Securities Industry Sees Surge in Free Overseas Stock Capital Gains Tax Filing Services

Seohak Gaemi, Which Declined Last Year, Increasing Again This Year

As the comprehensive income tax filing period in May approaches, the securities industry is launching a free service to assist with overseas stock capital gains tax filing. In particular, with the number of Seohak Gaemi investors, who had been inactive due to last year's sluggish stock market, increasing again, overseas stock investment has been rising since early this year, and interest in related services is expected to grow.

Competition to Attract Seohak Gaemi Investors

According to the financial investment industry on the 27th, this year Mirae Asset Securities, KB Securities, Meritz Securities, Hana Securities, Kiwoom Securities, Hanwha Investment & Securities, and Toss Securities are providing overseas stock capital gains tax filing agency services. The reason the securities industry is offering this service for free is to attract Seohak Gaemi as customers. The intention is to retain existing customers and attract new ones.

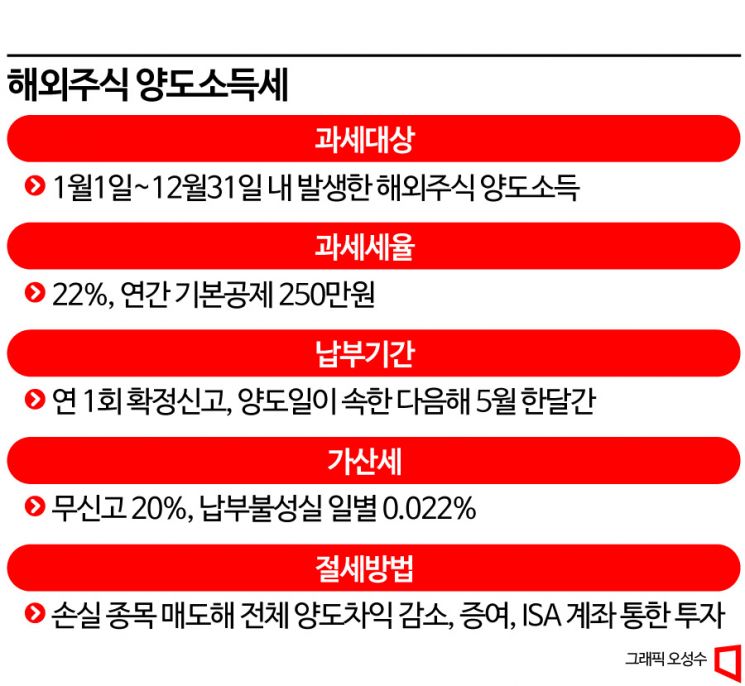

If the annual basic deduction amount of 2.5 million KRW is exceeded in overseas stock profits, capital gains tax is imposed at a rate of 22%. Overseas stocks settled between January 1 and December 31 of the previous year are subject to taxation. Once subject to taxation, capital gains tax must be definitively reported and paid to the relevant tax office between May 1 and the end of May.

For example, if you earned 10 million KRW in profits from overseas stock investments last year, you must pay 1.65 million KRW in capital gains tax this year, which is 22% of 7.5 million KRW after deducting 2.5 million KRW. If you fail to pay within the filing period, you will be subject to additional penalties. A 10% penalty applies if the reported amount is reduced, and a 20% penalty if not reported at all. If payment is delayed, an additional daily penalty of 0.022% is added.

Because this process is cumbersome, the number of investors using securities firms' agency services is increasing. Especially since entrusting capital gains tax filing to tax/accounting firms incurs costs, satisfaction with the securities firms' free service is relatively high.

The number of customers subscribing to overseas stock capital gains tax filing agency services at four securities firms?Mirae Asset, KB, Hana, and Kiwoom?increased significantly from 16,978 in 2020 to 66,549 in 2021, and 133,212 in 2022. This is a result linked to the increase in Seohak Gaemi investments. According to the Korea Securities Depository, the net purchase amount of overseas stocks by domestic investors was $21.9 billion (approximately 28.88 trillion KRW) in 2021. Except for last year (11.9 billion USD), when strong monetary tightening was implemented, it has steadily increased since 2019 ($2.5 billion) and 2020 ($19.7 billion). A securities firm official explained, "Many overseas stock investors were unaware of their capital gains tax filing and payment obligations or found the procedures complicated, so they frequently inquire. Helping with tax payments also aids in attracting potential customers."

Domestic Investors' Foreign Currency Securities Holdings Increase in Q1 This Year

However, the use of this service may slow somewhat in May this year due to reduced overseas stock trading volume and profits caused by last year's extensive tightening. Nevertheless, since Seohak Gaemi investments have increased again from early this year, the number of subscribers using the service is expected to rise going forward.

The amount of foreign currency securities held by domestic investors turned to an increasing trend in the first quarter of this year. As of Q1, foreign currency securities holdings amounted to $91.13 billion, and settlement amounts were $97.46 billion. Compared to Q4 last year, these increased by 18.8% ($76.69 billion) and 22.5% ($79.56 billion), respectively. By type, holdings were $66.89 billion in stocks and $24.24 billion in bonds, increasing by 20.8% and 13.7%, respectively. For stocks, the U.S. accounted for $67.78 billion, representing 86.3% of the total holdings.

The top stock holdings were all U.S.-based, including Tesla, Apple, Nvidia, ProShares UltraPro Short QQQ ETF (SQQQ), and Microsoft, in that order. The top 10 stocks accounted for 46.9% of the total. Tesla holdings decreased from $15.46 billion in 2021 to $6.763 billion last year but rose again to $11.799 billion. Apple and Nvidia holdings were $5.041 billion and $3.161 billion, respectively.

Need to Establish Tax-saving Strategies

The securities industry advises establishing overseas stock tax-saving strategies in advance. The most basic strategy is to sell loss-making stocks at the end of the year to reduce overall capital gains. For example, if you realized a profit of 10 million KRW this year but have a loss of 5 million KRW from other stock investments, you temporarily sell the loss-making stocks at year-end. Although you would pay about 1.65 million KRW in capital gains tax on the 10 million KRW profit, combining the 5 million KRW loss reduces the tax to 550,000 KRW.

If profits have not yet been realized, tax savings are possible through "gift then transfer." When receiving gifts from direct ascendants, adults can receive up to 50 million KRW, minors up to 20 million KRW, and spouses up to 600 million KRW without gift tax over 10 years. When gifting overseas stocks, the recipient must calculate and report gift tax based on the average value over four months?the two months before and after the gift date. When the recipient sells the gifted stocks, the acquisition cost is the gifted value. Therefore, capital gains tax is imposed only on profits exceeding the four-month average gifted value.

Investing in overseas exchange-traded funds (ETFs) through an Individual Savings Account (ISA) is also an option. ISA offers tax exemption benefits up to 2 million KRW when investing in various financial products such as deposits, funds, ETFs, and stocks.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.