KIEP to Announce '2023 Global Economic Outlook' on 16th

Slow Recovery Expected with 2.6% Growth in 2023

Risks of Prolonged Recession Due to Financial Instability and Credit Tightening, Weakening Global Policy Coordination

The Korea Institute for International Economic Policy (KIEP) slightly revised its global economic growth forecast for this year upward from 2.4% in November last year to 2.6%, but it expects the economic recovery to be slow. It predicted that credit contraction caused by high inflation and high interest rates in major advanced countries will delay the global economic recovery.

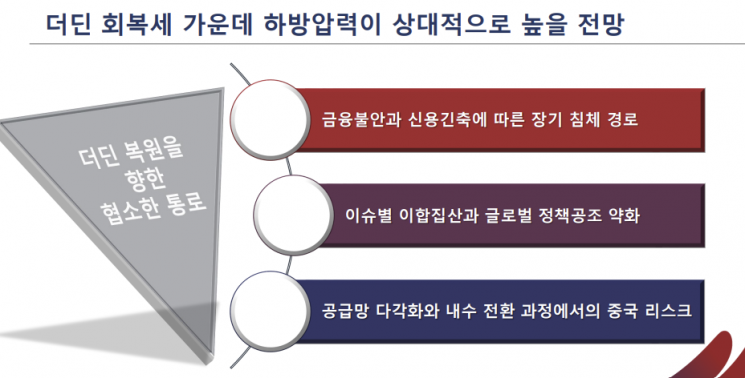

At a press briefing on the ‘2023 World Economic Outlook (Update)’ held at the Government Complex Sejong on the 16th, KIEP forecasted that the global economy will grow by 2.6% this year. This is a slight upward revision of 0.2 percentage points from the 2.4% forecast in November last year, and it described the keyword for the global economy in the second half of this year as a ‘narrow path toward slow recovery.’ KIEP’s forecast is lower than the International Monetary Fund (IMF)’s forecast of 2.8% and is the same as the OECD’s forecast of 2.6%.

Global Economy Expected to Grow 2.6% in 2023... ‘Narrow Path Toward Slow Recovery’

For the second half of the year, KIEP diagnosed that ‘long-term recession path due to financial instability and credit tightening,’ ‘weakening of global policy coordination,’ and ‘China risk in the process of supply chain diversification and domestic demand transition’ will slow economic recovery. Kim Heung-jong, President of KIEP, said, “We slightly revised the forecast upward reflecting the solid employment indicators in the U.S., Europe’s decent growth despite high inflation, and China’s rapid reopening effect,” adding, “However, this figure is significantly lower than pre-pandemic levels, indicating that the global low-growth phase is likely to become entrenched, so it is difficult to say the situation has improved.” He further added, “As U.S.-China conflicts intensify and geopolitical risk factors remain unresolved, the path toward economic recovery is expected to be very narrow.”

Financial instability caused by the bankruptcy of small and medium-sized banks in the U.S. since March 2023 is expected to act as an obstacle to the recovery of not only the U.S. but also the global economy. As banks, concerned about insolvency, tighten loan screening, credit contraction occurs, and if asset prices fall, it will lead to a contraction in the real economy, creating a vicious cycle that is unlikely to be easily broken.

Furthermore, amid the ongoing Russia-Ukraine war, conflicts between China, which considers trade with Russia important, and Western countries that have imposed strong sanctions, are weakening global policy coordination, which is also cited as a downside risk to the global economy. KIEP pointed out, “With multilayered alliances and divisions occurring, the driving force to solve common human problems is at risk of disappearing.” Additionally, the global supply chain diversification strategy resulting from ongoing U.S.-China conflicts has shifted China toward a domestic demand-centered policy, reducing China’s contribution to the global economy, which is also a source of concern. The global economy is forecasted to grow 3.0% next year.

Growth Forecasts: U.S. (1.2%), Europe (0.8%), Japan (1.4%)... Only China Grows 5.5% Due to Reopening Effect

By country, the U.S. growth forecast for this year was raised from 0.6% in November last year to 1.2%. Attention was paid to the continuously solid employment indicators (3.5% unemployment rate in March) and increasing retail sales despite inflationary pressures. However, financial market instability caused by the bankruptcy of small and medium-sized U.S. banks is expected to act as a burden, slowing growth.

The European Union (EU) growth forecast was also slightly raised from 0% to 0.8%. Despite the global economic slowdown and easing energy prices, core inflation remains high, so economic growth is expected to be limited.

Japan’s growth forecast was revised downward by 0.1 percentage points from 1.5% to 1.4%. Based on government support measures and wage increases, consumption recovery is expected to be prominent, leading to a slight recovery centered on the domestic market. However, Japan also faces risk factors due to external risks such as worsening overseas economies and expanding geopolitical risks.

China’s growth forecast was raised by 0.7 percentage points from 4.8% to 5.5%. Due to the resumption of economic activities following reopening and government policies to stimulate domestic demand, China is expected to exceed its government’s economic growth target of around 5%. Russia’s growth forecast was also revised upward from -2.5% to 0.5%. Due to the base effect from last year’s contraction and high international prices of crude oil and natural gas, net exports are expected to increase significantly, resulting in limited but positive growth.

The impact of China’s reopening effect on South Korea’s economic growth is expected to be limited. President Kim Heung-jong explained, “In the past, China’s economic growth positively influenced the global economy including South Korea’s economy, but as China has started to procure many things internally, this correlation is decreasing.”

Limited Decline in Major Countries’ Government Bond Yields... Gradual Easing of Dollar Strength Expected

Although inflationary pressures are easing and the pace of base rate hikes is slowing, the possibility of a significant decline in major countries’ government bond yields in international financial markets is limited. This is because the U.S. Federal Reserve is unlikely to abruptly shift to a rate-cutting stance within this year. It is expected that the current interest rate level will be maintained through 2023, with the possibility of rate cuts starting in 2024 depending on developments in employment indicators, economic indicators, and financial market instability.

The strong dollar trend is expected to gradually ease. The U.S. Federal Reserve, which sharply raised rates in 2022, is expected to end the rate hike cycle and maintain a hold stance in the first half of this year, balancing the recession caused by high inflation and high interest rates, so the strong dollar trend is expected to gradually ease. KIEP forecasted, “The exchange rate will show a high start and low finish,” adding, “Currently, it is moving around the 1,300 won level, but it is expected to fall below this level in the second half of the year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.