Due to consecutive interest rate hikes, the knowledge industry center transaction market has shrunk by more than 60% in a year. In particular, Seoul saw the number of transactions decrease by over 70% during the same period.

A view of a knowledge industry center in Doksan-dong, Geumcheon-gu, Seoul.

A view of a knowledge industry center in Doksan-dong, Geumcheon-gu, Seoul. [Photo by Asia Economy DB]

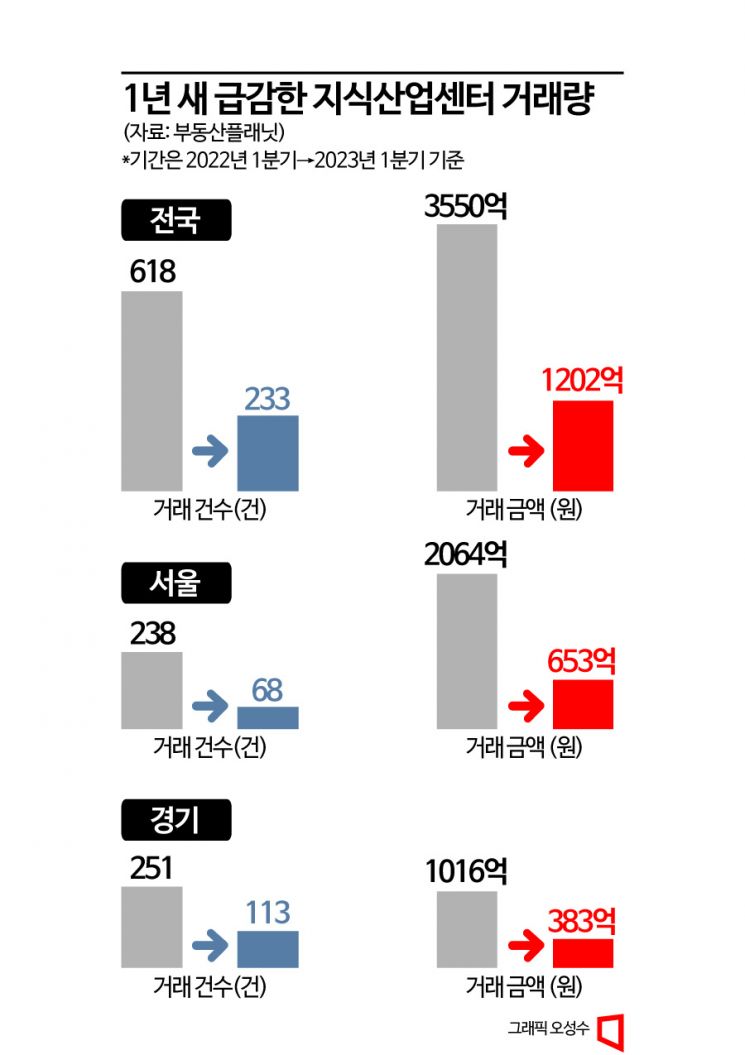

According to Real Estate Planet, a commercial real estate specialist company, the nationwide knowledge industry center sales volume in the first quarter of this year was recorded at 233 cases. Compared to the first quarter of last year (618 cases), this is a decrease of 385 cases (62.2%). The transaction amount also dropped from 355 billion KRW to 120.2 billion KRW during the same period, a decrease of 234.8 billion KRW (66.1%).

A knowledge industry center refers to a collective building of three or more floors where companies engaged in manufacturing, knowledge industries, and information and communication industries, along with support facilities, can coexist. Knowledge industry centers have been popular since 2019 due to their high loan eligibility ratio and exclusion from the housing count. However, since last year, the market has rapidly frozen due to downward factors such as interest rate hikes.

By region, Seoul saw the number of transactions decrease from 238 cases in the first quarter of last year to 68 cases in the first quarter of this year, a drop of 170 cases (71.4%). During the same period, the transaction amount fell from 206.4 billion KRW to 65.3 billion KRW, a decrease of 141.1 billion KRW (68.3%). In Gyeonggi Province, the number of transactions decreased from 251 cases to 113 cases, a drop of 138 cases (54.9%), and the transaction amount declined from 101.6 billion KRW to 38.3 billion KRW, a decrease of 63.3 billion KRW (62.3%).

Recently, the sales transaction patterns between the metropolitan area and non-metropolitan areas have clearly diverged. According to Real Estate Planet, 86.7% of the total sales volume and 91.1% of the transaction amount in the first quarter were traded in the metropolitan area. This represents an increase of 16.8% and 3.1%, respectively, compared to the previous quarter (Q4 2022).

The most active transaction areas were Seongdong-gu in Seoul and Anyang in Gyeonggi Province. Jung Soo-min, CEO of Real Estate Planet, said, “Location is the most important factor in the knowledge industry center market,” adding, “Since there are signs that knowledge industry centers are reviving mainly in the metropolitan area, it may be helpful to conservatively assess the pros and cons based on location conditions and observe the investment timing.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.