Tiffany & Co. New York Flagship Reopening All Hands on Deck

Strengthening Ties with LVMH, Owner of Multiple Luxury Brands

Luxury Segmentation into Menswear and Shoes, Attracting New Brands

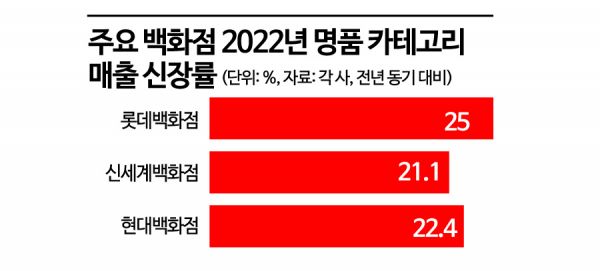

Heads of domestic department stores are actively working to strengthen their luxury lineups. Since the outbreak of COVID-19, the luxury category has experienced "stormy growth," accounting for a significant portion of sales, prompting the department store industry to focus its efforts on adding major luxury brands, segmenting categories, and discovering emerging brands for sustainable growth.

Domestic Department Store CEOs Gather for Tiffany New York Flagship Reopening

According to the distribution industry on the 26th, on the 28th (local time), Kim Sang-hyun, Vice Chairman and CEO of Lotte Shopping, Jung Joon-ho, CEO of Lotte Department Store, and Son Young-sik, CEO of Shinsegae Department Store, will attend the reopening event of luxury jewelry brand Tiffany & Co.'s flagship store on 5th Avenue in New York, USA. This marks a full attendance of domestic department store CEOs at the reopening event of a luxury jewelry brand's flagship store in the United States.

The visit of domestic department store heads to New York was made possible by an invitation from Bernard Arnault, chairman of Louis Vuitton Mo?t Hennessy (LVMH) Group, which owns Tiffany, last month. In 2021, LVMH acquired Tiffany for $15.8 billion (approximately 17 trillion KRW). LVMH owns numerous luxury brands including Louis Vuitton, Dior, Bulgari, Fendi, and Celine. Tiffany is where Alexandre Arnault, the third son of Chairman Arnault, serves as vice president. Through this visit, the CEOs plan to strengthen relationships with key LVMH personnel, including Tiffany, to support securing major store locations. Both CEO Jung Joon-ho and CEO Son Young-sik are experts in this field with experience overseeing luxury and overseas fashion.

Segmenting and Expanding Luxury to Seek 'Additional Growth After Stormy Growth'

Domestic department stores are focusing on luxury brands because luxury accounts for a large share of department store sales, strengthens the symbolic meaning of being a department store equipped with major luxury brands, and helps induce derivative consumption. During the COVID-19 period, with overseas travel routes blocked, domestic consumers' "revenge consumption" led to rapid growth in department store luxury sales, sometimes reaching annual growth rates in the 30% range. However, growth has slowed this year, and department stores now need new strategies for a second sales leap. The luxury sales growth rates for the first quarter of this year for the three major department stores?Lotte, Shinsegae, and Hyundai?were 7%, 7.8%, and 9.1%, respectively, all in single digits. Nevertheless, the share of luxury in department store sales still exceeds 30%. According to the Ministry of Trade, Industry and Energy, last month, the share of luxury (overseas famous brands) sales in department stores was about 32.3%.

Accordingly, they are putting effort into segmenting existing luxury stores by categories such as women, men, children, and shoes, and attracting trending luxury brands. Shinsegae Gangnam, the top-grossing domestic department store, has four Chanel and four Herm?s stores each. Herm?s classifies its Pavilion (scarves and accessories) and Maison (tableware) as separate stores, expanding the product assortment to facilitate additional sales.

Major stores have especially focused on men's fashion specialty halls. This is because demand for men's luxury has expanded and more customers are shopping without gender distinctions. By creating a men's overseas fashion hall through the renewal of Lotte Department Store's main branch, sales from January 1 to April 25 this year more than tripled compared to the same period before the renewal in 2021. They introduced luxury brands favored by young men such as Louis Vuitton, Tom Ford, Dolce & Gabbana, and Valentino, and opened men's specialty stores for brands with a high proportion of male customers, such as Loro Piana, Balenciaga, and Kenzo, which were previously operated as mixed-gender stores.

Hyundai Department Store also operates the 4th floor of its Apgujeong branch as a men's luxury hall, housing Gucci Men’s, Balenciaga Men’s, Prada Uomo, and Louis Vuitton men's specialty stores. Although Balenciaga, Prada, and Louis Vuitton were already located on the 1st and 2nd floors, they strengthened the brands by additionally attracting men's specialty stores. Shinsegae Department Store opened Louis Vuitton, Gucci, Berluti, Fendi, Tom Ford, and Dolce & Gabbana in its men's luxury hall, Men's Salon. In addition, department stores are expanding children's luxury brands such as Baby Dior, Moncler Enfant, Givenchy Kids, Burberry Children, and luxury shoes in the form of specialty halls.

A department store industry insider said, "Although direct commission revenue is low, considering the overall sales due to high average spending, the symbolic meaning showing the department store's status, and derivative sales from visitors such as 'open runs' (waiting in line before the store opens), the atmosphere of CEOs personally engaging in attracting luxury brands and putting effort into luxury will continue in the future."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.