April Daily Average Trading Volume Down 46% from Previous Month

Price Stagnation, Financial Risk Easing, and Dollar Strength Impact

Bitcoin prices rose nearly 70% in the first quarter of this year alone. The increase in price also led to a rise in trading volume. However, as the price surge slowed in April, the average daily trading volume sharply declined compared to before.

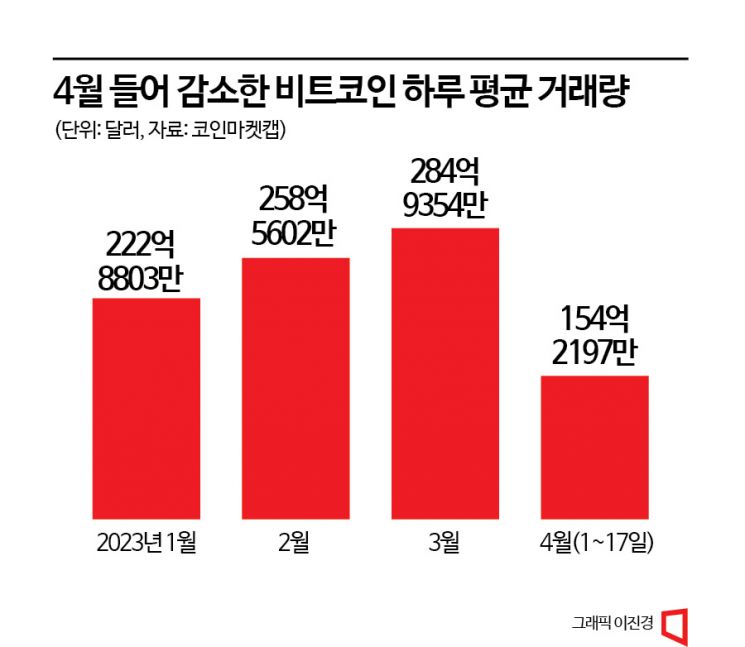

According to CoinMarketCap, a global virtual asset market data site, the average daily Bitcoin trading volume from the 1st to the 17th of this month was $15.42197 billion (approximately 20.3246 trillion KRW). This represents a sharp 45.88% decrease compared to the previous month's average daily trading volume of $28.49354 billion (approximately 37.5516 trillion KRW).

Bitcoin trading volume showed a steady increase since the beginning of this year. The average daily trading volume was $22.28803 billion in January and $25.85602 billion in February. This was due to a recovery in price, which had been around $16,600 at the start of the year but rose to the $28,000 range by the end of last month. On the 14th of last month, the daily trading volume surged to $54.62223 billion (approximately 71.9811 trillion KRW), marking the highest level this year. The easing of concerns over tightening by the U.S. Federal Reserve (Fed), which significantly influences Bitcoin prices, acted as a positive factor.

Since the beginning of this month, the average daily trading volume has sharply decreased. Except for the 11th and 22nd of this month, it did not exceed $20 billion, and on the 8th, it dropped to $9.37326 billion, shrinking below $10 billion for the first time since January 8. Although Bitcoin prices surpassed $30,000 for the first time in 10 months, the price increase was limited compared to before, leading to a reduction in trading volume. Last month, Bitcoin prices rose from around $20,000 to the $28,000 range, and in February, from the $21,000 range to the $24,000 range. In January, prices surged from the $16,600 range to the $23,000 range. However, this month, the price only increased by about $2,000 from the $28,000 range to around $30,000, and the $30,000 level, which had been maintained for about a week, was broken the day before, indicating a price slowdown.

On the 18th, Bitcoin prices also showed a downward trend. As of 3:17 PM, Bitcoin was priced at $29,498 (approximately 38.89 million KRW), down 1.58% from the previous day. Riyad Carey, a researcher at Kaiko, a virtual asset data company, explained, "Economic factors such as the strength of the U.S. dollar and mixed first-quarter earnings of U.S. companies may have influenced the decline in Bitcoin prices," adding, "The U.S. dollar index and Bitcoin prices are inversely related."

Additionally, as financial risks such as the collapse of Silicon Valley Bank (SVB) increased, Bitcoin was perceived as a safe-haven asset, leading to price increases. However, this momentum is gradually fading. Edward Moya, senior market analyst at global investment firm OANDA, said, "As the banking crisis appears to be disappearing, virtual assets are losing their appeal," and added, "Bitcoin seems to be settling into a new range between $26,500 and $31,000, solidifying its price."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.