is expected to grow at an average annual rate of 20% over the next five years. This outlook is due to the rapid growth anticipated in the U.S. electric vehicle market following the recent passage of the U.S. Inflation Reduction Act (IRA), which is expected to increase demand for related automotive components.

As of last year, electric vehicle sales in the U.S. totaled 920,000 units, accounting for a single-digit share (6.7%) of the total automobile market. This is very low compared to China (27.2%) and Europe (19%). With the U.S. government actively supporting the electric vehicle market through the IRA, the market growth potential is considered very large. Yang Seung-su, a researcher at Meritz Securities, said, "With an expected order backlog of 100 trillion won for the VS division by the end of the year, it is necessary to raise expectations for medium- to long-term growth. Significant sales expansion and profitability improvement are expected to occur simultaneously from 2024."

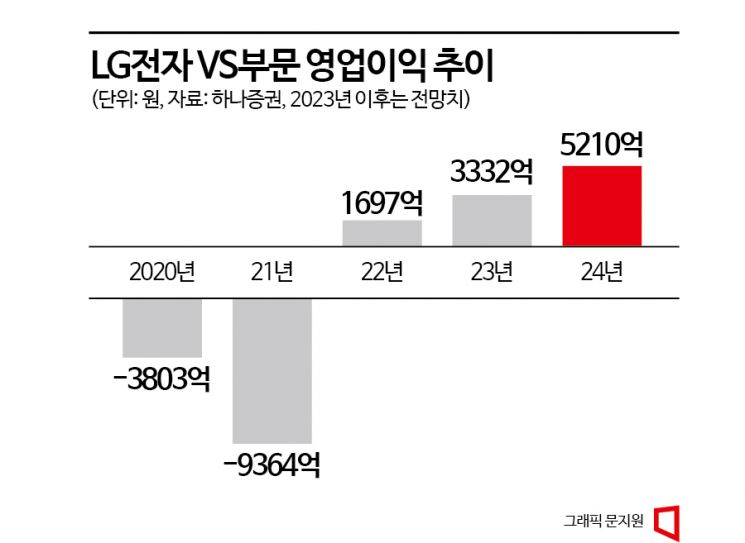

Accordingly, there is a forecast that the value of LG Electronics' VS division will reach 10 trillion won, double its current level. Additionally, the vertical integration of automotive components through affiliates such as LG Display's automotive displays, LG Innotek's automotive cameras, sensors, and communication modules, and LG Energy Solution's batteries is considered a strength. The LG Electronics VS division recorded losses until 2021 but turned profitable last year with an operating profit of 169.7 billion won. This year, operating profit is expected to nearly double to 333.2 billion won, and grow to 521 billion won next year. Sales are also projected to surpass 10 trillion won next year.

Kim Rok-ho, a researcher at Hana Securities, said, "Based on the production plans of secondary battery companies and LG Electronics' order backlog, the Magna Joint Venture's performance share within the VS division is estimated to exceed 15% by 2025. Reflecting this, the value of the VS division is about 9.9 trillion won, roughly twice the current target price valuation of 4.9 trillion won." He added, "LG Electronics' target stock price could be raised to 195,000 won."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.