Ra Deok-yeon Claims "Behind the Mass Limit-Downs Are Short Selling Forces"

5 Stocks Are Prohibited, 1 Recently Allowed... "Causing Investigation Confusion"

Possibility of Inflating Stock Prices by Targeting Short Selling Ban Stocks

Ra Deok-yeon, CEO of H Investment Consulting and a key figure suspected of stock price manipulation related to the Soci?t? G?n?rale (SG) Securities-triggered stock price crash, pointed to short-selling forces as the cause of the limit-down prices in eight stocks. However, the impact of short selling appeared to be minimal. There is growing suspicion that Ra’s insistence on investigating the funding sources of the short-selling forces, including Kim Ik-rae, chairman of the Daou Kiwoom Group, may be intended to confuse the investigation. The market believes that the price manipulation group targeted stocks banned from short selling to drive up prices. Financial authorities stated, "We are comprehensively examining the possibility of involvement by short-selling forces and whether major shareholders had prior knowledge."

According to the financial investment industry, the eight stocks involved in the mass limit-down incident?Daesung Holdings, Sebang, Samchully, Seoul Gas, and Daol Investment & Securities?are not part of the KOSPI 200 index and have been banned from short selling for the past three years. Only Daou Data, Harim Holdings, and Seonkwang, which are included in the KOSDAQ 150 index, are eligible for short selling. The Financial Services Commission temporarily banned short selling on all KOSPI and KOSDAQ stocks on March 16, 2020, to reduce stock price volatility caused by the COVID-19 crisis. As the market stabilized, short selling was allowed again in May 2021 for 350 large-cap stocks included in the KOSPI 200 and KOSDAQ 150 indices.

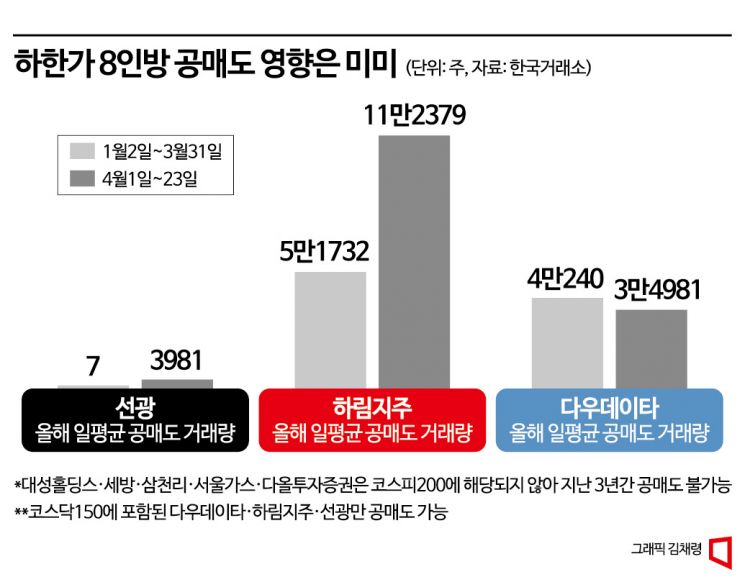

Moreover, Seonkwang was only included in the KOSDAQ 150 on the 19th of last month, allowing short selling recently. The short-selling volume of Seonkwang, which was usually less than 10 shares, increased to over 40,000 shares on the 19th, likely due to the resumption of short selling. From the beginning of this year until March 31, Seonkwang’s average daily short-selling volume was only 7 shares. By April 23, the day before the crash, the average daily short-selling volume rose to 3,981 shares. Harim’s average daily short-selling volume also increased, from 51,732 shares until March 31 to 112,379 shares by April 23.

Daou Data is somewhat different. Its average daily short-selling volume from April until just before the crash was 34,981 shares, not significantly different from the previous period’s 40,240 shares. The proportion of short-selling transaction value during the two days starting April 24, when the stocks hit the limit-down, was only 2.1% for Daou Data, 0.9% for Harim, and 1.8% for Seonkwang.

Ra claims that as he bought up the short-selling volume, short sellers covered their positions, causing the stock price to rise. However, considering that some of the stocks were banned from short selling, market experts view Ra’s claim as lacking basis. The prevailing analysis is that the price manipulation group deliberately targeted stocks where short selling was fundamentally blocked to drive up prices.

Nonetheless, financial authorities plan to investigate the possibility of involvement by short-selling forces. A financial authority official said, "We are currently examining the reasons behind the sudden surge in short selling for some stocks before the price crash," adding, "We are comprehensively reviewing where the limit-down started and the possibility that short-selling forces were involved in the selling process."

Meanwhile, it has been confirmed that the financial authorities (Financial Services Commission) failed to detect the signs of the crash until they received tips from media outlets, and cooperation was not smooth, leading to criticism that the delayed response by the financial and supervisory authorities (Financial Supervisory Service) exacerbated the situation. In response, on the 28th of last month, a joint investigation team was quickly formed, including the Seoul Southern District Prosecutors’ Office Financial Securities Crime Joint Investigation Unit (led by Dan Sung-han), and investigative personnel from the Financial Services Commission and the Financial Supervisory Service. The joint investigation team is investigating not only the possibility of involvement by short-selling forces but also whether major shareholders of the related stocks had prior knowledge.

Since the end of last year, some securities firm analysts had raised warning signals about the related stocks, saying "the stock prices seem excessive," indicating abnormal signs. There were rumors in the market about the involvement of manipulation groups. However, it appears that by steadily raising prices over a long period, they avoided detection by authorities and the Korea Exchange. A financial industry insider familiar with the matter said, "It is not easy to manipulate prices gradually over a long time without the participation or tacit consent of major shareholders," adding, "Since the number of circulating shares in the eight stocks is small, it is presumed that price manipulation groups could easily prearrange prices and times to buy and sell shares, so investigating whether major shareholders had prior knowledge is also necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)