Higher Returns Than Principal-Guaranteed Products

Synchronization with Major Indices During Market Rises, Loss Protection in Downturns

Pension assets managed through Target Date Funds (TDF) surpassed 10 trillion won as of the first quarter of this year. This marks seven years since TDFs were first introduced in Korea in 2016. Notably, TDFs continue to grow primarily in the pension market, with analyses showing their effectiveness in generating returns during stock market upswings and mitigating losses during downturns. Unlike traditional funds, TDFs are products specifically designed and operated for pension purposes.

According to the Korea Financial Investment Association on the 9th, the accumulated TDF assets within retirement pensions have more than doubled annually from 2018 to 2021, exceeding 10 trillion won by the end of the first quarter this year. TDFs account for about 20% of the entire retirement pension market. Of the 10 trillion won in TDF net assets, over 90% is pension-related, with retirement pensions making up 73.7% and individual pensions 18.6%.

TDFs are asset allocation funds that set the investor’s retirement date as the target date and automatically adjust the portfolio according to the life cycle. With the onset of an aging society, public interest in managing retirement pensions has increased, which is interpreted as a key factor behind the significant growth in TDF net assets.

Fueled by this growth, 2 to 4 new companies enter the market annually, fostering product diversification and increased competition. By vintage, distinguished by the fund investment period, TDF 2025, 2030, and 2045 recorded cumulative net assets in that order, showing a bimodal distribution. This is interpreted as investors choosing vintages that suit their preferences regardless of their retirement date.

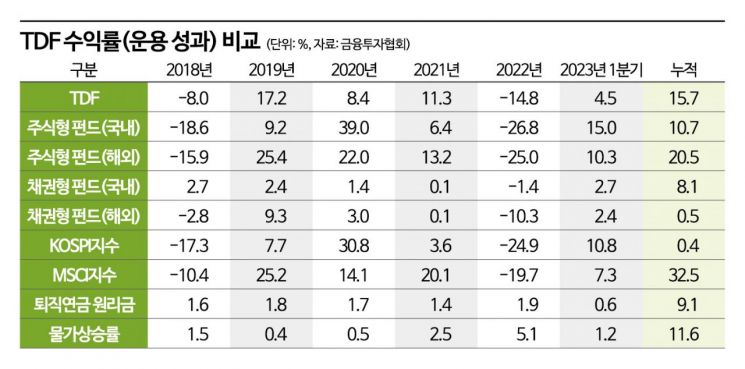

In terms of performance, TDFs have consistently delivered stable returns between overseas equity funds and domestic bond funds each year. During stock market upswings, they synchronized with major global indices to generate profits, while in downturns, they partially defended against losses.

While domestic and international equity funds experienced sharp fluctuations resembling a rollercoaster, TDFs maintained stable returns, achieving a cumulative return of 15.7% over approximately five years. Despite declines in 2018 and 2022, TDFs showed meaningful long-term performance.

This long-term cumulative return exceeded that of principal-guaranteed products. Based on retirement pensions, from 2018 to the first quarter of 2023, TDFs recorded a cumulative return of 15.7%, compared to 9.1% for principal-guaranteed products. The cumulative inflation rate (CPI) during the same period was 11.6%.

Na Seok-jin, Head of the Industry Market Division at the Korea Financial Investment Association, stated, "As Korea’s first pension-specialized product, TDFs are expected to continue growing with the introduction of the retirement pension default option system and increasing interest in pension investments. TDFs align well with the long-term and installment nature of pension investments and are ultimately expected to contribute to improving retirement pension returns and increasing the pension assets of the public."

Meanwhile, due to low birth rates and aging, the National Pension alone can no longer guarantee the public’s retirement security, increasing expectations for the role of retirement pensions. The Korea Financial Investment Association emphasizes the need for funds that serve as stepping stones, allowing retirement pension assets?previously held mainly in banks and insurance companies?to be safely transferred and actively grown for retirement funds. According to Korea Investment Trust Management, the retirement pension market, which stood at 336 trillion won at the end of last year, is expected to grow to 557 trillion won by the end of 2027 and 860 trillion won by the end of 2032.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.