"The sale date is passively determined according to the schedule of foreign securities firms"

Kim Ik-rae, chairman of Daou Kiwoom Group, on the 3rd disclosed the transaction statement for 1.4 million shares of Daou Data sold through an after-hours block deal, refuting the claims made by Ra Deok-yeon, the head of an unregistered investment advisory firm who raised suspicions of short selling, as false information.

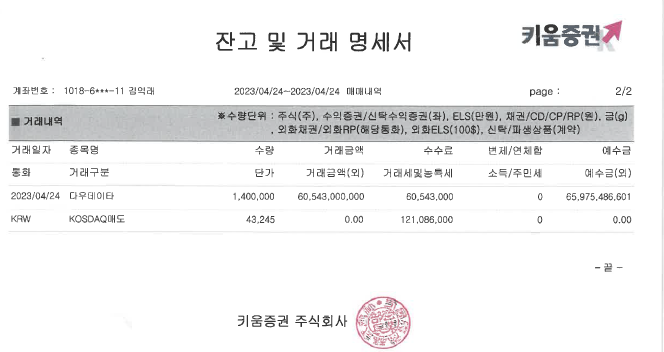

Kim’s side stated in a press release distributed through Kiwoom Securities on the same day that "(Mr. Ra’s allegations) are absurd claims" and announced they would release evidence to prove this. The disclosed balance and transaction statement show that the payment for the sold shares was deposited on the settlement date, April 24.

On the 24th of last month, Kim received 60.543 billion KRW (43,245 KRW per share) for 1.4 million shares (3.65% stake) of Daou Data into his Kiwoom Securities account. Since stock settlements occur two business days after the trade date and Kim conducted the block deal after market close on the 20th of last month, the payment was deposited on the 24th.

Kim’s side also detailed the process by which the block deal was completed. The block deal for Kim’s shares, which began in early April, involved contact with foreign securities firms on the 5th of the same month. After one selected underwriter completed its due diligence and legal review and finalized internal approval on the 19th, the transaction proceeded, according to Kim’s side.

A representative from Kim’s side emphasized, "On April 20 at noon, we notified overseas institutions of the transaction, and the block deal was completed after market close that day," adding, "The sale date was not decided by us but was passively determined according to the schedule of the foreign securities firm."

Previously, Mr. Ra claimed in multiple media interviews that it should be verified whether Kim actually received the proceeds from the sale into his account. He raised suspicions that if only the shares changed hands without actual money being received, it could constitute a naked short sale.

In response, a representative from Kim’s side said, "Ra Deok-yeon distorted the facts and made such claims to spread false information among the general public unfamiliar with stock trading, aiming to obscure the essence of the matter."

The representative added, "Finding buyers is the role of foreign securities firms, and we neither know nor can know who the buyers are," and "We can only infer from the foreign investor purchase volume on April 20 that the buyers were foreign institutions." He further stressed, "Distorting clear facts and spreading false information is a serious criminal act, and we will continue to respond strictly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.