Korea's Market Share Sees Slight Increase

Taiwan and Vietnam Fill China's Gaps

Since the US-China trade conflict in 2018, China's share of the US semiconductor import market has been cut by one-third. Taiwan and Vietnam filled the gap created when the US excluded China from the semiconductor import market. In this market restructuring process, South Korea is evaluated to have played a spectator role without exerting much influence.

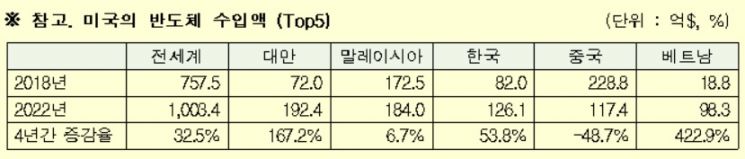

On the 9th, the Federation of Korean Industries analyzed the market shares of major countries in the US semiconductor import market from 2018 to 2022. The results showed that Taiwan (up 9.7 percentage points) and Vietnam (up 7.3 percentage points) rapidly increased their shares by capitalizing on the decline in China's share (-18.5 percentage points), strengthening their positions as semiconductor production bases. South Korea's share rose by 1.8 percentage points but was relatively insignificant.

China's share, the main target of US semiconductor regulations, dropped from 30.2% in 2018 to 11.7% in 2022, a reduction to one-third. This was due to the US imposing various regulations from 2018, including tariffs on imports from China and export restrictions on Chinese companies, citing national security and strengthening its own supply chain.

The US imposed additional tariffs of 10-25% on Chinese imports in three rounds in 2018 and continued this policy in 2019. During the same period, exports of parts and equipment made using US technology or software to China were also restricted. As a result, Chinese companies under sanctions faced difficulties in semiconductor production and capacity enhancement.

During the same period, Taiwan's share doubled from 9.5% in 2018 to 19.2% in 2022. In 2018, South Korea's share was 1.3 percentage points higher than Taiwan's, but due to Taiwan's rapid increase, South Korea lagged behind Taiwan by 6.6 percentage points in 2022, widening the gap between the two countries. Currently, Taiwan holds the top share in the US semiconductor import market. Unlike Taiwan, which rose from 4th place in 2018 to 1st in 2022, South Korea has remained in 3rd place since 2018. Vietnam's share jumped from 2.5% to 9.8%, moving its rank from 8th to 5th.

Taiwan and Vietnam strategically increased their shares by taking advantage of the weakening position of China in the US's largest semiconductor import category (33.4%), 'computer parts,' thereby enjoying a windfall. The 'computer parts' category includes components and accessories such as DRAM modules, computers, and hard drives. In the restructuring of the US semiconductor import structure, US imports from China in the 'computer parts' category decreased by $9.67 billion (-58%) from 2018 to 2022, while imports from Taiwan increased by $7.56 billion (327%) and imports from Vietnam also rose by $3.51 billion (4038%) during the same period. South Korea's imports increased by only $2.58 billion (52%).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.