Binggrae, Hanwha Aerospace, YG Entertainment, and Others in Focus

Operating Profit Surprises - Stocks with Upward Earnings Revisions, Potential Entry into Structural Growth Phase

During this year's first-quarter earnings season, many listed companies experienced an 'earnings shock,' prompting securities firms to advise focusing on stocks that recorded an 'earnings surprise.' This is because companies that posted operating profit surprises and subsequently saw upward revisions in consensus estimates are likely entering a phase of structural growth. As the domestic stock market faces mixed forecasts for the second half of the year, with expectations of either a peak 'Samcheonpi' or a 'Boxpi' market, it is advised to carefully select stocks that have recorded earnings surprises as potential 'rising stars.'

According to the Korea Exchange and the Korea Listed Companies Association, both operating profit and net profit of companies listed on the KOSPI market in the first quarter of this year were halved compared to the same period last year. The consolidated net profit of 622 KOSPI-listed companies with December fiscal year-end was 18.8424 trillion KRW in the first quarter, down 57.68% year-on-year. Although sales increased by 5.69% to 697.3744 trillion KRW during the same period, operating profit fell by 52.75% to 25.1657 trillion KRW. This is the first time since the first quarter of 2009, when the global financial crisis struck, that listed companies' profits have decreased by more than 50% compared to the same period last year.

The semiconductor sector is cited as the main reason behind the poor performance of listed companies in the first quarter. Lee Seung-min, head of the investment strategy team at Samsung Securities, explained, "The deterioration in corporate earnings in the first quarter was largely due to the semiconductor slump. Although consumption increased due to China's reopening of economic activities, it did not contribute to trade growth."

Despite most listed companies posting weak results in the first quarter, the proportion of companies exceeding consensus estimates based on operating profit was 43.7%. This was thanks to earnings surprises in sectors related to the economy, such as consumer goods (automobiles), industrial goods (machinery and defense), and finance (insurance and banking), despite the slump in semiconductors and IT industries.

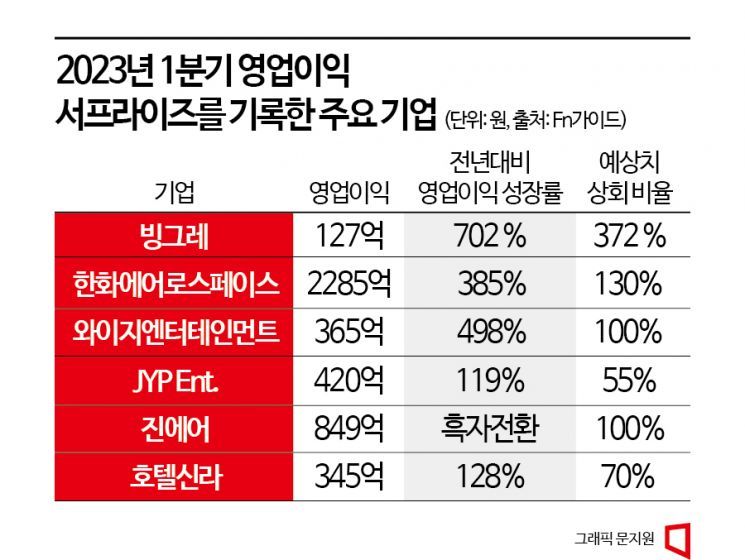

Securities firms particularly advise focusing on stocks that have shown both an operating profit surprise and an upward revision in earnings estimates. According to IBK Investment & Securities, companies that have seen both operating profit surprises and positive changes in earnings estimates include Binggrae, Hanwha Aerospace, YG Entertainment, Jin Air, and Hotel Shilla.

Binggrae recorded sales of 293.5 billion KRW and operating profit of 12.7 billion KRW in the first quarter despite it being the off-season. Operating profit grew by more than 700% compared to the same period last year. Kim Tae-hyun, a researcher at IBK Investment & Securities, analyzed, "Binggrae posted an operating profit margin in the 4% range even in the off-season first quarter and is expected to achieve results exceeding consensus in the second quarter as well. We believe there is significant potential for further stock price gains due to product price increases, external growth, entry into the summer peak season, and the effects of reopening."

YG Entertainment is also a stock attracting attention from the securities industry. YG Entertainment recorded consolidated sales of 157.5 billion KRW and operating profit of 36.5 billion KRW in the first quarter. Operating profit increased by 497.6% year-on-year, more than doubling consensus estimates, marking an earnings surprise and the best quarterly performance in its history. In addition to YG Entertainment, the four major entertainment stocks?JYP Ent., SM, and HYBE?also posted record-breaking results, indicating they have entered a phase of structural growth. Kim Jong-young, a researcher at IBK Investment & Securities, stated, "It is necessary to monitor stocks that have experienced operating profit surprises and subsequent upward revisions in consensus estimates. Stocks with upward revisions after a surprise are likely entering a phase of structural growth and an upcycle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.