LS Cable & System Recognized as 4th Largest Submarine Cable Provider Worldwide

KEPCO Plans 56 Trillion KRW Large-Scale Transmission and Transformation Projects

Opportunities to Expand Domestic and International Renewable Energy Cable Business

Despite the global economic downturn, major cable manufacturers such as LS and Daehan Electric Wire are posting strong performances. This is due to increased orders from North America and Europe, as well as growing demand for renewable energy power cables for wind and solar power, which is giving momentum to their businesses.

At the LS Cable & System 'HVDC Submarine Cable Factory Completion Ceremony,' Koo Ja-eun, Chairman of LS Group (6th from the left), Myung Noh-hyun, CEO of LS Corporation (7th from the left), and Koo Bon-gyu, CEO of LS Cable & System (5th from the left), are participating in the commemorative ceremony.

At the LS Cable & System 'HVDC Submarine Cable Factory Completion Ceremony,' Koo Ja-eun, Chairman of LS Group (6th from the left), Myung Noh-hyun, CEO of LS Corporation (7th from the left), and Koo Bon-gyu, CEO of LS Cable & System (5th from the left), are participating in the commemorative ceremony. [Photo by LS Cable & System]

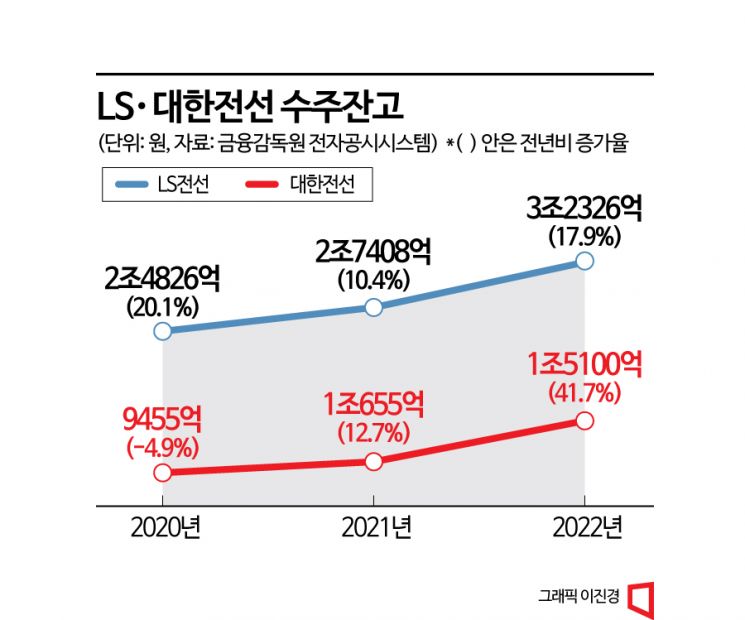

LS Cable & System and Daehan Electric Wire both set new records for order backlogs last year. LS Cable recorded KRW 24.826 trillion in 2020, KRW 27.408 trillion in 2021, and KRW 32.326 trillion last year. The year-over-year growth rates were 20.1%, 10.4%, and 17.9%, respectively. Daehan Electric Wire recorded KRW 945.5 billion in 2020, a 4.9% decrease from 2019, but recovered from the 2020 slump by increasing to KRW 1.065 trillion in 2021 and KRW 1.51 trillion last year. The growth rate compared to 2021 reached 41.7%.

Sales also increased during the same period. LS Cable posted KRW 48.315 trillion in 2020, KRW 61.114 trillion in 2021, and KRW 66.215 trillion last year. Daehan Electric Wire earned KRW 1.5698 trillion in 2020, KRW 1.9977 trillion in 2021, and KRW 2.4505 trillion last year.

Daehan Electric Wire announced that it recorded KRW 703.9 billion in sales in the first quarter, marking the highest first-quarter performance in 12 years since 2011. They stated, "Performance increased despite lower copper prices." The average copper price on the London Metal Exchange (LME) in the first quarter was $8,930 per ton, 10.5% lower than the $9,984 average in the first quarter of last year. Cable manufacturers include escalation clauses in contracts with public enterprises such as KEPCO, which reflect copper price increases in the sales price. Simply put, the higher the copper price, the higher the sales.

The reason for increased performance despite lower raw material prices is that efforts to diversify business in North America and Europe are translating into results. LS Cable entered the North American market in 2006. It secured its first contract worth $60 million (approximately KRW 79.8 billion) for ultra-high voltage XLPE (cross-linked polyethylene) cables from U.S. power company KeySpan. XLPE is an insulating material that withstands high temperatures and high pressure while supplying electricity stably. Chairman Koo Ja-yeop actively participated in the U.S. business, and his son, CEO Koo Bon-gyu, also worked at LS Cable's U.S. subsidiary for three years starting in 2007.

LS Group Chairman Koo Ja-eun is visiting the L&K factory in Germany and receiving an explanation about the production process of the core product, Oxygen Free Copper, from CEO Christof Barklage.

LS Group Chairman Koo Ja-eun is visiting the L&K factory in Germany and receiving an explanation about the production process of the core product, Oxygen Free Copper, from CEO Christof Barklage. [Photo by LS]

Europe is a hub not only for LS Cable but for the entire LS Group's electric vehicle business. The first overseas site visited by LS Group Chairman Koo Ja-eun after his inauguration was the LS Cable and Superior Essex (SPSX) cable factories in Germany, Poland, and Serbia. LS Cable's recent KRW 2 trillion order for ultra-high voltage direct current (HVDC) cables from the Dutch state-owned power company TenneT on the 8th is no coincidence. It is the world's largest cable supply contract.

Daehan Electric Wire established its U.S. sales subsidiary T.E.USA in 2001. Last year, the U.S. subsidiary secured a local power grid supply project worth KRW 400 billion, the largest achievement in 21 years since entering the U.S. market. In Europe, after establishing a UK branch in 2017, it set up a Netherlands subsidiary (2019), Denmark branch (2021), and Sweden branch (2022). Recent orders include two ultra-high voltage power grid construction projects worth KRW 70 billion secured in Germany in February.

A view of LS Cable & System's Donghae Plant Subsea Building 4 and VCV Tower, completed on the 2nd of last month. [Photo by LS Cable & System]

A view of LS Cable & System's Donghae Plant Subsea Building 4 and VCV Tower, completed on the 2nd of last month. [Photo by LS Cable & System]

The increasing demand for cables required for renewable energy facilities is also a positive factor. LS Cable possesses the technology to install submarine cables at depths of up to 8,000 meters. Thanks to this, it is recognized as the world's fourth-largest submarine cable company, following the three major European cable companies Nexans (France), Prysmian (Italy), and NKT (Denmark).

Cable manufacturers are rushing to expand submarine cable factories. LS Cable announced on the 2nd that it completed the only and largest HVDC submarine cable factory in Asia, located in Donghae City, Gangwon Province. After completion, production capacity is expected to increase by 1.5 times compared to before. Daehan Electric Wire also began construction of a KRW 100 billion offshore submarine cable factory in Dangjin, Chungnam Province, in December last year. LS Cable CEO Koo Bon-gyu attended the factory completion ceremony on the 2nd and said, "The completion of the HVDC factory during the rising trend of the power industry will act as a growth accelerator," adding, "We will contribute to strengthening national competitiveness by building an efficient energy network."

The energy network construction capability of cable manufacturers mentioned by CEO Koo Bon-gyu is related to KEPCO's announcement on the 8th of the "10th Long-Term Transmission and Transformation Facility Plan." KEPCO's plan is to send surplus renewable energy power from Jeju Island and Jeolla Province to the metropolitan area to meet the rapidly increasing demand from semiconductor factories, data centers, and others. For the project to succeed, HVDC submarine cables must be properly expanded. Although KEPCO has not announced specific project schedules or scales, submarine cable manufacturers such as LS Cable are paying close attention to this policy. A KEPCO official stated, "We plan to build an HVDC backbone network from the West Coast to the metropolitan area to supply power to the metropolitan area, which lacks carbon-free power sources such as nuclear and renewable energy, and to lead the HVDC industrial ecosystem, which is expected to expand rapidly worldwide in the future." The official added, "The investment cost for the 10th plan is expected to be KRW 56.5 trillion by 2036, and the cost for connecting carbon-free power sources to the power grid is estimated at about KRW 34.5 trillion."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.