Black Sea Grain Agreement Set to Expire Next Week... Uncertainty Over Ukraine Grain Exports

Grain Price Cycles of About 2 Years 7 Months... Grain Price Decline Also Expected

Concerns are growing that the grain export route of Ukraine, the world's largest granary, will be blocked again, causing domestic feed-related stocks to surge.

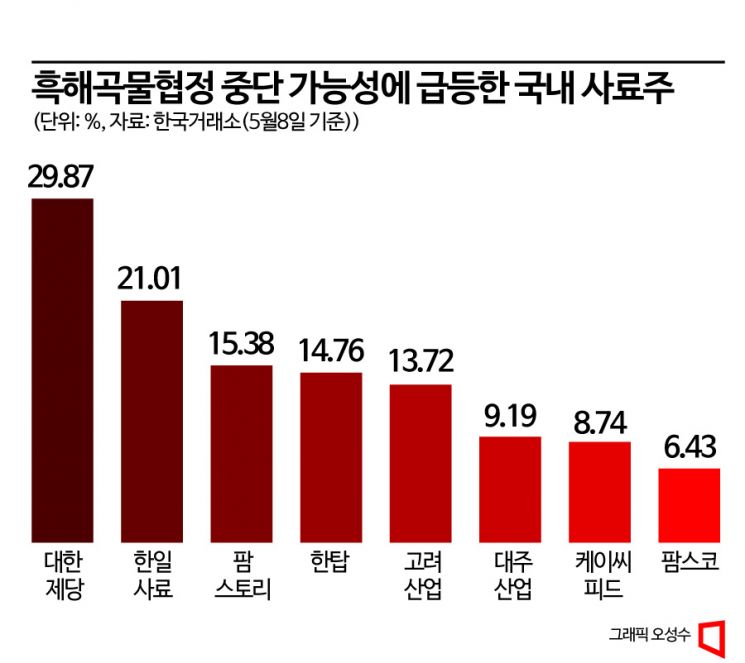

According to the Korea Exchange on the 9th, the stock price of Daehan Sugar closed at 4,065 won, hitting the price limit increase of 30% the previous day. This is nearly a 60% increase compared to the beginning of the year. Daehan Sugar recorded total sales of 1.2 trillion won last year, of which about 20% came from the compound feed sector. Not only Daehan Sugar, but feed-related companies such as Hanil Feed (21.01%), Farmstory (15.38%), Hantap (14.76%), and Korea Industry (13.72%) saw their stock prices jump by double digits in a single day, showing a sharp rise.

The background for the sharp rise in domestic feed stocks is interpreted as the Black Sea Grain Initiative, which is set to expire next week, being at risk of termination. Ukraine is one of the world's largest suppliers of major staple grains, accounting for 30% of global wheat exports. When Russia invaded Ukraine early last year, Ukraine's export routes were blocked, causing global grain prices to soar and raising concerns about a food crisis. In response, under the mediation of the United Nations (UN) and T?rkiye, Russia and Ukraine participated in a four-party Black Sea Grain Initiative, first signed in July last year, allowing grain exports through the Black Sea. It was subsequently extended twice, in November last year and March this year.

The problem is that with the expiration date approaching on the 18th, Russia is uncooperative in extending the agreement. In particular, Russia is demanding the lifting of comprehensive economic sanctions by Western countries, especially the removal of the expulsion of major Russian banks from the international interbank messaging system SWIFT, causing difficulties in negotiations. If the Black Sea Grain Initiative collapses and Ukraine's grain export routes are blocked again, there are concerns that global grain prices for wheat, soybeans, corn, etc., which have been relatively stable this year, will show sharp volatility again.

However, since the agreement was extended after last-minute delays in the previous two extensions, there is significant uncertainty about the negotiation outcome, and caution is advised against short-term stock price speculation. In fact, since the Russia-Ukraine war last year, there have been repeated cases of sharp stock price fluctuations around the times of grain agreement extensions. Additionally, in the long term, grain prices are expected to gradually decline. Shim Eun-joo, a researcher at Hana Securities, explained, "Referring to the long-term trend of grain prices with an average rise and fall cycle of about 2 years and 7 months, there is a high probability that grain prices will enter a downward phase in the first half of the year. Speculative long (buy) positions are noticeably decreasing, and futures prices are reflecting this."

The U.S. Department of Agriculture also included a forecast in its recently released 'Long-Term Grain Price Outlook' that major grain prices will decline from this year through 2032. Especially given the supply-demand imbalance concerns caused by the Russia-Ukraine war over the past year, a significant mid- to long-term drop is expected. A representative from a major securities firm said, "Although there will be differences by grain type, a decline centered on wheat is expected to begin in earnest from the third quarter. From the fourth quarter of next year, all grain input costs are expected to fall significantly compared to the same period last year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.