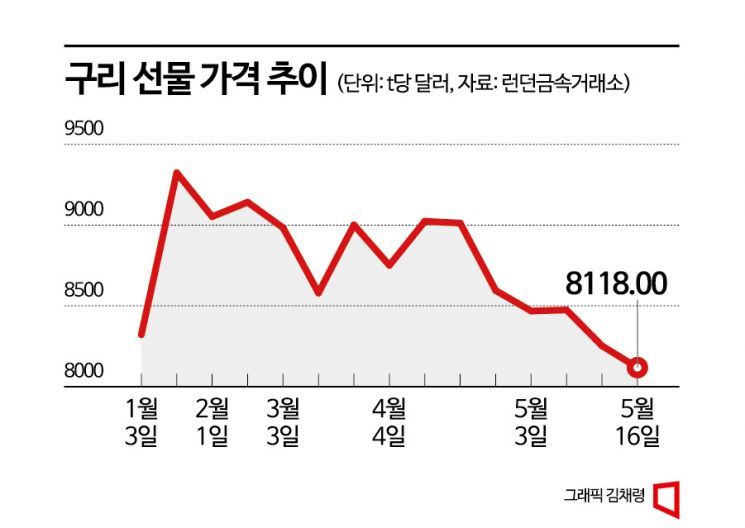

Copper 3-Month Futures Price Hits Yearly Low at $8,818.80 per Ton

China's Economic Recovery Slower Than Expected...Focus on Potential Stimulus Measures

Copper prices, which had surged on expectations of China's reopening (resumption of economic activities), have sharply declined. This is because, upon examining China's economic situation, it was confirmed that the economy is not in a condition good enough to cause a surge in raw material demand, weakening the expected demand. Additionally, as the value of the dollar rose due to a series of defaults by U.S. regional banks, the downward trend in copper prices accelerated.

According to the London Metal Exchange (LME) on the 17th, the price of 3-month copper futures closed at $8,118.80 per ton as of the previous day, down about 10% from a month ago ($8,964.50). Compared to the year's highest price recorded on January 18 ($9,430), it has fallen about 14%. Until March, copper prices hovered around $9,000 but have gradually shown a downward trend. Currently, copper prices remain at their lowest level of the year.

Prices of other non-ferrous metals mainly used in manufacturing showed a similar trend. The non-ferrous metals index (LMEX), calculated by the LME by indexing futures prices of six metals centered on aluminum, copper, and zinc (including lead, nickel, and tin), currently points to 3,724.10. This is more than 15% lower than the year's highest point recorded on January 26 (4,403.50). All these metals have about half of their demand originating from China.

The main reason for the decline in copper and other non-ferrous metal prices is China. At the beginning of this year, market experts were optimistic about the reopening effect in China, suggesting copper prices could exceed $10,000. This was because demand was expected to increase significantly after the lifting of COVID-19 lockdowns. In particular, news that the Chinese government was working to stimulate the real estate market increased investors' interest in raw material investments. However, due to results differing from expectations, investors who bet on a rise earlier this year likely suffered losses exceeding 10%. This contrasts with the KOSPI and KOSDAQ indices, which have risen more than 11% and 20%, respectively, since the beginning of the year.

In fact, China's economic indicators released the previous day for April fell significantly short of market expectations. The industrial production growth rate in April increased by only 5.6% year-on-year, below the market forecast of 10.9%, and retail sales recorded 18.4%, falling short of the expected 21%. Earlier, Winnie Wu, China equity strategist at Bank of America (BoA), said, "The Chinese economy is in a recovery phase compared to last year, but recent economic indicators fall short of market and investor expectations," adding, "The momentum for revenge consumption seems weaker than at the time of the COVID-19 lifting."

For the ‘KODEX Copper Futures ETF,’ which tracks copper futures prices traded on the New York Commodity Exchange (COMEX), a simple estimate suggests that if one had invested three months ago (February 16), the value would have dropped by more than 9%. Compared to this year's peak, it has fallen over 14%. The ‘TRUE Leverage Copper Futures ETN,’ which aims to deliver twice the return of the copper futures index, has plunged 17% compared to a month ago and about 20% from the peak. Shares of copper-related companies such as Igusaneop have fallen 12.5% compared to a month ago, while LS and Poongsan dropped 6% and 6.6%, respectively.

Experts expect volatility to increase for the time being as expectations for China's economic recovery waver. Since a clear recovery in China's economy has not appeared, it is difficult for the direction of non-ferrous metal prices to change in the short term. Hwang Byung-jin, a researcher at NH Investment & Securities, said, "As China's economic indicators fall short of market expectations, a short-term contraction in investment sentiment is inevitable," adding, "In the short term, pessimism may form even in the industrial metals sector, where China is the largest consumer." The increase in copper inventories should also be considered. Inventory levels and non-ferrous metal prices have an inverse relationship, and currently, copper inventories in warehouses at the London Metal Exchange stand at 76,600 tons, about 20,000 tons higher than a month ago (54,400 tons).

If considering investment, it is necessary to watch whether China will introduce economic stimulus measures. Park Sang-hyun, a researcher at Hi Investment & Securities, analyzed, "Relying on autonomous revenge consumption for the normalization of the Chinese economy has its limits," adding, "As expectations for China's economic normalization in the second half of the year weaken, additional measures by the Chinese government are urgently needed to avoid falling into a low-growth trap."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)