The Ministry of Economy and Finance recommended restructuring and improvement for 60 projects across 18 funds. This move is interpreted as a measure to prevent wasteful spending while reviewing funds to cover the shortfall in tax revenue. In particular, it was evaluated that the Information and Communications Promotion Fund and the Broadcasting and Communications Development Fund should be integrated due to their similar functions.

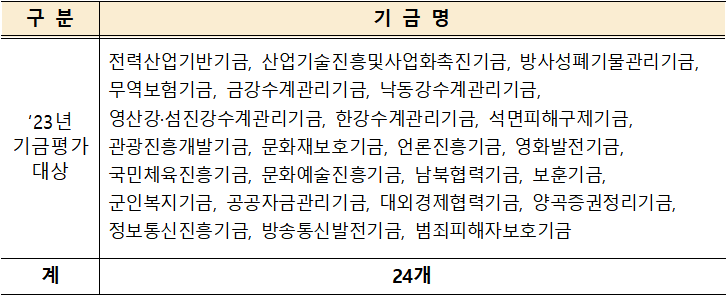

On the 23rd, the Ministry of Economy and Finance reported the ‘2023 Fund Evaluation Results’ from the Fund Operation Evaluation Team, which included these details, to the Cabinet meeting. Fund evaluation consists of retention evaluation, which assesses whether to maintain the fund and its projects and resources, and operation evaluation, which inspects asset management and operational systems.

In this year’s fund retention evaluation, 18 out of 24 funds under review were recommended for restructuring and improvement. Based on projects, 60 out of 493 projects (12.2%) were subject to recommendations. The recommendation rate significantly increased from 5.1% (25 projects) in 2021 and 7.4% (31 projects) last year. Among these, 8 projects were deemed to require restructuring due to similarity or overlap with other projects. For 52 projects, such as those aimed at revitalizing the sports industry or supporting cultural tourism festivals, which had inappropriate targets or methods, it was suggested that the system be improved.

Regarding resource adequacy, recommendations were made for 13 funds. For 8 funds, including the National Sports Promotion Fund, it was advised to implement ‘increased deposits to the public fund’ due to excessive surplus funds. Conversely, 5 funds, such as the Tourism Promotion and Development Fund, which lacked surplus funds, were in need of project adjustments and the discovery of new revenue sources.

In particular, the evaluation team judged that the Broadcasting and Communications Development Fund and the Information and Communications Promotion Fund should be integrated. It was pointed out that there is no reason to keep them separate as their functions, roles, and resource procurement methods are similar. Currently, 55% of the frequency allocation fees are distributed to the Information and Communications Promotion Fund, and 45% to the Broadcasting and Communications Development Fund. The evaluation team advised, “With the trend of ICT convergence, the boundary between information and communications and broadcasting and communications has become blurred,” and “through fund integration, project redundancy should be eliminated and expenditures streamlined.”

The stricter fund evaluation is interpreted as a consequence of the recent tax revenue shortfall. The government collected 87.1 trillion won in national taxes by March, which is 24 trillion won less than the previous year. If the current trend continues, there will be a shortfall of about 30 trillion won by the end of the year. The government’s stance is to avoid borrowing or leaving budgets unused and to utilize global surplus funds and fund resources.

Choo Kyung-ho, Deputy Prime Minister and Minister of Economy and Finance, also attended the National Assembly’s Planning and Finance Committee meeting held the day before and stated, “When tax revenue is insufficient, it is often asked whether it will be difficult to execute budgets originally intended for people’s livelihoods, but as I have repeatedly said, we are reviewing the remaining global surplus funds from last year’s settlement and all fund resources,” adding, “These are available resources that can be flexibly used within the legally defined scope.”

In the fund operation evaluation, despite the National Pension Fund experiencing the largest-ever decline in returns, it maintained a ‘good’ rating as in the previous year. The National Pension Fund recorded a -8.28% return last year due to the Russia-Ukraine war and global financial market tightening. Although this was a sharp decrease from the previous year’s 10.86% return, the evaluation team explained that the decline was relatively smaller compared to the five major global pension funds, thus assigning a good rating.

Excluding the National Pension Fund, the returns of the remaining 30 funds fell from 2.33% to -1.53% due to rising benchmark interest rates and a deteriorating stock market. There were criticisms regarding the lack of professionalism and independence in asset management for funds such as the Military Fund and the Sports Fund. The number of funds rated ‘excellent’ or higher was 13, similar to 14 last year.

The government plans to use the fund evaluation results for establishing next year’s fund operation plans and other fiscal management purposes and will submit them to the National Assembly by the end of this month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.