Samsung Electronics and SK Hynix Reach Intraday Record Highs on 25th

Foreign Investors Buy 9.2744 Trillion KRW of Samsung Electronics This Year

Semiconductor Market Expected to Improve in Second Half, Won Strength Forecasted

As semiconductor leaders Samsung Electronics and SK Hynix hit new all-time highs, investors are experiencing mixed emotions. Foreign investors, who have concentrated 80% of their net KOSPI purchases on Samsung Electronics this year, are smiling, while individual investors who have been net sellers are frowning. With expectations of an improvement in the semiconductor market in the second half of the year, love calls for Samsung Electronics are expected to continue for the time being, and securities firms are raising their target prices for Samsung Electronics one after another.

According to the Korea Exchange, on the 25th, Samsung Electronics closed at 68,800 KRW, up 0.44% from the previous trading day. On that day, Samsung Electronics reached an intraday high of 70,000 KRW, setting a new all-time high. It is the first time in about 1 year and 2 months since March 31 of last year (70,200 KRW) that Samsung Electronics’ stock price exceeded 70,000 KRW based on intraday highs. SK Hynix, also considered a semiconductor leader alongside Samsung Electronics, closed at 103,500 KRW, up 5.94% from the previous trading day. SK Hynix also set a new all-time high by rising to an intraday high of 104,300 KRW. Based on intraday highs, SK Hynix surpassed 100,000 KRW for the first time since July 29 last year (100,000 KRW).

The rise in semiconductor stocks on that day was largely influenced by Nvidia, a semiconductor company on the New York Stock Exchange, which surged up to 28% in after-hours trading the previous day. Nvidia announced in its earnings report that its revenue for the second quarter of the fiscal year (May to July) is expected to be around $11 billion (approximately 14.531 trillion KRW), exceeding market expectations by more than 50%.

The ones smiling at the ‘70,000 KRW Samsung Electronics’ are foreign investors who have been steadily buying Samsung Electronics this year. According to the Korea Exchange, foreign investors purchased 9.2744 trillion KRW worth of Samsung Electronics shares from January 2 to May 25 this year. During this period, foreign investors’ net KOSPI purchases amounted to 11.5878 trillion KRW. Of this, a whopping 80% was poured solely into Samsung Electronics. This is a complete turnaround from the past three years when foreign investors were net sellers of Samsung Electronics. As a result, the foreign ownership ratio of Samsung Electronics, which had fallen to 49.24% on September 29 last year, rose to 52.21% on that day. It is the first time since March last year that the foreign ownership ratio has reached the 52% range.

Lee Seung-woo, a researcher at Eugene Investment & Securities, explained, “The trend of foreign investors’ net purchases of Samsung Electronics has been clear this year. On an annual basis, foreign investors net sold 30.8 trillion KRW worth of Samsung Electronics shares during the COVID-19 pandemic period from 2020 to 2022, but this year, they have been net buyers of over 9 trillion KRW in five months.”

Lee Woong-chan, a researcher at Hi Investment & Securities, said, “Although foreign capital outflows from the KOSPI were detected from February to early April, foreign investors did not sell Samsung Electronics even while reducing their KOSPI exposure. Foreign investors started buying at the end of March and have been concentrating their purchases on Samsung Electronics shares in the KOSPI since April. A market supporting large-cap stocks like Samsung Electronics is expected to continue.”

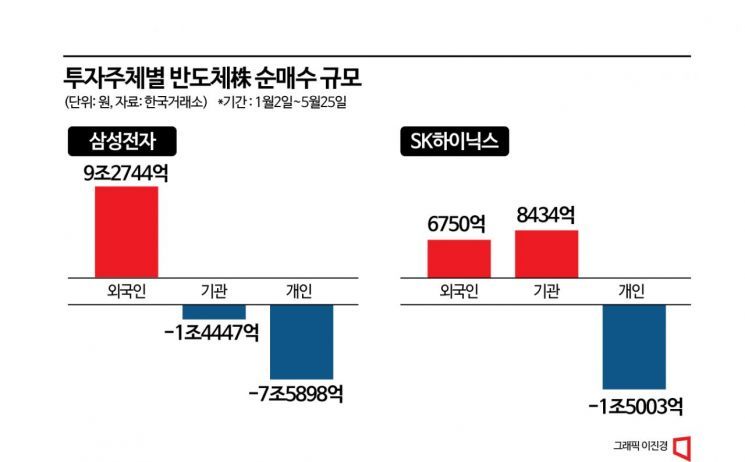

On the other hand, individual investors have not been smiling despite Samsung Electronics breaking through 70,000 KRW. Individual investors have sold 7.5898 trillion KRW worth of Samsung Electronics shares this year. Institutional investors also net sold 1.4447 trillion KRW worth of Samsung Electronics shares. The volume sold by individuals and institutions was entirely bought by foreign investors.

During the same period, foreign and institutional investors net purchased SK Hynix shares worth 675 billion KRW and 843.4 billion KRW, respectively. Individual investors net sold 1.5003 trillion KRW worth of SK Hynix shares. While institutional investors performed somewhat well with SK Hynix, individual investors failed to ride the semiconductor stock rally.

Securities firms are also raising their target prices for Samsung Electronics. Eugene Investment & Securities raised its target price from 82,000 KRW to 90,000 KRW. Yuanta Securities and IBK Investment & Securities also set Samsung Electronics’ target price at 90,000 KRW. BNK Investment & Securities forecasted 87,000 KRW, while KB Securities and Kyobo Securities projected 85,000 KRW.

Securities firms expect money to flow into Samsung Electronics in the second half of the year as the semiconductor market recovers. Samsung Electronics, which has secured semiconductor production capacity and cash, is likely to be the winner after this semiconductor downcycle, and the improvement in semiconductor supply and demand in the second half is expected to be faster than anticipated, leading to an upward cycle next year. A weak dollar and strong won are also forecasted, which could provide foreign investors with exchange gains. Additionally, Samsung Electronics’ operating profit forecast for this year is 10.5 trillion KRW, with 12% expected in the first half and 88% in the second half, suggesting that the expected expansion of earnings improvement in the second half will also drive foreign investors’ sentiment. Kim Dong-won, a researcher at KB Securities, said, “Foreign net purchases in the KOSPI this year have reached over 11 trillion KRW, and foreign net purchases of Samsung Electronics have reached over 9 trillion KRW, the highest since the Korea Exchange began compiling statistics in 1998,” adding, “Such love calls for Samsung Electronics are expected to continue for the time being.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)