4th Year of Alcohol Smart Order... Growth in Both Service and Users

Improved Consumer Convenience and Additional Revenue for Businesses

Criticism of Large Corporation-Centered Growth Contrary to Original Intentions

Office worker Kim Hyung-wook (34, male) has developed a hobby of "liquor window shopping" on his smartphone since last year. He has installed several applications (apps) that provide liquor smart order services and occasionally browses for new drinks or special deals. Kim said, "I skim through them during spare moments, and it’s a small pleasure," adding, "It’s personally beneficial because I can briefly check various information about different liquors beyond just inventory status." However, the main reason Kim frequently uses smart order services is convenience. He said, "It’s difficult to visit liquor specialty stores or supermarkets every day, but above all, the biggest advantage is being able to browse comfortably without feeling awkward or having to stand around checking prices in the store."

Now in its fourth year since introduction, liquor smart order services have become integrated into daily life, establishing themselves as a new way to purchase alcoholic beverages. Consumers enjoy benefits such as time savings and expanded choices, while businesses cite additional revenue generation as a reason for service expansion. However, the fundamental limitation remains that customers must visit stores in person to pick up their orders, and the service is mainly established by large corporations like convenience store chains that have nationwide bases, which is also pointed out as an issue.

Large Corporations in the Distribution Industry Race to Adopt Services

Liquor smart order is a service where customers order alcoholic beverages online via smartphone apps and then pick them up at offline locations such as restaurants, supermarkets, or convenience stores. Unlike other products, liquor sales have traditionally required face-to-face transactions considering public health and the impact on youth, with restrictions on telecommunication sales. However, as adult verification became possible online, the government decided in April 2020 to allow telecommunication sales of liquor. Still, this service is premised on consumers visiting stores in person to receive the liquor directly from the seller.

With regulations eased, large corporate-affiliated distributors such as convenience stores and large supermarkets rushed to adopt the service, and startups like DailyShot, Dally, and Kihya have entered the market by securing partnerships with restaurants and pubs, expanding the service area. Last month, e-commerce companies also joined the liquor smart order service, with Curly partnering with Coffee Bean to use cafes as pickup locations.

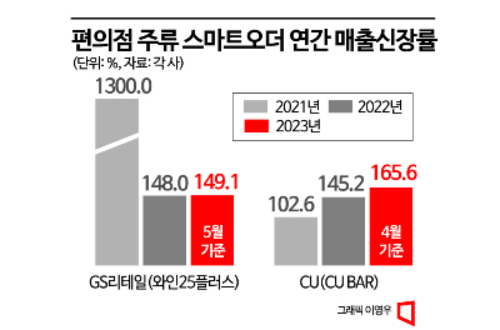

GS Retail’s ‘Wine25Plus,’ which launched in July 2020, recorded an explosive sales growth rate of 1300% in 2021. Interest in the service has continued to grow, with 148% growth last year and 149% growth as of the 15th of this year. CU’s ‘CU BAR’ also showed strong growth with sales increases of 102.6% in 2021, 145.2% in 2022, and 165.6% year-on-year as of April this year.

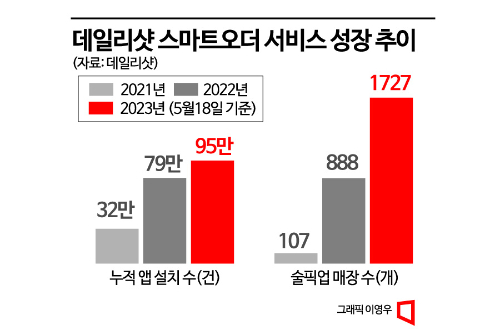

DailyShot, a representative liquor smart order app, has steadily increased its users and partner stores. The app downloads, which were 90,000 in its first year in 2020, rose to 320,000 in 2021, 790,000 in 2022, and reached 950,000 as of the 18th of this year, making it likely to surpass 1 million downloads within the year. The number of ‘Sul Pickup’ partner stores, which was only 107 in 2021, recently increased to 1,727, more than 16 times in two years.

Capturing Both Consumer Convenience and Business Revenue

The continuous growth of liquor smart order services is due to the alignment of consumer demand for convenience and business needs for additional revenue. From the consumer’s perspective, the biggest advantage of smart order is efficiency. Customers can pick up products at nearby locations without having to travel far to liquor specialty stores or large supermarkets, reducing unnecessary travel time and using their time more efficiently. Additionally, since customers can review available products and sale information in advance and then visit to pick up their orders, they save time selecting products or participating in ‘open runs’ for popular items.

From the perspective of large distributors or liquor wholesalers, efficient inventory management has become possible. Offline stores can only stock and sell products expected to have a certain level of demand. However, by checking product lists and inventory status online and ordering accordingly, the burden of selecting items to sell and managing inventory is reduced. Moreover, accumulating purchase data makes it easier to understand consumer preferences for types of liquor or brands.

An E-Mart representative explained, "Because we provide product recommendation services based on customer purchase data, it positively influences increased customer usage." Currently, GS Retail offers about 7,000 types of liquor for purchase, which is more than 28 times the approximately 250 types available when the service first launched. E-Mart and CU also offer about 3,500 and 1,200 types of liquor, respectively, for online purchase.

Partner businesses that serve as pickup points also have incentives to diversify revenue channels. Even ordinary restaurants or cafes that only handled a few types of liquor like soju and beer can expect additional sales simply by handling relatively simple tasks such as receiving, storing, and handing over products without special costs like system construction.

Criticism of Convenience Stores Becoming Dominant Channels in the Liquor Market

However, the fundamental limitation remains that even if orders are placed online, customers must visit stores in person and undergo additional identity verification procedures to pick up products. In an era where same-day delivery to the doorstep has become commonplace, having to visit offline stores every time to collect products?even if nearby?can feel inconvenient.

A DailyShot representative said, "Despite the enormous size of the domestic liquor market at 29 trillion won annually, the online penetration rate remains below 1%. Since easing related regulations in a healthy direction is linked to both corporate growth and consumer convenience, it is necessary to consider a process of consultation with relevant ministries and gathering diverse opinions from stakeholders from a long-term perspective."

It is also pointed out as a problem that, contrary to the original purpose of introducing the service for efficient store management by small business owners, the service is settling mainly among large corporations that have nationwide store networks. A partner business owner A, who runs a meat restaurant in Gangseo-gu, Seoul, said, "Most customers only pick up products, and even including regular customers, less than 5% of pickup customers become dining customers," adding, "Although we have continued the partnership for two years because of the additional revenue, considering storage costs, the actual benefit is not significant."

Professor Myung Wook of the Barista & Sommelier Department at Sejong Cyber University also evaluated that liquor smart order is the system that played the biggest role in convenience stores gaining hegemony in the liquor market. Professor Myung said, "Convenience stores, which have tens of thousands of stores nationwide, take the largest share, and the rest inevitably goes to small business owners," adding, "For self-employed people to earn meaningful profits beyond the current level, the government needs to consider additional system development."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.