Boom in VC Establishment by Venture Capital Firms and New Companies... Focus on Synergy with Parent Companies

Attention on Fund Deployment in Pharma and Bio Industries Facing Investment Shortages

Daewoong Pharmaceutical, famous for ‘Urusa,’ has launched its corporate venture capital (CVC) arm, Daewoong Investment. Amid a cooling investment sentiment in the bio industry, the steady emergence of pharmaceutical-affiliated venture capitals (VCs) is drawing attention. It remains to be seen whether they will serve as a catalyst for investment in the pharmaceutical and bio sectors.

According to the investment banking (IB) industry on the 20th, Daewoong Pharmaceutical recently established the CVC Daewoong Investment. The initial capital is 2 billion KRW, meeting the registration requirements for a venture capital company. It is expected to obtain a venture capital license from the Ministry of SMEs and Startups soon. The inaugural head is Jeon Seung-ho, CEO of Daewoong Pharmaceutical. He holds a master's degree in pharmaceutical sciences from Seoul National University and an MBA from Aalto University School of Business in Finland.

Daewoong Investment Aims to Be a Strategic Investor

A representative of Daewoong Investment explained, "We plan to focus not only on simple investments in promising bio companies but also on creating business synergies with Daewoong Pharmaceutical." They aim to be a strategic investor (SI) that supports everything from clinical design to product approval.

Before establishing Daewoong Investment, Daewoong Pharmaceutical was already active in discovering bio ventures. They officially started open innovation in 2020. They also fostered in-house ventures and contributed to healthcare funds. Last year, they were selected as an operator of the TIPS (Tech Incubator Program for Startups), a private investment-led technology startup support program. They are the only TIPS operator among domestic pharmaceutical companies. The VC industry is paying close attention to whether Daewoong Investment will secure bio-specialized investment screening personnel.

There are several cases of domestic pharmaceutical companies establishing venture capitals (VCs). Besides Daewoong Pharmaceutical, which recently set up an investment firm, ▲Chong Kun Dang (CKD Startup Investment) ▲Dong-A Socio Group (NS Investment) ▲Dongkoo Bio & Pharma (Lofty Rock Investment) ▲Kwangdong Pharmaceutical (KD Investment) ▲Kyungdong Pharmaceutical (Kinggo Investment Partners) are actively operating in the venture investment market.

Ownership Stakes Held by Founding Families in CKD Startup Investment and NS Investment

Among these, CKD Startup Investment and NS Investment are notable because the ownership stakes are held directly by the founding families rather than group affiliates. The largest shareholder of CKD Startup Investment was Chong Kun Dang Holdings, the holding company of the Chong Kun Dang Group. However, in 2018, to meet holding company activity restrictions, Chong Kun Dang Holdings sold all its shares to Chairman Lee Jang-han and his eldest son Joo-won and daughter Joo-ah. NS Investment is a bio-specialized venture capital established in 2015 by Kang Jung-seok, the third-generation owner of the Dong-A Socio Holdings Group, using his personal funds.

CKD Startup Investment’s activities are particularly prominent. Currently, CKD Startup Investment operates a total of seven funds, including ‘CKD Start-Up No.3 Venture Investment Association,’ ‘CKD Bio-Healthcare Corporate-Fund No.1 Venture Investment Association,’ ‘Smart CKD Bio-Healthcare No.1 Venture Investment Association,’ and ‘CKD-BS Start-Up Venture Investment Association.’ Among these, six funds are sub-funds created with investments from the Korea Venture Investment Corp’s mother fund. They have consistently proven their investment capabilities and secured policy institution funds. Recently, they invested in various sectors such as Stockeyper, the operator of Hanwoo fractional investment platform Bankau; Green Ribbon, the operator of insurance claim information platform LifeCatch; and Quattro Labs, a blockchain startup.

NS Investment is composed of pharmaceutical and bio professionals, including those from Dong-A Pharmaceutical. Based on their expertise, they discover promising deals. They are particularly specialized overseas, mainly conducting investment activities in the United States. They have consistently formed ‘Global Bio Investment Associations’ jointly with Paratus Investment.

Dongkoo Bio & Pharma, which grew with venture capital investments such as Smilegate Investment, has invested about 60 billion KRW in over 20 companies in the past five years. Representative investments include DND Pharmatech (3 billion KRW), an Alzheimer’s treatment developer; Robotus (1.6 billion KRW), a collaborative robot developer; Genome & Company (3 billion KRW), a new drug developer; and Vuno (3 billion KRW), an AI medical device developer. In October last year, they also contributed 3 billion KRW to a fund established by the private equity fund (PEF) Han & Brothers for acquiring the massage chair company Bodyfriend.

Lofty Rock Investment, established by Dongkoo Bio & Pharma, is a specialized new technology business finance company (Shingisa). Shingisa has the advantage of a broader investment scope than venture capital companies. It can form various types of funds, including new technology investment associations and venture investment associations. It is actively conducting diverse investment activities centered on the bio sector. Its first fund, ‘Dongkoo Bio-Welcome New Technology Business Investment Association No.1,’ invested in Pinterapeutics, a developer of Target Protein Degrader therapies.

Kwangdong Pharmaceutical has KD Investment as its subsidiary. KD Investment is a Shingisa established with 20 billion KRW capital from Kwangdong Pharmaceutical. Together with the private equity fund operator Uon Investment, they formed the KD Uon New Growth No.1 Investment Association. They plan to gradually expand their management scale by raising follow-up funds.

Investing with a Pharmaceutical Perspective... Positive Signal for the Industry

Kinggo Investment Partners is a new technology finance company established in August 2017 by alumni companies of Sungkyunkwan University pooling their funds. Kyungdong Pharmaceutical is the largest shareholder, with Daehwa Pharmaceutical, Wave Electronics, and Sungkyunkwan University also holding shares. It has grown into a management company with assets under management (AUM) exceeding 100 billion KRW.

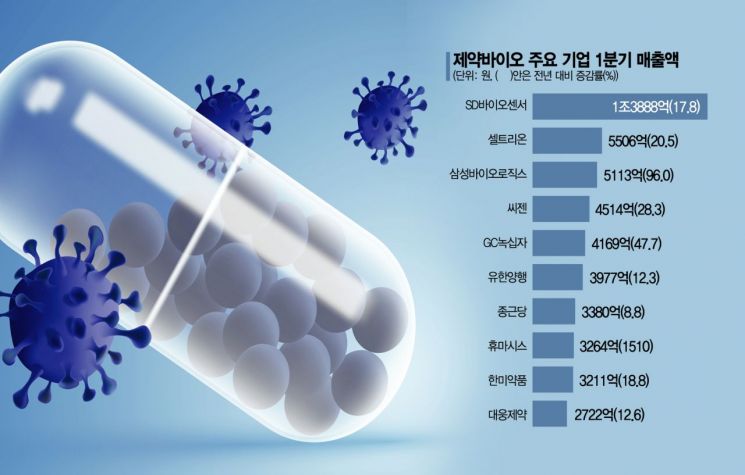

The Ministry of SMEs and Startups announced that venture investment in the first quarter of this year was 881.5 billion KRW, down 60.3% compared to the same period last year. This is a decrease of 1.3399 trillion KRW in amount. Of the 1.4481 trillion KRW increase over the past two years, 92% has been lost. The bio sector showed the largest decline rate. Investment sentiment in bio remains frozen. In this context, the increase in pharmaceutical-affiliated VCs is viewed positively by the industry.

A bio-specialized investment analyst said, “Pharmaceutical company VCs basically focus on creating synergy effects with their parent companies,” adding, “Unlike general VCs, they invest reflecting the pharmaceutical company’s perspective.” He continued, “During downturns, the more players there are, the better. It is read as a good signal.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.