While household loans at commercial banks continue to decline, internet-only banks are bucking the trend with increasing loan balances.

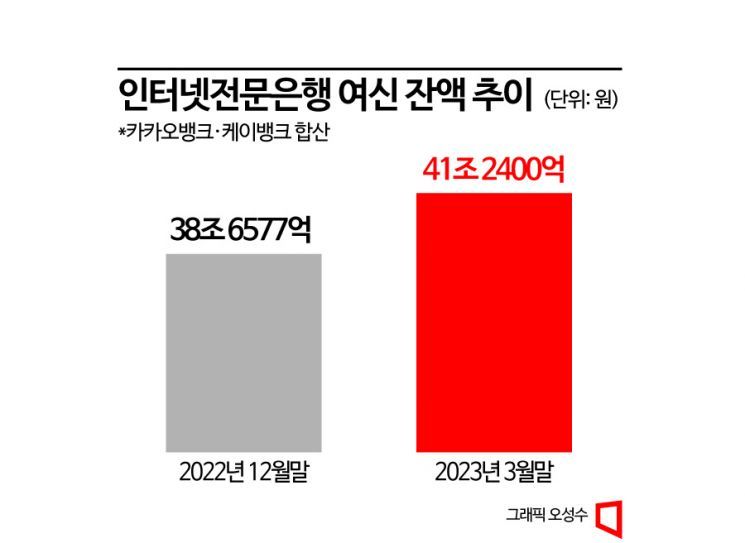

According to the financial sector on the 4th, as of the end of March, KakaoBank and K Bank recorded a loan balance of 41.24 trillion KRW, approximately 7% higher than 38.6577 trillion KRW in December last year. Since internet-only banks still have a relatively small proportion of corporate loans, over 90% of their loan balances consist of household loans. This trend contrasts with the steady decline in household loans at the five major banks (KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup) since January last year. During the same period, household loans at the five major banks decreased by about 2%, from 692.5335 trillion KRW to 680.7661 trillion KRW.

Internet-only banks are maintaining loan growth by promoting their 'low interest rate competitiveness.' According to disclosures by the Banks Association, the average interest rate for KakaoBank's installment mortgage loans (based on March transactions) was 4.04%, the lowest among 16 banks, while K Bank's rate was 4.09%, the second lowest.

KakaoBank's mortgage loans are regarded as cost-effective enough to be recommended by loan officers at other banks. In fact, statistics on the 'proportion of loans by interest rate range' show that 55.9% of KakaoBank's newly issued installment mortgage loans in March were subject to interest rates between 3.5% and under 4%. Due to these low rates, KakaoBank's balance of mortgage loans for refinancing purposes surged from 5 billion KRW in Q1 last year to 866 billion KRW in Q1 this year, and the new loan amount in Q1 increased by 643 billion KRW to 1.437 trillion KRW compared to the previous quarter (794 billion KRW). K Bank also recorded that 45.1% of its borrowers received loans with interest rates between 3.5% and under 4%. In contrast, the proportion of borrowers at the five major banks receiving loans in this interest rate range was only between 0.3% and 2.1%.

However, managing delinquency rates remains a challenge. KakaoBank's delinquency rate rose to 0.58% in Q1 this year, up 0.09 percentage points from 0.49% in the previous quarter and 0.32 percentage points from 0.26% in Q1 last year, showing an upward trend. Although K Bank has yet to announce its earnings, its delinquency rate stood at 0.85% at the end of last year, doubling from 0.41% in 2021 and the highest among first-tier banks. The banks explain that the increase in delinquency rates is due to loans mainly extended to medium- and low-credit borrowers, characteristic of internet-only banks. Kim Seok, Chief Operating Officer (COO) of KakaoBank, stated, "There has been no significant change in the delinquency rate for high-credit loans, and the delinquency rate difference between high-credit and medium-credit loans is three to four times," adding, "We discussed with the Financial Supervisory Service and additionally set aside 9.4 billion KRW in provisions in Q1."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.