There is a forecast that the semiconductor market will hit its bottom in the second to third quarters of this year. It is analyzed that the gross domestic product (GDP) will decrease by nearly 1% due to exports and price declines.

According to the "Recent Semiconductor Market Trends and Macroeconomic Impact" report released on the 10th by the Korea Development Institute (KDI), considering the cycle of demand for semiconductor-related products, the semiconductor market is expected to reach its bottom in the second to third quarters of this year. Jo Garam, a research fellow at KDI's Economic Outlook Office, stated, "The recent overlapping replacement cycles of computers and mobile devices have led to a simultaneous decline in demand, causing a sharp drop in the semiconductor market," and added, "Considering the replacement cycles, the semiconductor market is close to its bottom."

In fact, the semiconductor market is largely influenced by computers and mobile devices, which account for 60% of total demand. The replacement cycle for computers is 4 to 5 years, and for mobile devices, it is 2 to 3 years. Considering that the recent low point for computer demand was in 2019 and mobile device demand rapidly increased from the third quarter of 2020, it is highly likely that the bottom will form within this year.

The semiconductor production bottom is also expected to form in the second to third quarters. The semiconductor market typically follows a cyclical curve, where when inventory peaks, production indicators always hit their lowest point 3 to 6 months later. Recently, major semiconductor suppliers have announced production cuts and are expected to adjust inventories. In fact, semiconductor inventory decreased in March compared to the previous month, and according to this scenario, production will reach its bottom between June and September.

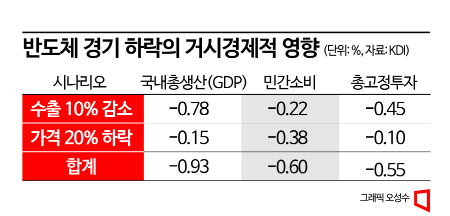

There is also a forecast that GDP will shrink by 0.93% due to the worsening semiconductor market. This is based on the assumption that semiconductor export volume decreases by 10% and prices fall by 20%. Even if only export volume decreases without a price drop, GDP would decline by 0.78%. If semiconductor prices fall by 20%, GDP would decrease by 0.15%. Combining the two scenarios, private consumption is also expected to decrease by 0.60%, and total fixed investment is projected to contract by 0.55%.

The scenario analysis suggests that the semiconductor market downturn will negatively affect domestic demand not only through exports but also through income channels. It is analyzed that this could act as a factor worsening tax revenue conditions in 2023 and 2024. However, the employment inducement effect of the semiconductor industry is not significant, so the impact on the labor market is expected to be relatively small. The employment inducement coefficient of the semiconductor industry is 2.1 persons per 1 billion KRW, which is minimal compared to 10.1 persons across all industries.

KDI advised that since Korea is heavily concentrated in memory semiconductors and thus more vulnerable to market downturns, investment in system semiconductors should be expanded. Memory semiconductors are highly volatile, and in Korea, the export share of memory semiconductors was 63.8% last year, more than twice the global market share of 30.5%. The 9.5 percentage point increase in the decline of semiconductor exports in the first quarter is also interpreted as an effect of this. Although investment in system semiconductors has been ongoing since 2018, dependence on the memory sector remains high, resulting in high volatility in semiconductor exports.

Resolving geopolitical risks was also mentioned as an area for improvement. Currently, the United States and China are engaged in intense conflicts over the semiconductor industry. The U.S. has been applying various regulations since 2018, including imposing tariffs on imports from China and export restrictions on Chinese companies, citing national security and strengthening its own supply chain. Research fellow Jo said, "As conflicts between the U.S. and China intensify, the semiconductor industry is highly exposed to geopolitical risks," and advised, "It is necessary to demonstrate industrial, trade, and diplomatic leadership to reduce uncertainties related to the industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.