The prices of "daejang apartments," considered leading indicators of the housing market, have turned upward for the first time in 11 months. This comes as the housing market shows signs of recovery due to the government's comprehensive deregulation efforts. In particular, the sale prices in the southeastern region, where many daejang apartments are located, have risen for six consecutive weeks, and the volume of apartment transactions in Seoul has exceeded 3,000 units for the first time in 20 months, creating a revived atmosphere in the real estate market.

Apartment view of Yeouido area, Yeongdeungpo-gu, Seoul, seen from the 63 Building in Yeouido

Apartment view of Yeouido area, Yeongdeungpo-gu, Seoul, seen from the 63 Building in Yeouido[Photo by Ryu Taemin]

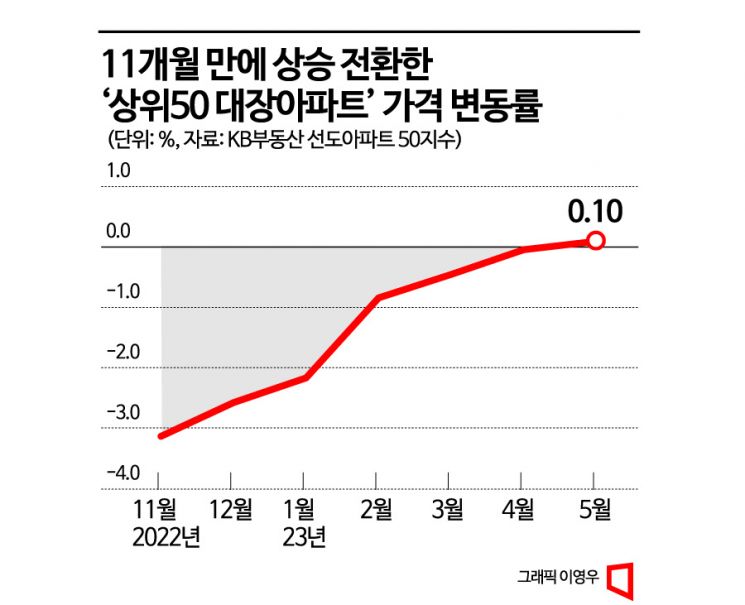

According to the monthly housing trend report released by KB Kookmin Bank on the 30th, the 'KB Leading Apartment 50' index rose by 0.10% compared to the previous month. This index had been declining for 10 consecutive months since turning downward in July last year. In November last year, it recorded the largest drop ever with a 3.14% decline, but it has shifted to an upward trend this month.

The KB Leading Apartment index selects the top 50 apartment complexes nationwide by market capitalization and indicates the rate of change in market capitalization. It is highly sensitive to price fluctuations and is mainly used as a leading indicator to forecast the housing market. Major complexes in the Gangnam area, such as Jamsil Jugong 5 Complex, Acro River Park, and Eunma Apartments, are included in this index.

The turnaround of this index is interpreted as an effect of the government's 1.3 real estate measures. Most of Seoul's regulated areas have been deregulated, and loan restrictions have been eased, reviving sales transactions. Song Seung-hyun, CEO of Dosiwa Economy, explained, "After deregulation, the market went through an adjustment period, and recently, this is reflected in price changes."

In fact, the number of apartment sales transactions in Seoul is increasing. According to the Seoul Real Estate Information Plaza on this day, the volume of apartment sales transactions in Seoul in April was 3,174 units. This is more than five times the volume in October last year (559 units), when the transaction freeze was severe due to interest rate hikes. Notably, the transaction volume exceeding 3,000 units is the first time in 20 months since August 2021 (4,065 units). Following the surpassing of 1,000 units in January and 2,000 units in February this year, the breaking of the 3,000-unit barrier last month has raised expectations for market recovery.

Price Fluctuations and Transaction Volumes Revive Due to Buyers Targeting Gangnam Area Apartments

In particular, the price increase trend continues in the Gangnam 4 districts (Gangnam, Seocho, Songpa, Gangdong), where more than half of the Leading 50 apartments are concentrated. According to the Korea Real Estate Board, the apartment sale price change rate in the southeastern region of Seoul, which includes the Gangnam 4 districts, has been rising for six consecutive weeks since turning upward in the third week of April. Especially in the fourth week of May, the increase accelerated, rising 0.17% in just one week.

The transaction volume is also showing signs of recovery. According to the Seoul Real Estate Information Plaza, Songpa-gu recorded 274 apartment transactions last month, the highest among the 25 autonomous districts. Gangdong-gu (246 transactions) followed Songpa-gu in second place, with Nowon-gu (215 transactions) and Gangnam-gu (185 transactions) trailing behind. According to statistics from the real estate big data company Apartment Real Transaction (Asil) on this day, the apartment complex with the highest number of transactions this year (excluding rental apartment purchases) was Helio City with 161 transactions. Following were Parkrio (106 transactions), Godeok Gracium (88 transactions), Godeok Raemian Hillstate (59 transactions), and Licenz (55 transactions), most of which belong to the Leading 50 index.

This trend is also reflected in actual transaction prices. According to the Ministry of Land, Infrastructure and Transport's real transaction price disclosure system, an 84.99㎡ (exclusive area) unit in Helio City, Garak-dong, Songpa-gu, was sold for 1.67 billion KRW in February but changed hands for 1.905 billion KRW on the 29th of last month, rising by 235 million KRW. The Eunma Apartment in Daechi-dong, Gangnam-gu, known as a "reconstruction big fish," was traded for 2.13 billion KRW in February but was sold for 2.43 billion KRW on the 4th of this month, recovering 300 million KRW.

Song Seung-hyun, CEO of Dosiwa Economy, analyzed, "Apartments in the Gangnam area have high expectations for price increases and relatively small declines, so they are perceived as safe assets. Since the price decline has lowered the entry barrier, potential demand may have started buying."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.