SSM Sales Decline for 10 Consecutive Quarters

Major SSM Focuses on 'Delivery Within 2 Hours'

Corporate Supermarkets (SSMs) are focusing on expanding 'quick commerce,' which emphasizes fast delivery. Their strategy is to overcome various government regulations and the trend of contactless consumption by enhancing delivery services.

Last year, Emart Everyday launched the online rapid delivery service 'eMile'

Last year, Emart Everyday launched the online rapid delivery service 'eMile' [Photo provided by Emart Everyday]

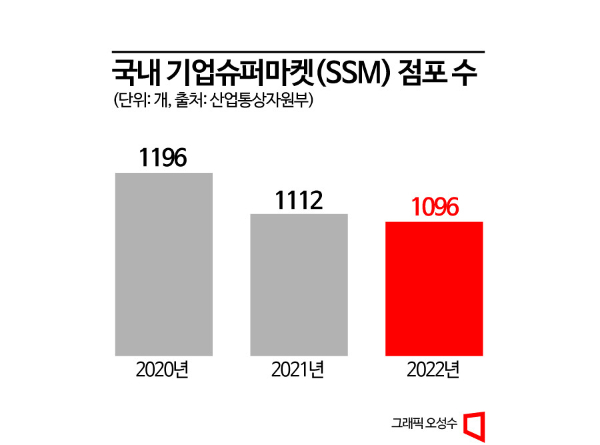

According to the 'March Major Retailers Sales' report released by the Ministry of Trade, Industry and Energy on the 28th, the combined sales of four major SSMs?Emart Everyday, Lotte Super, Homeplus Express, and GS The Fresh?decreased by 1% compared to the previous year. This contrasts with other retail sectors such as department stores (9.5%), convenience stores (9.7%), and large supermarkets (1.2%), all of which saw sales increases. SSMs have experienced year-on-year decline for 10 consecutive quarters from Q4 2020 through Q1 2023. The number of stores has also decreased for three consecutive years: 1,196 in 2020, 1,112 in 2021, and 1,096 in 2022.

The background to this is analyzed to be the impact of various government regulations such as restrictions on store openings and operating hours, combined with the contactless consumption trend established during COVID-19. Like large supermarkets, SSMs are not allowed to operate on the second and fourth Sundays of each month. Additionally, there is a regulation that prohibits opening stores within 1 km of traditional markets, making it practically difficult to open new stores except in a few new towns, according to industry insiders. As a result, customers increasingly purchase simple groceries from nearby convenience stores and food material marts, and with the shift of consumption from offline to online after COVID-19, a large portion of demand has been diverted to e-commerce.

In response, SSMs are seeking differentiation by expanding quick commerce. Unlike e-commerce, which requires building separate logistics centers, SSMs have the advantage of utilizing existing offline stores as delivery bases. This allows them to relatively save on logistics and labor costs needed to establish delivery networks.

In November last year, Emart Everyday officially launched the online rapid delivery service 'e-mile.' e-mile delivers ordered products to customers within a 2 km radius of the store in at least one hour. It is currently operating in about 230 stores, and Emart Everyday plans to gradually expand the service to more stores.

Homeplus Express recently moved up its 'Immediate Delivery' service by one hour, allowing orders placed from 10 a.m. to 10 p.m. to be delivered within one hour. Currently, about 180 stores operate immediate delivery starting at 10 a.m. Additionally, they offer a 'Mart Direct Delivery' service, where customers who order products by 2 p.m. can have them delivered at their preferred time. GS The Fresh launched the 'Baro Delivery' service last year in partnership with GS Fresh Mall. When customers order products from the Baro Delivery menu within GS Fresh Mall, the products are delivered immediately from GS The Fresh stores within a 4 km radius.

Professor Lee Young-ae of the Department of Consumer Studies at Incheon National University said, "It is not easy to shift consumption trends back from online to offline. Unlike e-commerce, which requires huge costs to build delivery networks, SSMs can relatively save costs. Leveraging this strength to build an 'omni-channel' that combines online and offline will be a good strategy for SSMs."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)