April Hive and May YG Entertainment Focused Buying

Hyundai and Kia Achieve Record High Earnings Despite IRA Penalties

Foreigners' Top 1-6 Net Selling All in Battery Sector

This year in the second quarter, foreigners fell in love with the automobile and entertainment sectors. These are industries expected to grow overseas, and notably, their first-quarter earnings recently exceeded expectations. The battery sector, which was heavily bought at the beginning of the year, all ranked among the top net sellers.

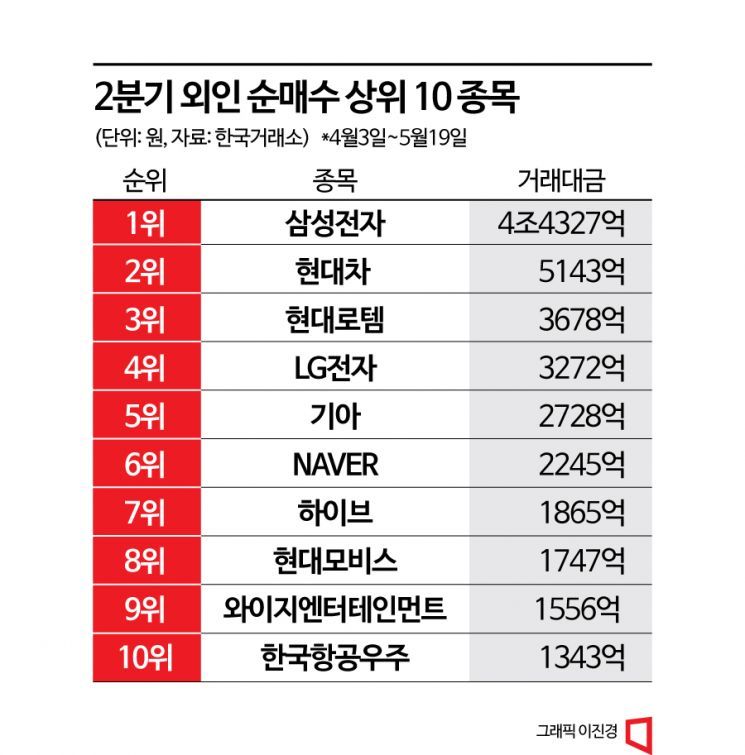

According to the Korea Exchange on the 22nd, the top stocks by net foreign buying in the second quarter (April 3 to May 19) were Samsung Electronics(KRW 4.4327 trillion), Hyundai Motor Company(KRW 514.3 billion), Hyundai Rotem(KRW 367.8 billion), LG Electronics(KRW 327.2 billion), Kia(KRW 272.8 billion), NAVER(KRW 224.5 billion), HYBE(KRW 186.5 billion), Hyundai Mobis(KRW 174.7 billion), YG Entertainment(KRW 155.6 billion), Korea Aerospace Industries(KRW 134.3 billion) and others.

It is notable that the entertainment sector ranked high among net purchases. Foreigners' buying spree in entertainment was prominent in March. This was due to a public tender offer battle triggered by the management dispute at SM Entertainment (SM). In March, SM and HYBE ranked 5th and 10th respectively in foreign net buying.

Although the SM management dispute ended, as of April, HYBE ranked 7th in foreign net buying. In May, instead of HYBE, YG Entertainment (6th) and JYP Entertainment (9th) took their places.

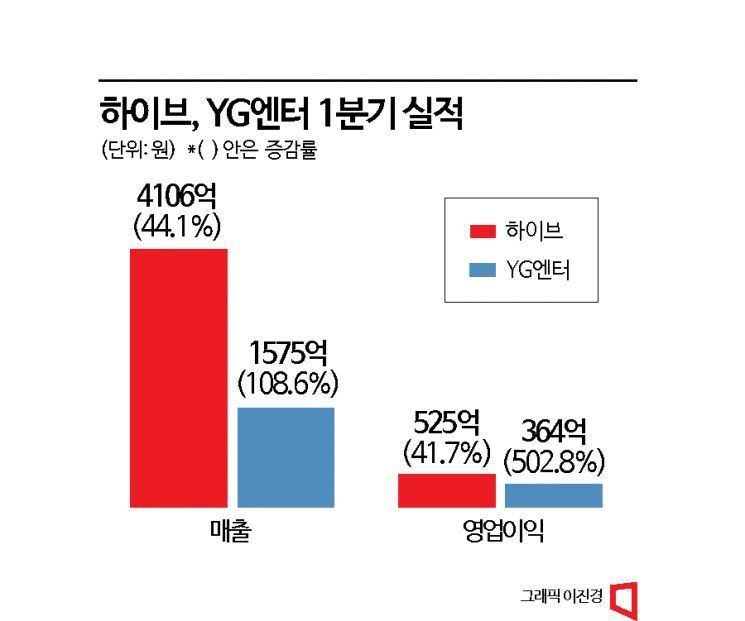

The common factor among the entertainment stocks bought by foreigners is 'earnings.' YG Entertainment posted record-high quarterly earnings this year. Its first-quarter revenue increased by 108.6% year-on-year to KRW 157.5 billion, and operating profit surged 502.8% to KRW 36.4 billion. Researcher Choi Jong-kyung of Heungkuk Securities said, "Blackpink and Treasure demonstrated the continuous growth potential of global intellectual property (IP)," adding, "In the second quarter, steady earnings are expected to continue due to active activities by the artists."

HYBE also posted strong results. Its first-quarter revenue rose 44.1% to KRW 410.6 billion, and operating profit increased 41.8% to KRW 52.5 billion, surpassing the consensus estimate (KRW 46.7 billion). High-margin album sales reached 9.32 million units (based on Circle + Oricon), marking a quarterly record, while the sales proportion of high-cost concerts decreased.

Interest in the automobile sector is also notable. Hyundai Motor Company, Kia, and Hyundai Mobis ranked among the top net purchases. This is interpreted as being driven by strong earnings from automobile companies and proactive shareholder return policies stimulating investor sentiment. Although the Inflation Reduction Act (IRA) led to the suspension of electric vehicle subsidies in the U.S., the growth trend of electric vehicles continues.

As of April, Hyundai Motor's internal combustion engine vehicle sales increased 44.5% year-on-year to 1,104,000 units. Electric vehicle (EV/PHEV) sales surged 85.5% to 526,787 units. In April, the share of electric vehicles (EV/PHEV) in the automobile market reached 32.3%. Researcher Lee Jae-il of Eugene Investment & Securities said, "Due to accumulated pent-up demand and ongoing inventory shortages, production and sales momentum are expected to continue in the second quarter," adding, "Exchange rate conditions are favorable, and profit outlooks are positive."

In contrast, foreigners showed a 'sell' trend in the battery sector. The top six net sellers were POSCO Holdings, EcoPro, POSCO Future M, LG Chem, L&F, and EcoPro BM, respectively.

EcoPro group stocks have faced ongoing concerns about short-term overheating since last month. Additionally, negative factors such as the failure to be included in the Morgan Stanley Capital International (MSCI) index and owner-related risks have adversely affected stock prices.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)