Challenge to Turn a Profit in the Second Half of the Year

LG Display is challenging a turnaround to profitability in the second half of the year by expanding the proportion of order-based business.

On the 4th, LG Display announced that it plans to increase the proportion of order-based business, which expanded to the low 40% range in the first quarter of this year, to around 70% within 2 to 3 years. The strategy is to secure stable profitability despite economic fluctuations by expanding order-based business, which involves receiving orders based on long-term contracts with customers and producing accordingly. Order-based business has longer contract periods and can guarantee more stable profitability compared to supply-demand type business product groups such as TV panels. Representative order-based product groups include displays for tablets, smartphones, smartwatches, and automobiles.

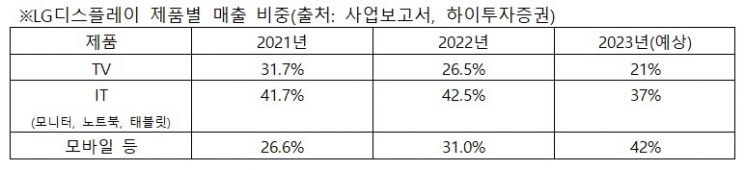

In the process of expanding order-based business, the proportion of TV sales, which accounted for 31.7% in 2021, is expected to decrease to 21% in 2023, while the proportion of products including mobile displays such as smartphones and automotive displays is likely to increase from 26.6% in 2021 to 42% in 2023. There is also high expectation that sales of mobile and other products could grow to about 10 trillion won this year.

First, the increase in supply volume of OLED panels for iPhones is a positive factor. Market research firm DSCC diagnosed that LG Display's share of iPhone 14 OLED panels has increased for seven consecutive months, expanding to 36% in March. Furthermore, it predicted that LG Display's panel market share will expand in the iPhone 15 series scheduled for the second half of the year. Dongwon Kim, a researcher at KB Securities, mentioned the possibility of LG Display turning profitable in the fourth quarter, stating, "LG Display's OLED panel supply share for the iPhone 15 Pro series, scheduled for release in the second half, is expected to rank first at 65%."

The growth trend of automotive displays, a pillar of the order-based business, is also steep. LG Display succeeded in securing orders worth more than 3 trillion won for automotive displays in the first quarter alone this year. The order backlog increased by about 20% compared to the end of last year and grew 70% compared to the end of 2021. Wonseok Jung, a researcher at Hi Investment & Securities, said, “We should pay attention to the fact that the order backlog for automotive panels recorded about 16 trillion won, a 60% increase last year, amid the trend of shortened new car development periods of 3 to 4 years by automakers,” adding, “Following last year, we expect to secure a large volume of new orders again this year.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)