Investigation of Labor Cost Changes Compared to Sales from Q1 2018 to 2023

Samsung Electronics 7.9% Last Year → 10.1% This Year... First Over 10% Since 2018

SK Hynix Up 6.8%P in One Year... Hyundai Motor Down 3.8%P, Kia Down 2.5%P

The ratio of labor costs to sales (labor cost ratio) at Samsung Electronics exceeded 10% in the first quarter. This is the first time in five years since 2018 that the first quarter labor cost ratio has reached the 10% range.

It is analyzed that the labor cost ratio increased as the company did not spare labor costs to retain talent amid worsening performance due to the global economic downturn. The labor cost ratios of automobile companies such as Hyundai Motor Company were found to have decreased.

The view of Samsung Electronics Seocho Building in Seoul on the morning of the 7th. [Image source=Yonhap News]

The view of Samsung Electronics Seocho Building in Seoul on the morning of the 7th. [Image source=Yonhap News]

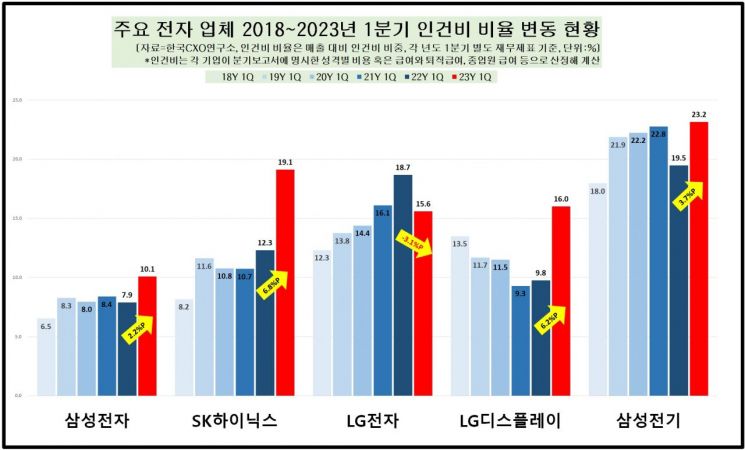

The Korea CXO Research Institute, a corporate analysis specialist, announced on the 25th the results of the "2018-2023 Q1 Electronics and Automobile Major Companies Labor Cost Change Analysis." The study surveyed five electronics companies?Samsung Electronics, SK Hynix, LG Electronics, LG Display, Samsung Electro-Mechanics?and three automobile companies?Hyundai Motor, Kia, Hyundai Mobis. The labor cost ratio relative to sales was examined based on separate first-quarter data by year.

The survey results confirmed that among the five electronics companies, four excluding LG Electronics saw their labor cost ratios rise in the first quarter of this year compared to last year. All four recorded their highest levels since Q1 2018.

By company, Samsung Electronics' labor cost ratio was 6.5% in 2018 → 8.3% in 2019 → 8% in 2020 → 8.4% in 2021 → 7.9% last year, maintaining around 8%, but jumped to 10.1% in Q1 this year. This is the first time during the survey period that it recorded a ratio in the 10% range. It increased by 2.2 percentage points from last year and 3.6 percentage points from 2018.

Q1 sales were KRW 42.1686 trillion, and labor costs were KRW 4.2559 trillion. Sales decreased by 1% compared to 2018 (KRW 42.6069 trillion), while labor costs (KRW 2.7829 trillion) increased by 52.9%.

The explanation is that the rise in labor cost ratio is more serious given the decreased profitability. Based on separate financial statements, Samsung Electronics recorded an operating loss of KRW 3.9087 trillion. In Q1 2018, operating profit was KRW 11.2008 trillion.

SK Hynix's labor cost burden became even greater than Samsung Electronics'. The labor cost ratio was 8.2% in 2018, then 11.6% in 2019 → 10.8% in 2020 → 10.7% in 2021 → 12.3% last year. The annual change rate was around 1 percentage point. In Q1 this year, it rose to 19.1%, an increase of 6.8 percentage points from last year. Compared to 2018, it rose by 10.9 percentage points.

It is analyzed that SK Hynix also spent more on labor costs relative to sales. Q1 sales this year were KRW 4.4434 trillion, down 49.2% from Q1 2018 (KRW 8.7458 trillion), but labor costs increased by 19% to KRW 850 billion from KRW 714.3 billion in 2018.

LG Display (16%) and Samsung Electro-Mechanics (23.2%) also saw their Q1 labor cost ratios soar to the highest levels since 2018.

LG Electronics' Q1 labor cost ratio was 15.6%, down 3.1 percentage points from 18.7% last year. Although sales decreased by 11.1% from KRW 8.0926 trillion in Q1 last year to KRW 7.1948 trillion this year, it is analyzed that the labor cost ratio decreased mainly because labor costs were reduced by 25.9%, from KRW 1.5126 trillion to KRW 1.1215 trillion.

The Hyundai Kia Motors headquarters building lit up on the night of the 26th of last month.

The Hyundai Kia Motors headquarters building lit up on the night of the 26th of last month. [Photo by Hyunmin Kim kimhyun81@]

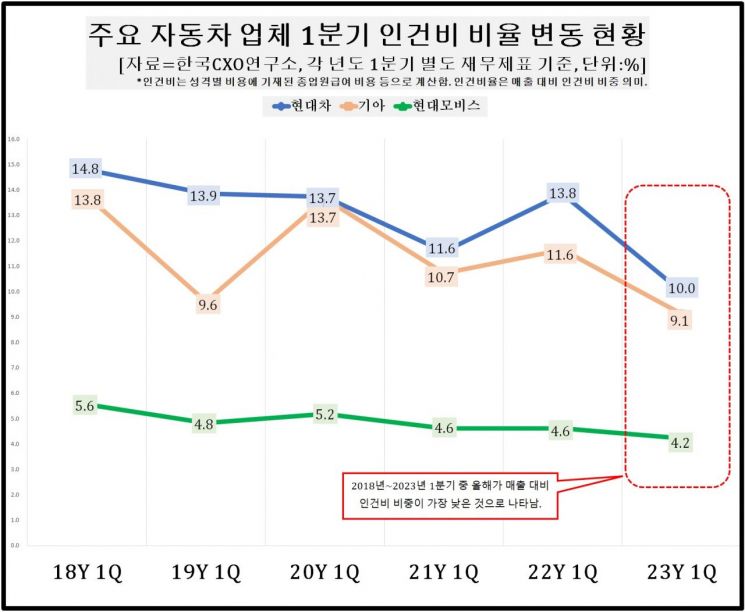

The labor cost situation in automobile companies was the opposite of electronics companies. Hyundai Motor, Kia, and Hyundai Mobis recorded their lowest Q1 labor cost ratios since 2018.

Hyundai Motor's ratio fell from 14.8% in 2018 to 10% last year, a decrease of 4.8 percentage points. Kia dropped from 13.8% in 2018 to 9.1% this year, down 4.7 percentage points. Hyundai Mobis also decreased from 5.6% to 4.2% during the same period, down 1.4 percentage points.

Oh Il-seon, director of the CXO Research Institute, said, "Major electronics companies need to reduce labor cost burdens by lowering labor costs beyond a certain level," adding, "If management improvement trends are not clear after Q1, there is a possibility that employee salaries at major electronics companies this year will decrease by about 5-10% compared to last year, and some companies may find it difficult to avoid workforce restructuring in the second half."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.