Apartment Complexes in Gwangmyeong and Yongin, Gyeonggi with National Average 84㎡ Prices Exceeding 1 Billion KRW

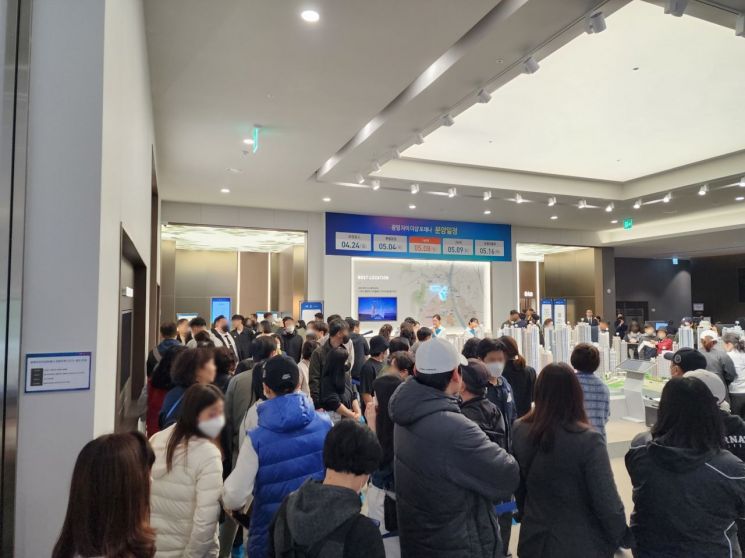

Despite High Price Controversy, Units Sold Out Within Ranking... Over 3,000 Applicants

Experts Say Polarization Among Complexes Persists, Recovery of Subscription Market Premature

Recently, apartment complexes in Gyeonggi Province that faced controversy over 'high pre-sale prices' have been attracting attention as they continue to achieve successful subscription results. This is interpreted as demand surging due to the government's significant relaxation of subscription regulations under the 1·3 measures, coupled with expectations that pre-sale prices will continue to rise in the future.

According to Subscription Home on the 15th, the first-priority subscription held on the 8th at Gwangmyeong Xi The Sharp Forena in Gwangmyeong-si, Gyeonggi Province, attracted 4,422 applicants for 422 units, recording a competition rate of 10.48 to 1. Among the seven housing types, the exclusive 39㎡ unit, which was the only one to fail to close in the first priority, succeeded in closing in the second priority. The pre-sale price per 3.3㎡ of this complex is about 27 million KRW, and the pre-sale price for the 84㎡ unit, known as the national standard size, reached up to 1,045.5 million KRW, exceeding 1 billion KRW despite not being in Seoul, sparking controversy over high pre-sale prices.

At e-Pyeonhansesang Yongin Station Platform City in Giheung-gu, Yongin-si, Gyeonggi Province, the highest pre-sale price for the 84㎡ unit is 1,235 million KRW, well over 1 billion KRW. However, the subscription results for first and second priority on the 3rd and 4th showed 3,454 applicants for 787 units, recording a competition rate of 4.4 to 1. The 84㎡ C-type unit, which was undersubscribed in the first priority, made up for it in the second priority subscription, achieving a decent result.

The industry views this surge in demand as a result of the relaxation of subscription regulations attracting both young real demand and investment demand. With the 1·3 measures, all areas except the three Gangnam districts and Yongsan-gu in Seoul were designated as non-regulated areas, leading to the introduction of a large number of lottery-based units, allowing low-score applicants and homeowners to apply. Furthermore, the subscription savings account membership period required for first-priority eligibility was reduced from two years to one year, and subscription eligibility was extended to household members who are not heads of households, resulting in a large influx of subscription demand. Consequently, the average subscription competition rate in the metropolitan area is also rising. According to Real Estate R114, the average first-priority subscription competition rate in the metropolitan area, which was only 0.28 to 1 in January, rose to 7.68 to 1 last month.

There is also an analysis that subscription demand surged due to expectations that pre-sale prices will continue to rise. Buyers, judging that prices are unlikely to fall, rushed to secure their homes as soon as possible. In fact, pre-sale prices have been on the rise due to increased construction costs and the impact of high interest rates. The construction cost index in March was 151.11, rising 1.7% over the first three months of this year. According to Real Estate R114's analysis of new apartment complexes' pre-sale prices, the average pre-sale price nationwide from January to April this year was 16.99 million KRW per 3.3㎡, up 11.7% compared to last year (15.21 million KRW). With the lifting of regulations at the beginning of the year, the areas subject to the pre-sale price ceiling system were reduced to four districts in Seoul?Gangnam, Seocho, Songpa, and Yongsan-gu?meaning most regions are no longer under the government's high pre-sale price control, so the market expects little chance of prices falling in the near term.

However, experts say that although the subscription market atmosphere is improving, polarization between complexes remains, and it will take time for the metropolitan subscription market to fully recover. Yeokyung Hee, Senior Researcher at Real Estate R114, said, "It is true that the subscription market atmosphere is improving as real estate regulations are relaxed and pre-sale prices continue to rise, but in Yongin, especially, positive factors such as the semiconductor cluster and in Gwangmyeong, improvements in the residential environment along with inflows from nearby Seoul areas have been identified. There is still a significant difference in subscription results depending on location, so it is premature to talk about a full recovery of the subscription market."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)