2021 Takju Shipment Amount 509.8 Billion KRW... Up 8.3% YoY

Nearly 1,000 Takju Manufacturing Licenses

Traditional Liquor Category Led by Rapid Increase in Takju Driving Market Growth

The domestic Makgeolli shipment value has exceeded 500 billion KRW for the first time in 10 years. With an increase in traditional liquor license acquisitions and startups centered around the younger generation, unique product launches have continued, and consumers have responded to this trend, leading to market revitalization.

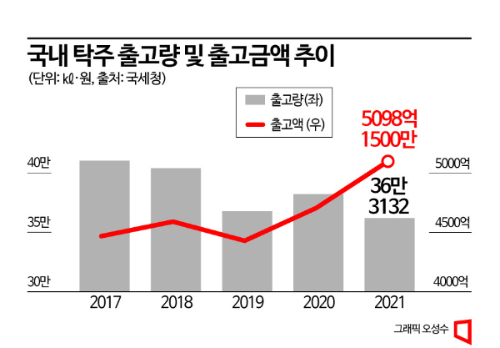

According to the ‘2021 Liquor Industry Information Survey’ report by the Korea Agro-Fisheries & Food Trade Corporation (aT) and the National Tax Service tax statistics on the 22nd, the domestic Takju (Makgeolli) shipment value in 2021 was 509.815 billion KRW, an 8.3% (39.236 billion KRW) increase compared to the previous year (470.579 billion KRW).

The shipment value of Takju exceeded 500 billion KRW for the first time in 10 years since 2011. After steadily declining since 2011 (approximately 509.7 billion KRW), the domestic Takju shipment value has rapidly rebounded since hitting a low point in 2019 (approximately 442.9 billion KRW). As the shipment value increased, its share in the overall liquor market also rose from 5.0% in 2019 to 5.8% in 2021.

The market is also expanding overseas. In 2021, Takju exports amounted to 15.804 million USD (approximately 20.8 billion KRW), a 26.8% growth compared to 2020 (12.468 million USD, approximately 16.4 billion KRW). During the same period, export volume also increased by 16.6%, reaching 14,643 tons. However, due to the rapid growth, last year’s export value slightly decreased to 15.677 million USD (approximately 20.6 billion KRW), down 0.8% from the previous year, indicating a brief pause.

As the Takju market grows, the number of market participants is also rapidly increasing. In 2021, 992 companies obtained Takju manufacturing licenses, a 3.2% increase from the previous year. Compared to 835 companies in 2016, this represents nearly a 20% increase over five years. Considering the recent growth trend, it is expected that the number of companies obtaining Takju manufacturing licenses last year exceeded 1,000.

Unlike the increase in shipment value, the shipment volume of Takju itself is decreasing. In 2021, domestic Takju shipment volume was 363,132 kiloliters, a 4.4% decrease from the previous year. This trend aligns with the overall liquor shipment volume, which decreased by 3.6% to 3,099,828 kiloliters during the same period. Takju shipment volume, which was 402,580 kiloliters in 2018, dropped to the 300,000 kiloliter range the following year and has steadily declined over the past five years.

Despite the somewhat stagnant overall shipment volume, the increase in Takju shipment value is attributed to the rise in Makgeolli classified as traditional liquor rather than general Takju. The shipment value of Takju classified as traditional liquor was only about 8.7 billion KRW in 2017 but exceeded 10 billion KRW the following year, surpassed 18 billion KRW in 2020, and grew rapidly to approximately 31.5 billion KRW in 2021.

The traditional liquor Takju market is closely related to the increase in traditional liquor license acquisitions and startups, especially among younger generations in recent years. Makgeolli, classified as a regional specialty liquor, must be brewed using local agricultural products, which results in relatively higher raw material costs compared to large-scale joint breweries that are free from the origin of raw materials. Additionally, since most breweries are small-scale, it is difficult to achieve economies of scale compared to major producers with mass production, leading to generally higher prices. However, despite the relatively higher prices, the market continues to grow by leveraging high quality, unique recipes, and design.

However, the overall Takju market remains polarized, with the top 30 companies accounting for about 90% of the market, and more than half of the businesses having annual sales below 100 million KRW. The industry expects that regional joint breweries such as Seoul Takju will continue to lead the market for the time being. An industry insider stated, “Regional cooperative breweries have relatively low consumption of domestic agricultural products and thus contribute less to the consumption of Korean rice. Proposing government-level alternatives to restructure this asymmetric industrial structure remains a challenge.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)