Low-to-medium credit borrowers pay 10 times more than high credit borrowers

Thorough loan management needed

Over the past two years, the delayed compensation fees imposed and collected by commercial banks and internet-only banks on overdue credit loans and mortgage loans have amounted to 46 billion KRW.

On the 21st, Choi Seung-jae, a member of the National Assembly's Political Affairs Committee from the People Power Party, obtained data from the Financial Supervisory Service submitted by the five major commercial banks?KB Kookmin, Shinhan, Hana, Woori, and others?as well as internet banks such as KakaoBank, K Bank, and Toss Bank. According to the data, over the past two years, banks have collected delayed compensation fees totaling 46 billion KRW (across 670 cases) from borrowers who were late in repaying credit loans and mortgage loans.

Delayed compensation fees are penalties imposed by banks when borrowers fail to pay the monthly interest on time. Generally, the interest rate applied is either the loan's contractual interest rate plus 3% or 15%, whichever is lower. The delayed compensation fee increases depending on the length of the overdue period. For delays under one month, the fee is added only to the contractual interest. After one month, the fee is applied to the principal as well, causing the amount to increase significantly.

For example, if a loan of 120 million KRW is taken out at a contractual interest rate of 5%, for delays under one month, the borrower only needs to pay a delayed compensation fee of 3,333 KRW at an annual rate of 8% (contractual interest + 3%) on two months' worth of contractual interest (500,000 KRW). After one month, the delayed compensation fee at an annual rate of 8% is applied to the principal as well. At the three-month overdue mark, the borrower must pay a total of 1,603,333 KRW, which includes 3,333 KRW for one month’s delayed compensation fee plus 1.6 million KRW for the delayed compensation fee accumulated over three months.

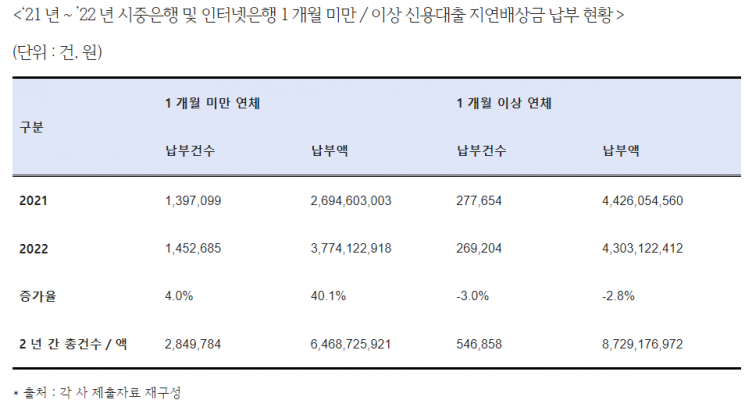

According to Choi’s office, the number of delayed compensation fee payments and the amounts have been gradually increasing. For credit loans, the number of delayed compensation fee payments for delays under one month at the five major commercial banks and three internet banks increased from 1,397,099 cases in 2021 to 1,452,685 cases in 2022. The total amount paid rose more sharply from 26.9 billion KRW to 37.7 billion KRW.

However, the number of payments for delays over one month slightly decreased from 270,000 cases in 2021 to 260,000 cases in 2022. The total amount paid also slightly declined from 44 billion KRW in 2021 to 43 billion KRW in 2022.

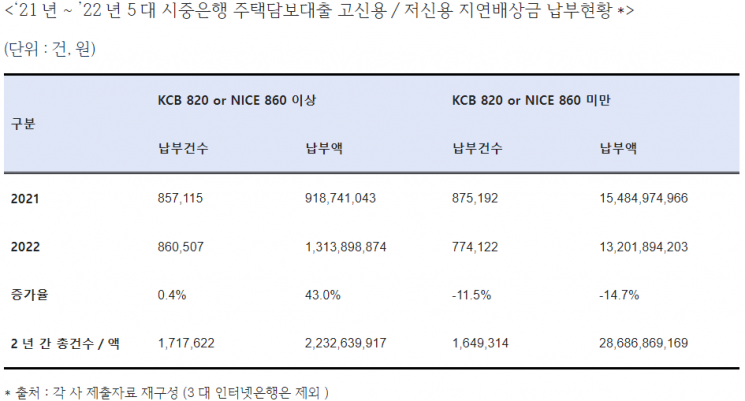

Meanwhile, the scale of delayed compensation fees varied according to credit ratings. For high-credit borrowers with NICE scores of 860 and KCB scores of 820 or above, the delayed compensation fees related to mortgage loans at the five major commercial banks increased by 43%, from 918.74 million KRW to 1.3139 billion KRW. This suggests that even high-credit borrowers are facing difficulties in repaying loans amid a surge in asset prices.

For middle- and low-credit borrowers with NICE scores below 860 and KCB scores below 820, the delayed compensation fees related to mortgage loans decreased from 15.48497 billion KRW in 2021 to 13.2189 billion KRW in 2022 but still exceeded 10 billion KRW. This amount is about ten times higher than that paid by high-credit borrowers. Analysts suggest that mortgage loans for middle- and low-credit borrowers have reached a level that is not only difficult but also risky.

Among banks, internet banks showed a remarkable increase in delayed compensation fees. The number of delayed compensation fee payments under one month at the three internet banks increased nearly fourfold, from 34,534 cases in 2021 to 151,937 cases in 2022. The amount also grew about sixfold, from 130.1 million KRW to 769.83 million KRW during the same period. For delays over one month, the number of payments rose from 13,737 cases to 28,700 cases, and the amount increased from 325 million KRW to 488.69 million KRW.

Representative Choi stated, "It is natural that additional interest is charged when loans are overdue, but since many experts are concerned about an economic downturn and expect interest rates to rise further, it is necessary to closely monitor debt situations and manage them prudently."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.