Reclaza and Amivantamab Combination Clinical Trial Data to Be Released by Year-End

AZ Advances First with Chemotherapy Combination

Domestic Competition Heats Up for First-Line Monotherapy

Tagrisso Passes First Hurdle for Insurance Coverage After Five Attempts

Reclaza Seeks Additional Indications Based on LASER301 Trial

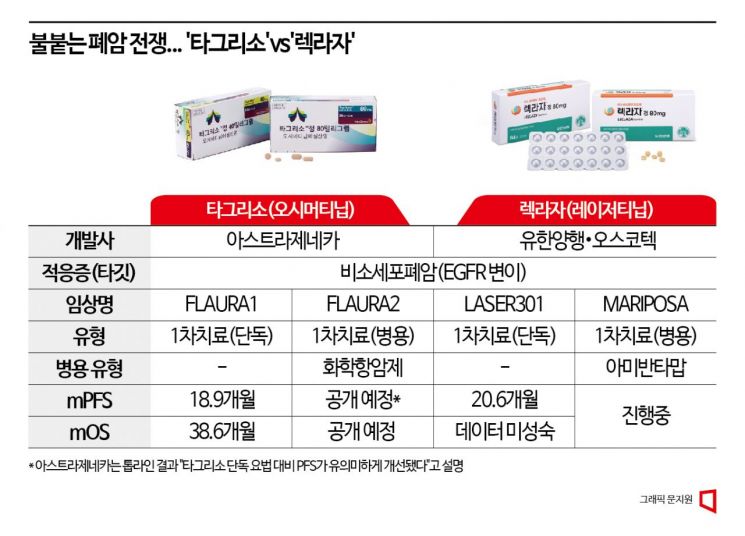

AstraZeneca (AZ) and Yuhan Corporation are directly competing in the development of treatments for epidermal growth factor receptor (EGFR) mutation-positive non-small cell lung cancer (NSCLC). AZ's 'Tagrisso' (active ingredient osimertinib), which was approved and is currently in use, is being rapidly pursued by Yuhan's 'Leclaza' (lazertinib), with a variety of battlefields emerging. Globally, the two companies are fiercely competing to gain the upper hand through more effective combination therapies, while domestically, the competition is intense to secure dominance as first-line monotherapy treatments.

Notably, in 2020, lung cancer accounted for 11.7% of cancer diagnoses in South Korea, making it the most commonly diagnosed cancer, and non-small cell lung cancer represents 85% of lung cancer cases. Furthermore, among NSCLC patients, the proportion of cases caused by EGFR mutations reaches 40% in Asians, highlighting the particular importance of developing these two drugs domestically.

On the 25th (local time), at the American Society of Clinical Oncology (ASCO) 2023, results from long-term follow-up and circulating tumor DNA (ctDNA) liquid biopsy studies using plasma samples were revealed for the first-line combination therapy of Leclaza and Janssen's (a Johnson & Johnson subsidiary) bispecific antibody cancer drug 'Rybrevant' (amivantamab) targeting EGFR mutation-positive patients. This study, named 'CHRYSALIS,' was presented as a poster at the conference.

Key efficacy indicators for anticancer drugs, such as median progression-free survival (mPFS) and median overall survival (mOS), have not yet been confirmed as the study is ongoing. However, the median duration of treatment was reported as 33.5 months, with 10 out of 20 clinical participants (50%) continuing treatment without disease progression. Although it is still early to judge success or failure due to the small scale and ongoing nature of the trial, expectations are rising for the 'MARIPOSA' first-line combination clinical trial of Leclaza and Rybrevant, with results expected by the end of this year.

The oncology market is not one where all research and development (R&D) ends with a single approval. If a drug is approved as a second- or third-line treatment, but patients are cured or die during the initial first-line treatment, the drug may never be used. Therefore, companies aim to enter the market as first-line treatments to maximize opportunities. Additionally, combination therapies that use drugs or treatments synergistically rather than a single drug have become the mainstream approach, necessitating ongoing research to find partners that can enhance drug efficacy.

Despite Tagrisso already being a blockbuster with $5.4 billion (approximately 7 trillion KRW) in sales last year as it is used as a first-line treatment overseas beyond second- and third-line therapies, development continues. Similarly, Leclaza is also pursuing various therapeutic developments.

Yuhan Partners with Janssen... AZ Takes the Lead with Chemotherapy

Yuhan licensed Leclaza from Oscotec in 2015 and subsequently out-licensed it to Janssen in 2018. Since then, Joaqu?n Duato, CEO of Janssen, has identified the Leclaza-Rybrevant combination therapy as one of the key pipelines expected to generate over $5 billion (approximately 6.65 trillion KRW) annually, reflecting high expectations from both companies. The MARIPOSA trial is set up with Tagrisso monotherapy as the control group, engaging in a direct competition. Final results are expected within this year. Given that Leclaza monotherapy showed an mPFS of 20.6 months, the goal is to surpass this mPFS value.

In response, AZ is attempting to shift the first-line treatment itself from Tagrisso monotherapy to a combination therapy with chemotherapy. If successful, this strategy could delay the market entry of the Leclaza-Rybrevant combination even if the MARIPOSA trial succeeds by changing the dominant first-line treatment approach.

On the 17th (local time), AZ announced topline clinical results showing that a combination therapy of Tagrisso with platinum-based chemotherapy agents such as cisplatin significantly improved progression-free survival (PFS) compared to Tagrisso monotherapy. This trial, named 'FLAURA2' as a follow-up to the Tagrisso approval trial 'FLAURA,' showed promising results. Since the mPFS of FLAURA1 was 18.9 months, and the investigator-initiated 'OPAL' trial combining Tagrisso with chemotherapy showed an mPFS of 31.0 months, there is hope for similarly favorable outcomes. Detailed data from FLAURA2 are expected to be presented at the World Conference on Lung Cancer (WCLC) or the European Society for Medical Oncology (ESMO) conference in the fall.

Additionally, on the 11th, AZ initiated a global phase 2 clinical trial, including South Korea, for the first-line combination therapy of Tagrisso and Rybrevant, demonstrating various contingency plans. This move is interpreted as an effort to preemptively prove the feasibility of Tagrisso-Rybrevant combination therapy should the Leclaza-Rybrevant combination succeed, thereby intensifying the competition.

Fierce Competition over 'First-Line Monotherapy' Domestically

The chase and evasion are similar domestically. In South Korea, the strategic battle over first-line monotherapy is intense. Tagrisso passed the first hurdle of the Cancer Disease Review Committee in March after five attempts to gain health insurance reimbursement as a first-line treatment. However, since its first-line treatment approval by the Ministry of Food and Drug Safety (MFDS) in 2018, it had repeatedly failed to pass the cancer review committee due to insufficient efficacy analysis in Asian populations, finally clearing the first hurdle after five years. Nonetheless, after price negotiations and other procedures, health insurance reimbursement as a first-line treatment is expected to be applied in the second half of this year. If successful in entering the first-line treatment market, domestic prescription sales, which were 106.5 billion KRW last year, are expected to increase three to fivefold.

Yuhan is also conducting the 'LASER301' clinical trial to expand Leclaza's indication as a first-line monotherapy. Currently, Leclaza is only approved as a second-line treatment in South Korea.

According to the LASER301 trial results announced in December last year, the key endpoint mPFS was 20.6 months, significantly improved compared to 9.7 months for gefitinib (control group), confirming statistical significance. The mOS data are not yet mature, with only 29% data maturity. Unlike PFS, which measures the time until disease progression or death, OS measures the time until death, requiring all participants to have died to fully analyze the data.

However, at 18 months post-enrollment, 80% of patients in the treatment group and 72% in the control group were alive. Dr. Byung-Chul Cho, director of the Lung Cancer Center at Yonsei Cancer Hospital and lead investigator, explained, "Although data maturity is still low, this can be interpreted as showing the potential of lazertinib." Based on this, Yuhan applied to the MFDS in March to add first-line treatment indications for Leclaza.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.