1 Point Awarded per 100,000 KRW Tax Payment

Usage Rate Remains at 0% Due to Inconvenient Inquiry and Use

According to SBS's report on the 30th, the actual usage rate of the tax point system operated by the National Tax Service to promote a sincere taxpaying culture has been found to be in the 0% range.

The National Tax Service established the tax point system in 2004 to allow citizens who faithfully pay their taxes to feel a sense of fulfillment and pride.

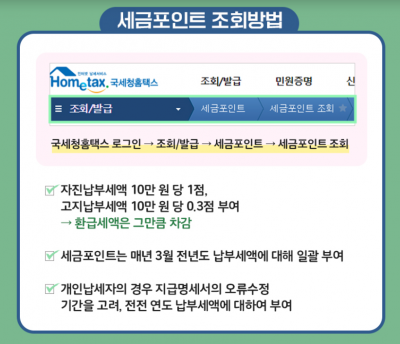

Points are awarded proportional to the amount of tax paid by individuals or corporations, with 1 point given for every 100,000 KRW of voluntarily paid tax.

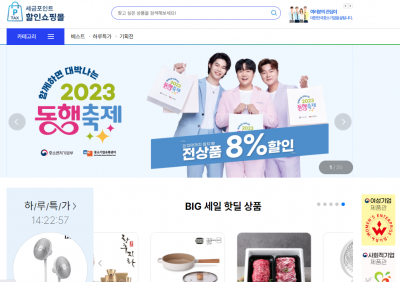

With tax points, consumers can purchase small and medium-sized enterprise products at up to a 5% discount through a discount shopping mall.

Admission fees to certain museums and arboretums, such as the National Museum of Korea, are discounted, and the Incheon International Airport Business Center can also be used.

Additionally, benefits include ▲deferment of property sales for small delinquent taxpayers ▲exemption from collateral for extensions of payment deadlines ▲priority enrollment in taxpayer tax law classes, among others.

However, the usage rate of tax points remains remarkably low.

Over the past three years, the usage rate of tax points has been in the 0% range, and the average over the 20 years since the system's implementation has also been in the 0% range.

The low usage of tax points is attributed to insufficient promotion and the inconvenience of the usage method.

Information about the tax point system can only be found by accessing the National Tax Service Hometax website under the menu: Inquiry/Issuance → Tax Points → Tax Point Benefits. Because of this, most people are unaware of the system's existence.

There are also several inconveniences when using discount benefits.

The tax point discount shopping mall can only be accessed through the National Tax Service Hometax, requiring a joint certificate login. However, the discount rates are not high enough nor are there a wide variety of products to justify enduring this inconvenience.

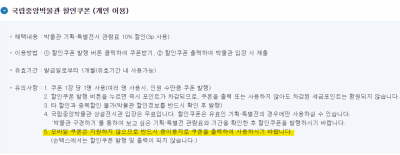

To receive discounts at museums or arboretums, coupons must be printed out and brought in person.

Other benefits such as extensions of payment deadlines and collection deferments rarely apply to individuals.

There is a notice stating that when using discount coupons for museum admission fees, the coupon must be printed on paper.

There is a notice stating that when using discount coupons for museum admission fees, the coupon must be printed on paper. [Photo by National Tax Service Hometax]

As a result, some have pointed out the need to consider where tax points can actually be effectively utilized.

Among netizens, opinions have emerged suggesting that "it might be good to provide points for use in local currencies targeted at small business owners."

Meanwhile, on the 18th, the National Tax Service signed a business agreement with the Korea Trade Insurance Corporation to expand the usage of tax points awarded on tax payments and to support export small and medium-sized enterprises.

Starting June 1, small and medium-sized enterprises (corporations) holding tax points will be able to use their tax points at the Korea Trade Insurance Corporation's cyber branch to access overseas company credit investigation services once per year without fees.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)