Novo Nordisk's 'Wegovy' Receives MFDS Approval

Developed as a Diabetes Treatment but Shows Significant Weight Loss Effects

Lilly Pursues with 'Mounjaro'

Direct Comparative Clinical Trials to Prove Superiority Underway

"Fasting, and Wegovy (Fasting And Wegovy)"

A Twitter user asked Elon Musk for his secret to losing weight, and this was Musk's response. Musk, who revealed his slimmer physique, stated that he lost 30 pounds (about 13.6 kg). The domestic launch of 'Wegovy' (active ingredient semaglutide), the 'miraculous obesity treatment' that Musk cited as his weight loss secret, is imminent. According to industry sources on the 8th, five types of 'Wegovy prefilled pens' developed by Novo Nordisk have recently been approved in Korea. The actual release is expected to take place in the first half of next year.

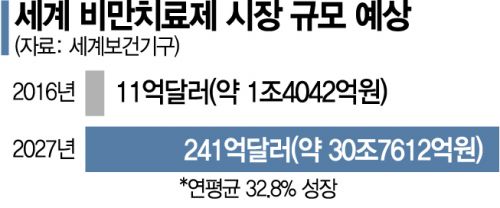

According to the World Health Organization (WHO), the global obesity treatment market is expected to expand to $24.1 billion (about 32 trillion KRW) by 2027. Especially during the COVID-19 pandemic, as outdoor activities decreased, 'COVID obesity' increased, so the market growth is expected to be more pronounced. There are even forecasts of an annual growth rate exceeding 30%. As a result, drugs originally used for diabetes treatment have been found to have weight loss effects, opening a new era in obesity treatment.

Wegovy was originally developed as a treatment for type 2 diabetes. It was approved domestically last April under the names 'Ozempic' and 'Rybelsus (oral)'. Although developed to act on glucagon-like peptide-1 (GLP-1) hormone analogs to control blood sugar levels in diabetic patients, when GLP-1 hormone levels exceed physiological amounts, it is known to reduce gastric motility, increase satiety, and suppress appetite, thereby showing a secondary weight loss effect. In multinational clinical trials (STEP), Wegovy showed an average weight loss effect of 14.9% from baseline in the treatment group (1,306 overweight or obese patients out of 1,961). In contrast, the control group (655 patients) lost only 2.4%.

Previously, Novo Nordisk also created a sensation with 'Saxenda,' which repurposed the diabetes drug 'Victoza' (active ingredient liraglutide) as an obesity treatment. Now, with Wegovy, which enhances efficacy and reduces dosing frequency to once a week, Novo Nordisk is aiming to dominate the obesity treatment market while expanding into diseases such as Alzheimer's dementia and non-alcoholic steatohepatitis (NASH), for which effective treatments have not yet been developed. Both diseases are currently undergoing multinational phase 3 clinical trials, including in Korea.

However, despite its tremendous popularity with over 100,000 prescriptions per week in the U.S. alone, supply has not kept up with demand. Novo Nordisk has announced that it will reduce the supply to new patients by half to ensure stable supply to existing patients, anticipating that the supply shortage will continue for several months. Nevertheless, the company plans to address this explosive demand by investing $3.6 billion (about 4.8 trillion KRW) this year to expand production capacity. Previously, manufacturing was outsourced only to Catalent in the U.S., but last month a second manufacturer began production in Europe, and a third manufacturer in the U.S. is expected to start production within this year.

Recently, a formidable competitor has also emerged. Eli Lilly is pursuing expansion of the use of 'Mounjaro' (active ingredient tirzepatide), originally developed as a type 2 diabetes treatment, into obesity treatment. It acts dually on GLP-1 and another hormone, glucose-dependent insulinotropic polypeptide (GIP). FDA approval in the U.S. is targeted for early next year.

As a latecomer, Eli Lilly has also started direct comparative clinical trials to quickly catch up with Wegovy. Although Mounjaro showed a weight loss effect of up to 22.5% in clinical trials, the first time exceeding 20%, these results cannot be directly compared to Wegovy because the trials were conducted separately with different designs, allowing only indirect comparisons. Therefore, the direct comparative trial aims to prove Mounjaro's superiority over Wegovy. The plan is to conduct the trial with 700 participants worldwide and release the primary results in the first quarter of next year.

However, there are voices cautioning against blindly relying on these drugs. The Korea Bio Association's Bioeconomy Research Center explained, "Clinical trial participants who stopped taking Wegovy regained about two-thirds of the weight they had lost after one year," adding, "Whether patients need to take the drug for life to maintain weight loss is the biggest issue researchers face." Wegovy costs $1,350 (about 1.8 million KRW) per month in the U.S., meaning that lifelong treatment would cost over 20 million KRW annually. Additionally, there are concerns that the weight loss is not purely fat loss but may also include muscle loss.

Regarding side effects, clinical results showed that diarrhea, vomiting, constipation, and abdominal pain were very common. Acute pancreatitis, acute cholecystitis, hypoglycemia in type 2 diabetes patients, and diabetic retinopathy were also more frequent in the treatment group compared to the placebo group.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)