Venture Industry Gains Legal Basis for Dual-Class Share System

Revised Venture Business Promotion Act Effective from November 17

Includes Safeguards Such as Conversion to Common Shares After Transfer or Listing

The amended Venture Business Act, which allows unlisted venture companies to issue multiple voting right shares, will take effect from November 17. It is expected to benefit high-growth venture companies that lose their status as the largest shareholder due to dilution of the founder's shares when receiving additional investments for fundraising. However, various safeguards have been put in place to prevent the abuse of multiple voting rights for illicit management succession.

The Ministry of SMEs and Startups announced that the partial amendment to the "Special Measures for the Promotion of Venture Businesses," which includes the multiple voting right shares system for unlisted venture companies, was approved at the Cabinet meeting on the 9th. According to the law, multiple voting right shares refer to shares that grant two or more and up to ten voting rights per share. This system is suitable for situations where companies need to receive investments for growth or new business initiatives but face difficulties in enforcing their management philosophy due to dilution of the founder's voting rights. In other words, multiple voting rights provide an option for venture founders who face a dilemma between large-scale investment and management stability. If the founder is deemed highly capable, they can stabilize management for a certain period with the consent of shareholders.

The issuance of multiple voting right shares is limited to unlisted venture companies and can only be issued to founders currently managing the company. Here, a founder is defined as an incorporator who established the corporation by contributing capital and owns at least 30% of the shares as the largest shareholder. If the founder of a venture company meeting these requirements attracts investment and their shareholding falls below 30% or they lose the status of the largest shareholder, issuance is possible only with the consent of more than 75% of shareholders. Specific investment amount requirements will be stipulated in the enforcement decree.

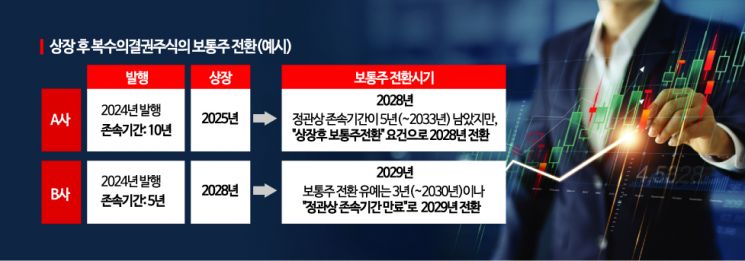

The duration of multiple voting right shares is limited to within 10 years as stipulated in the articles of incorporation. Once the duration expires, the multiple voting right shares are immediately converted into common shares. To prevent abuse for illicit management succession, shares are converted to common shares immediately upon inheritance, transfer, or loss of the founder's director position. Since shares are converted to common shares immediately upon inclusion in a publicly disclosed business group, large corporations cannot utilize this system. If a company issuing multiple voting right shares goes public, the existing duration is changed to the shorter period between the set duration and three years from the listing date. For example, if a company issues multiple voting right shares with a 10-year duration and lists in 2025, the shares will convert to common shares in 2028. If a company sets the duration to 5 years and issues multiple voting right shares in 2024 and lists in 2028, conversion will occur in 2029.

Companies issuing multiple voting right shares are obligated to report to the Ministry of SMEs and Startups. Anyone can report violations related to multiple voting right shares, and the ministry can conduct investigations ex officio regarding related allegations. Violations of reporting obligations may result in fines of up to 5 million KRW. In cases of false issuance, penalties include imprisonment for up to 10 years or fines up to 50 million KRW. The law, having passed the Cabinet meeting, will be promulgated on the 16th and enforced from November 17. The Ministry of SMEs and Startups plans to amend subordinate statutes before the system's implementation.

Due to the stringent conditions required to issue multiple voting right shares, it is uncertain whether this law will be effective in practice. Lee Jung-min, Secretary General of the Korea Venture Business Association, said, "It is true that the content has somewhat regressed from what the association originally requested," and added, "Companies will consider whether to adopt it after the enforcement decree is finalized." However, he noted, "According to surveys conducted among venture entrepreneurs, over 80% responded that they would introduce multiple voting right shares," and "Companies that have received Series A investment and are preparing for large-scale Series B investment are expected to benefit."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.