Zigbang, Analysis of Actual Transaction Prices for Multi-Unit Houses

Jeonse Transaction Prices Continue to Weaken

Concerns Grow Over Reverse Jeonse Occurrence

The proportion of leasehold (jeonse) transactions for multi-family houses in the Seoul metropolitan area is increasing again. This appears to be due to reduced financial burdens for securing jeonse deposits, thanks to falling jeonse prices and relatively lower interest rates. However, jeonse prices still show weakness, raising concerns about reverse jeonse when lease renewal periods arrive.

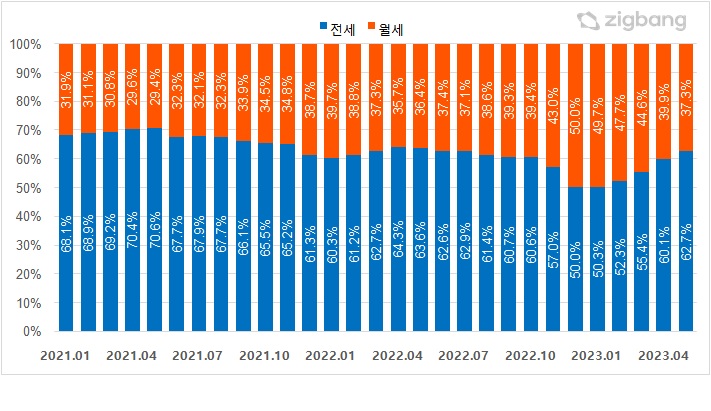

According to Zigbang on the 15th, examining the monthly proportions of jeonse and monthly rent transactions in the metropolitan area, the jeonse transaction ratio was around 65-70% in 2021 but slightly decreased to the low 60% range starting in 2022. In December 2022, the jeonse transaction ratio dropped to 50%, but from the beginning of this year, the jeonse transaction ratio has been increasing again, reaching 50.3% in January, 52.3% in February, 55.4% in March, and 60.1% in April.

Looking at the regions, the proportion of jeonse transactions in Seoul fell to 49.7% in December 2022, trailing the monthly rent transaction ratio of 50.3%, but the jeonse ratio has been rising since January 2023. In Incheon, the jeonse transaction ratio remained higher than the monthly rent ratio at 53.1% even in December 2022, which is the lowest proportion since February 2017. In Gyeonggi Province, the jeonse transaction ratio was reversed by the monthly rent ratio in January 2023, with 49.0% for jeonse and 51.0% for monthly rent. Seoul and Gyeonggi showed the lowest jeonse transaction ratios since the Ministry of Land, Infrastructure and Transport began publishing actual transaction data for jeonse and monthly rent in 2011.

Monthly Trend of Jeonse and Wolse Transactions Ratio for Multi-family and Row Houses in the Seoul Metropolitan Area (Provided by Zigbang)

Monthly Trend of Jeonse and Wolse Transactions Ratio for Multi-family and Row Houses in the Seoul Metropolitan Area (Provided by Zigbang)

The problem is that jeonse prices continue to show a steady decline. As jeonse prices fall, the average jeonse price per 3.3㎡ in the metropolitan area was actually 10,000 KRW lower last month compared to two years ago, and this gap widened to 190,000 KRW lower this month. Specifically, in Seoul, the average jeonse price per 3.3㎡ this month was 370,000 KRW lower than two years ago; in Gyeonggi, it was 350,000 KRW lower; and in Incheon, it dropped by 110,000 KRW.

Since reverse jeonse phenomena can also be confirmed in average jeonse transaction prices, conflicts between landlords and tenants are expected at the time of lease termination and renewal, especially regarding the return of jeonse deposits. Ham Young-jin, head of Zigbang Big Data Lab, said, "Tenants tend to prefer jeonse transactions over monthly rent transactions, which involve consumable costs, but due to concerns about jeonse fraud and reverse jeonse, coupled with a considerable number of apartment move-ins in the metropolitan area this year, the weakness in jeonse prices for multi-family houses is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.